It’s now September, where has this year gone? There is already an Autumnal feel in the air, leaves are turning from Green to Gold and Brown and starting to drop off the trees. At least the Premier League is back! To keep us all going over the Winter!

And we have seen a bit of an Indian Summer in terms of the local SK8 and SK3 property market, with listings and sales continuing to be higher than normal for the time of year.

But what has the picture been for the rest of the country? Let’s start our regular monthly look at the National picture by sharing the view from the Nationwide Building Society and the property portal Zoopla.

Here are the headlines from the Nationwide August Property Index:

Annual house price growth edged higher in August

UK house prices fell 0.2% month on month in August

Annual growth rate picked up to 2.4%, from 2.1% in July

Fastest pace of annual growth since December 2022

Energy efficiency becoming more important in influencing what buyers will pay for a home

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“UK house prices fell by 0.2% month on month in August, after taking account of seasonal effects, but the annual rate of house price growth continued to edge higher. Average prices were up 2.4% year on year, a slight pickup from the 2.1% recorded in July and the fastest pace since December 2022 (2.8%). However, prices are still around 3% below the all-time highs recorded in the summer of 2022.

“While house price growth and activity remain subdued by historic standards, they nevertheless present a picture of resilience in the context of the higher interest rate environment and where house prices remain high relative to average earnings (which makes raising a deposit more challenging).

“Providing the economy continues to recover steadily, as we expect, housing market activity is likely to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.

Price premium for energy efficient properties

“Decarbonising and adapting the UK’s housing stock remains critical if the UK is to meet its 2050 emissions targets, especially given that emissions from residential buildings account for 15% of the country’s greenhouse gas emissions. With this in mind, we’ve used our house price data to examine the extent to which owner occupiers pay a premium or discount for a home due to its energy performance rating.

“To do this, we included energy efficiency ratings from energy performance certificates (EPCs) alongside the usual property characteristics we use in our index. This allows us to control other factors that can influence the value of a house or flat, such as the number of bedrooms, location and whether it is newly built.

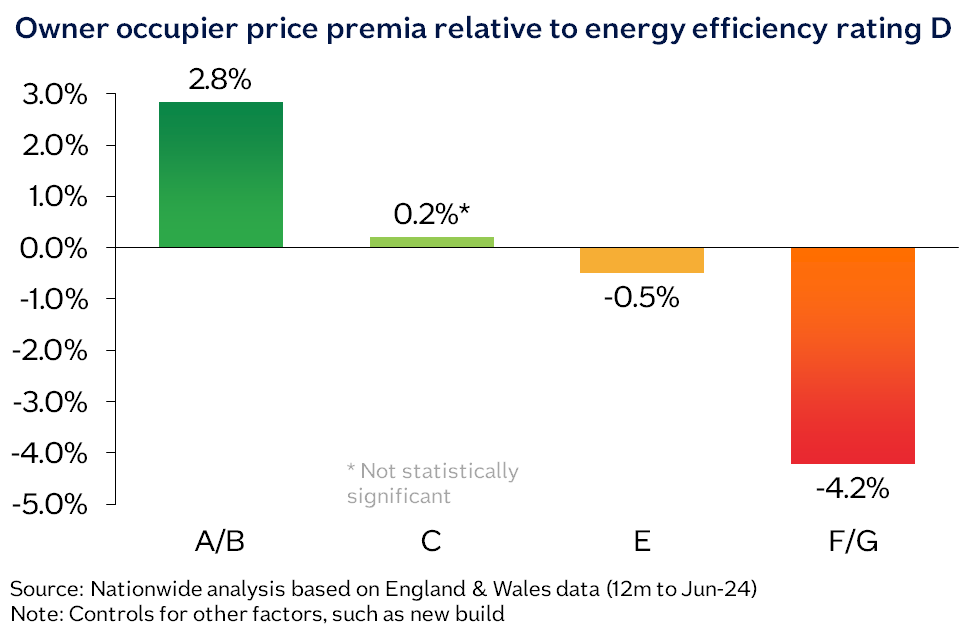

“Our analysis suggests that a more energy efficient property, rated A or B, attracts a modest premium of 2.8% compared to a similar property rated ‘D’ (the most commonly occurring rating). There is little difference for properties rated C or E compared with D, as shown in the chart below.

“There is a noticeable discount for properties rated F or G - the lowest energy efficiency ratings. Indeed, an F or G rated home is valued 4.2% lower than a similar D rated property.

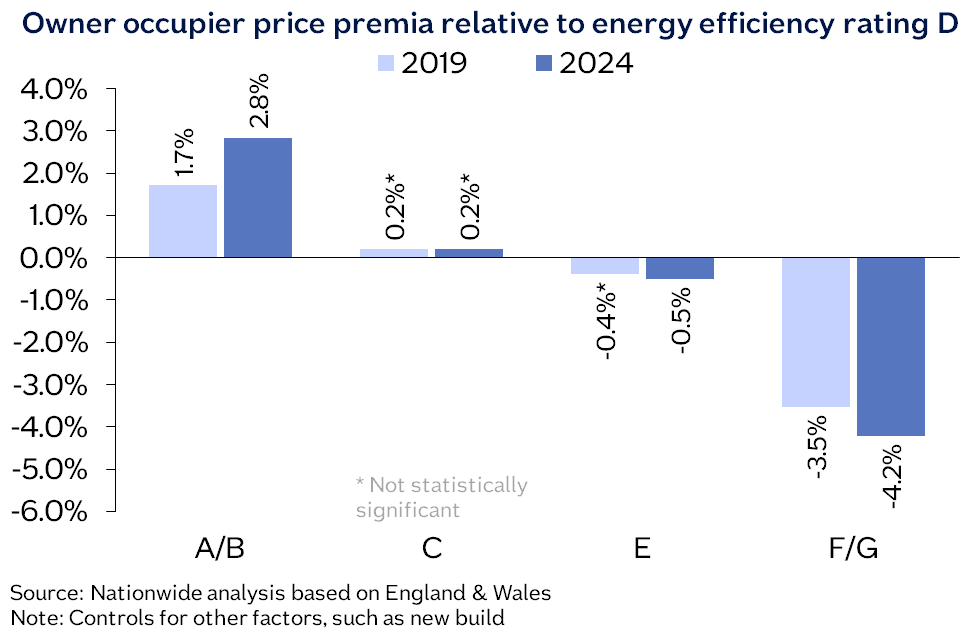

“Our research suggests while energy efficiency impacts remain relatively modest, they have increased relative to pre-pandemic levels, with A/B properties now attracting a larger premium compared with 2019 and F/G properties seeing a larger discount, as shown in the chart below.

“The value that people attach to energy efficiency is likely to continue to evolve, especially if the government takes measures to incentivise greater energy efficiency to help ensure the UK meets its climate change obligations.

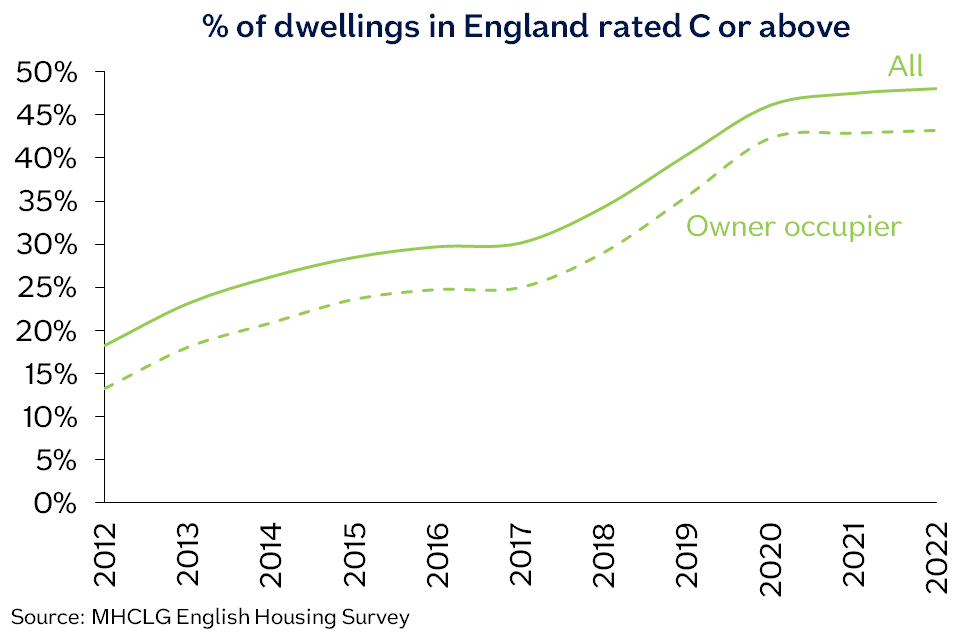

Energy efficiency of the housing stock is gradually improving

“Over the past ten years, energy efficiency has improved significantly, thanks in part to the higher energy rating of newly built properties. However, the rate of improvement has slowed markedly in recent years. The latest data (2022) shows 48% of the housing stock is now rated C or higher, up from 18% in 2012.

So now let us take a look at the Zoopla Property Market Index for August and see what they are saying by comparison with the Nationwide.

Key takeaways

Over the first 7 months of 2024, house prices have risen by 1.4%.

All areas of market activity are up year-on-year – the long-awaited base rate cut has not had a major impact so far

Price inflation has improved across all regions of the UK. It remains slightly negative in southern England, but London’s positive at 0.2%

1 in 5 homes have had their asking price cut by 5% or more, an above average level showing continued price sensitivity amongst buyers

It takes 28 days to sell a home with no asking price reduction, but 73 days if you overprice and then need to reduce by 5% or more

House prices are on track to be 2.5% higher over 2024 with 1.1m sales

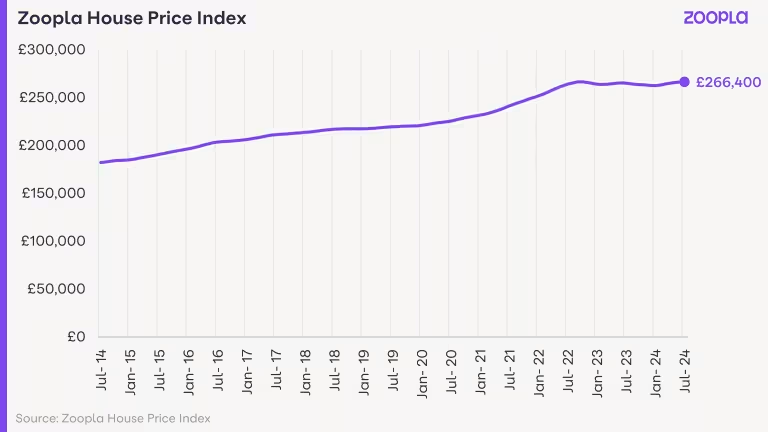

The average house price in the UK is £266,400 as of July 2024 (published in August 2024)

Property prices are now at 0.5% inflation compared to a year ago. However, the average UK house price is set to rise by 2.5% by the end of the year.

The graph below shows how the UK’s average house price has changed in the last 10 years.

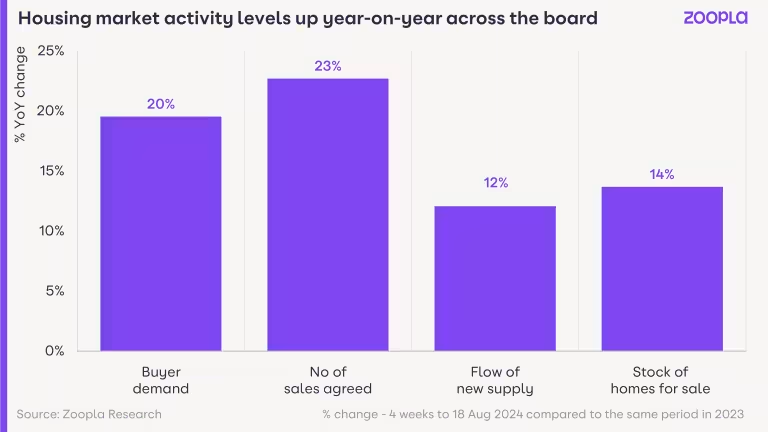

Housing market activity stronger than last year

All key measures of sales market activity are higher than they were in 2023. This has largely been supported by economic growth and rising consumer confidence.

Buyer demand for homes is a fifth higher than this time last year. Additionally, new sales agreed are almost a quarter higher, building on the increased momentum in sales from earlier in the year. Mortgage rates have fallen to an average of 4.5% for a 5-year fixed rate at 75% loan-to-value.

Sellers continue to bring homes to market at an above-average rate. Many of these sellers are also buyers, which explains why the number of sales agreed continues to increase.

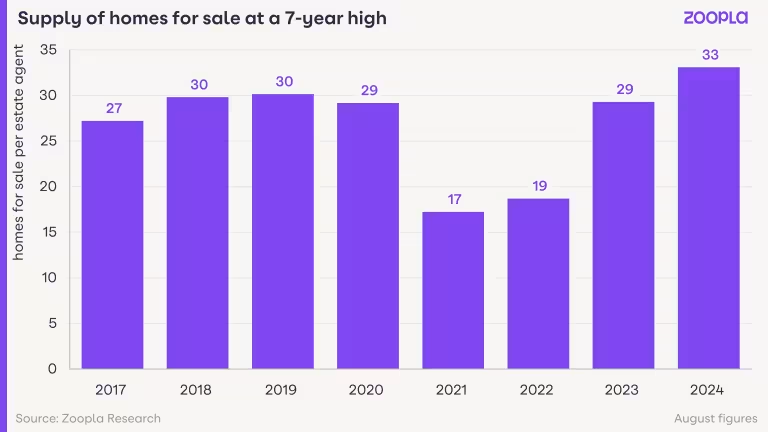

The stock of homes for sale continues to increase and now stands at a 7-year high of 33 homes per agent, giving buyers even more choice. A higher supply of homes will keep headline price inflation in check over 2024 and into 2025. Serious sellers must price realistically to agree a sale within a reasonable time.

No material impact from August base rate cut

The long-awaited cut in the base rate in August was welcome news for the wider economy and consumer sentiment, but it has had no material impact on levels of buyer demand compared to the underlying trend over recent weeks.

The real reason buyer demand for homes is 20% higher than last year is down to a fall in demand over summer 2023, which was in response to the spike in mortgage rates.

However, our data did register a modest increase in the number of new sales agreed in the days following the base rate reduction as wary buyers waited for a rate cut to agree a sale.

The good news is that there is sufficient buyer demand to support rising sales volumes. The number of sales agreed rising by 23% is a truer reflection of the health of the sales market which remains on track for 10% more sales than 2023.

UK house prices increase 1.4% so far this year

A modest recovery in house price inflation is occurring due to rising numbers of new sales agreed, as well as buyers paying a greater proportion of the asking price.

Our UK index shows that the average UK house price has risen by 1.4% so far since the beginning of the year and is on track to be 2.5% higher over 2024.

The annual rate of inflation in our UK house price index is lower at +0.5% as it includes price falls over the latter part of 2023.

Over the last decade, house price falls have only occurred during Q4 2022, Q3 2022, and Q4 2022. These falls were all in response to higher mortgage rates. This year has seen a return to low rates of house price inflation, albeit slowing in the last three months.

Overall price trend is upwards but there are some localised falls

The improvement in house prices over the year-to-date is being felt across most areas of the country.

Annual house price inflation ranges from -0.9% in the east of England to +5.1% in Northern Ireland.

Price inflation has turned positive in London (+0.2%), while prices are seeing small falls in the Southeast (of England), Southwest (of England) and East Midlands.

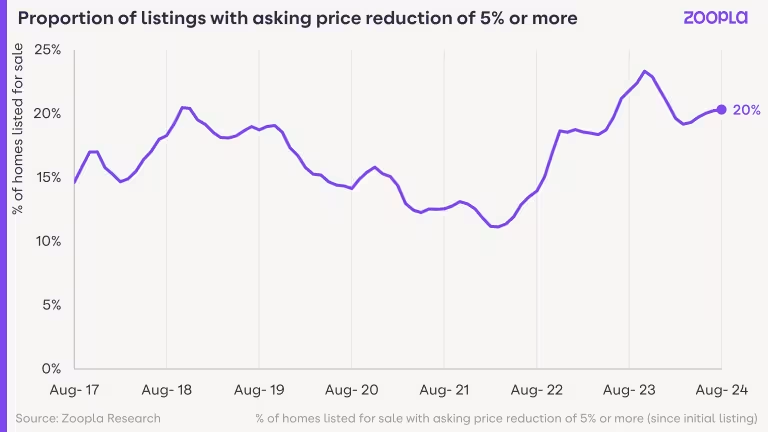

1 in 5 homes have cut asking price by more than 5%

While measures of market activity are higher and price inflation is positive, it’s important that sellers remain realistic on pricing, especially if they are serious about moving home.

The continued growth in the supply of homes for sale is boosting choice for buyers. This will keep UK house price inflation in check into 2025.

Buyers remain price sensitive as their purchasing power has been eroded by higher mortgage rates. This is slowly being offset by faster income growth but there is further to go to fully repair affordability.

We’ve found that 1 in 5 homes that were listed for sale in August have had an asking price reduction of 5% or more to attract buyer interest. This is above average, but lower than the 23% high recorded last autumn, when higher mortgage rates hit demand and house prices fell.

There is no major variation in asking price cuts across different parts of the country, but reductions are more common for 1 and 2-bed flats.

Homes that need an asking price cut take more than twice as long to sell as homes without asking price changes. Our data shows time to agree a sale is 28 days for a home with no price reduction, and 73 days for a home with a 5%+ reduction.

Getting the asking price right at the outset is essential to secure a timely sale.

Housing market outlook for the rest of 2024

The housing market is more balanced now than it’s been at any time over the last 5 years.

Lower mortgage rates and an improving economic outlook have brought more sellers and buyers into the market, supporting sales volumes and business plans for builders, estate agents and lenders.

How much lower mortgage rates will move depends on expectations for base rates.

Our view is that average mortgage rates will remain above 4%, which is sufficient to support more home moves and sales. Healthy growth in household incomes remains as important as borrowing costs for the overall health of the housing market as we look ahead into 2025.

So, there we have the national picture. What really caught our eye was the comment from Zoopla explaining that their data was showing that homes which needed a price reduction were taking more than twice as long to sell as homes which hadn’t been reduced. Homes that had no price reductions were taking on average 28 days to attract an offer, but 73 days for a home which had been reduced.

Now let’s take a look at what has been happening in the SK8 and SK3 property market during the month of August and see how we are comparing with the national picture.

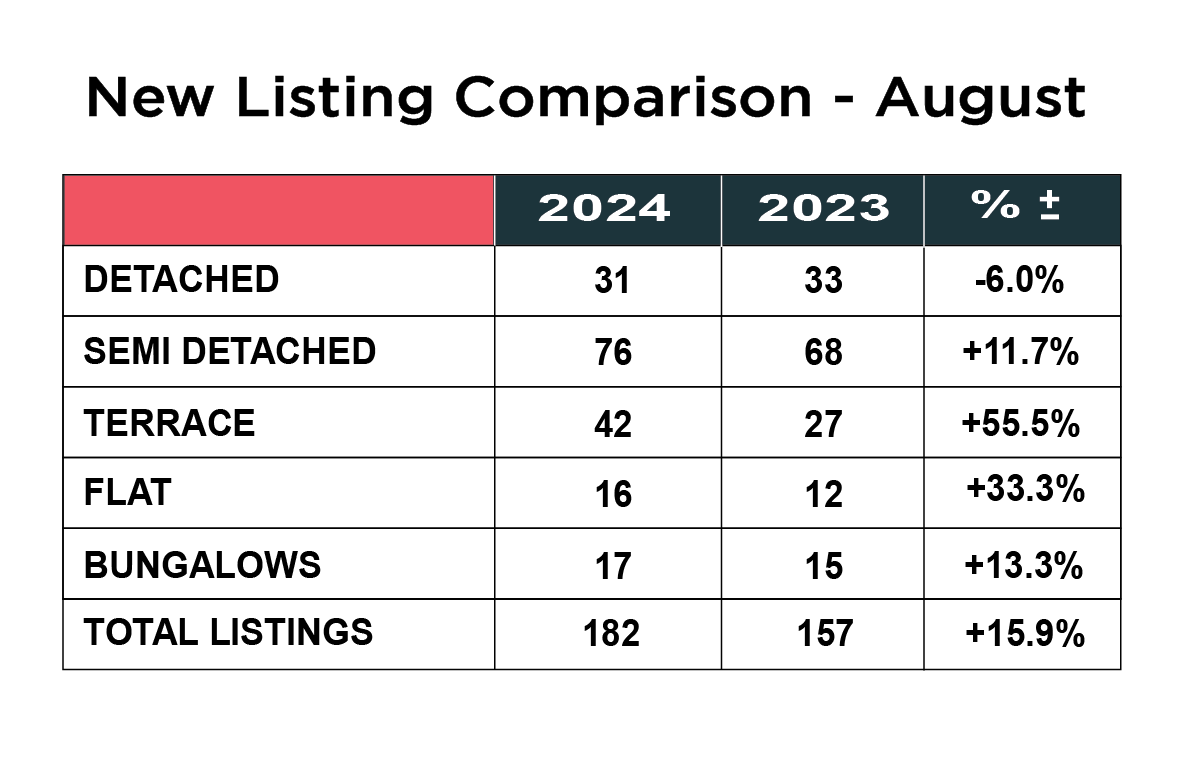

New instructions up a huge 48% across SK8 and SK3

Every individual type of property still saw a rise, except detached homes, which dropped from 33 in 2023 to 31 in 2024, a modest drop of 6%. However, there were significant increases in the number of terraced homes coming to the market for the second month running, up 55% from a year ago, increasing from 27 in 2023 to 49 in 2024. There was also a 33% uplift in the number of flats for sale, which went up from 12 last year to 16 in 2024. Bungalow listings increased 13.3% from 15 to 17 and semi-detached homes 11.7% from 68 to 76. Until stock levels drop, it will keep house price inflation subdued.

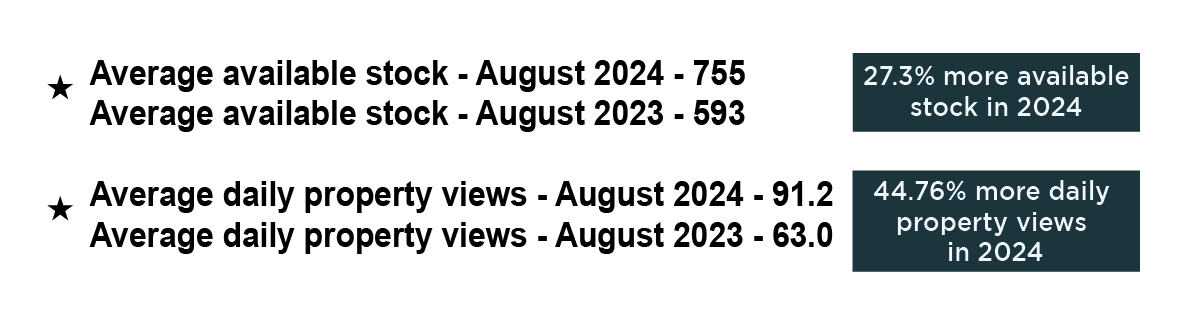

Stock levels still a quarter higher than in 2023 – but daily property views on the rise

For the 7th consecutive month stock levels rose to record levels, albeit the rate of increase reduced significantly in August 2024. There are now 755 properties currently available.

For the 7th consecutive month stock levels rose to record levels, albeit the rate of increase reduced significantly in August 2024. There are now 755 properties currently available.

On a positive note, the number of daily property views on Rightmove edged up from 89.2 last month to 91.2 in August, against last August when there were only 63 daily property views, so this year has seen a 45% uplift. This is still significantly below the peak in 2022, but a step in the right direction. It will be very interesting to see what happens during September, a month where there is a traditional bounce in activity once the kids have gone back to school.

What is happening to individual house price types in SK8?

The average price of a house in SK8 now stands at £372,314, which is a very slight drop on the previous month but still up 1.3% year on year and before anyone starts worrying too much – remember prices are still up 25% over a five-year period.

The average price of a house in SK8 now stands at £372,314, which is a very slight drop on the previous month but still up 1.3% year on year and before anyone starts worrying too much – remember prices are still up 25% over a five-year period.

When we break it down by property type, detached homes now stand at £513,516, which is a £4,000 drop on the previous month, but still up 0.4% year on year. Semi-detached homes now have an average of £372,194, which is up 1.3% on the previous twelve months. Terraced houses now average £307,036, which is down £7,000 on last month and -0.4% over the last twelve months. Flats have actually gone up in value, up almost £3,000 since last month and now stand at an average of £183,229 or an increase of 2.8% on the year.

What is happening with SK3 house prices by individual type?

The average price of a property in SK3 currently stands at £235,429, which is down 0.6% year on year and down £1,000 on the previous month. Average prices in SK3 have now been in decline for two consecutive months.

Detached homes now stand at an average value of £341,938 which is up from last month, but still down 3.4% year on year. Semi-detached homes now average £267,541, which is £7,000 down on the previous month and -2.0% for the year. Terraced houses now average £213,971, up 3.6% on this time a year ago, and flats now average £171,368 which is actually up an impressive 12.4% year on year.

Sales up in line with increased stock levels

After two fantastic months of sales for us in Cheadle, August didn’t disappoint and we enjoyed another outstanding month for sales, way above the previous two Augusts.

After two fantastic months of sales for us in Cheadle, August didn’t disappoint and we enjoyed another outstanding month for sales, way above the previous two Augusts.

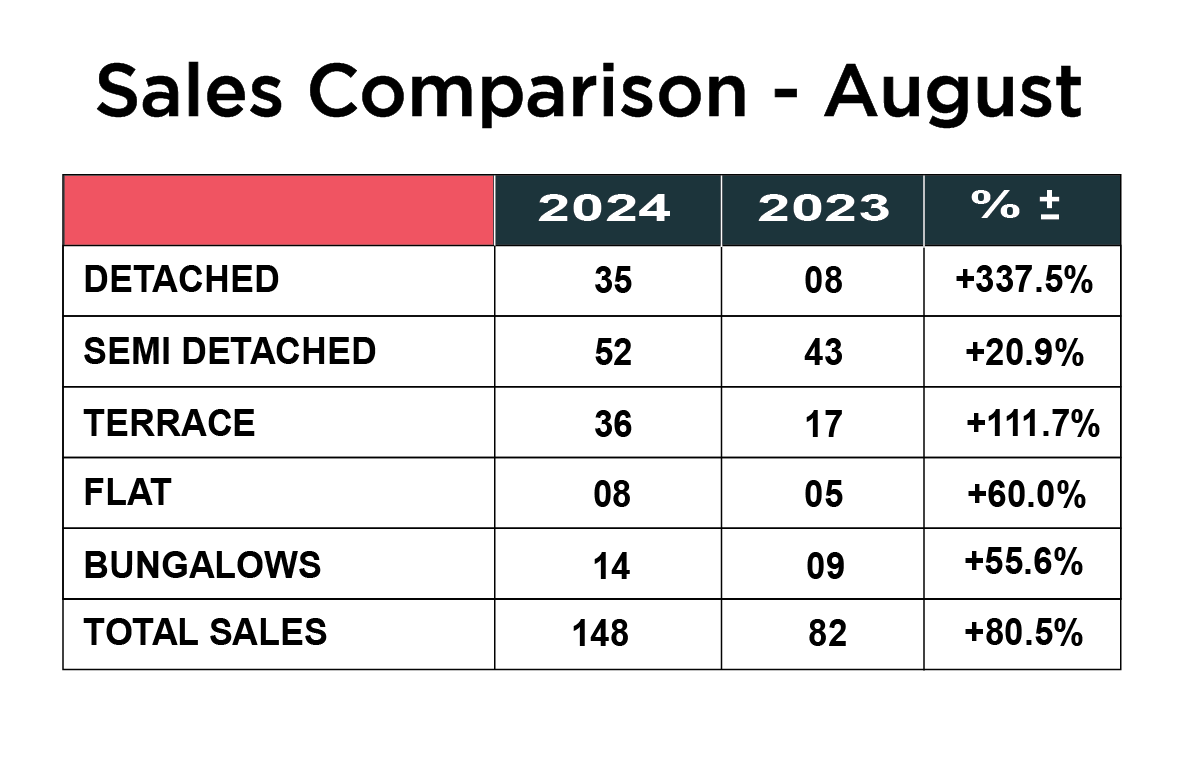

It would appear that it was a similar pattern across SK8 and SK3, as the number of properties sold increased 80% from the previous year, up from 82 last August to 148 in August 2024, which is traditionally one of the quieter sales months of the year.

When we break down the number of sales by type, there was a huge increase in the number of sales in every category of property. Most notable was the 337% increase in the number of detached homes sold, up from 8 in 2023 to 35 in 2024.

There was also an 111% increase in the number of terraced homes sold, up from 17 last year to 36 this year. The of flats and bungalow sales were up 60% and 55% respectively and the number of semi-detached homes sold increased from 43 to 52, which was an increase of 21%

What’s happening in the SK8 and SK3 rental market?

There remains a distinct imbalance between the supply of rental properties in SK8 and SK3 and demand, which remains extremely high. Rents have increased modestly year on year too, up 1.3% on the same period last year, with the average rent for a house now standing at £1,604 and the average rent for a flat is £935. The annual yield in SK8 is around 5.77%.

In SK3 rents are down 0.6% year on year, with a very healthy average yield of 6.13%. The average rent for a house in SK3 is £1144 and a flat stands at £1032

If you are a landlord with a property to rent out, we would love to hear from you, as we have a huge database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website CHECK OUT OUR LANDLORD SERVICES AND FEES

Summary

Nationally there doesn’t appear to have been a great deal of change in the property market during August, although the information in respect of house prices from Zoopla was very interesting and should be noted by those trying to sell their property currently.

What we have noted in SK8 and SK3 is a slowdown in the rate of increase for stock levels – this could be seasonal, and we will see how things play out in September, which is a traditionally busy month for the property market.

It will also be interesting to see how the Bank of England has been viewing the economy and whether they will be confident enough to give borrowers some more welcome respite with another interest rate cut this side of Christmas.

We know that our advice each month must start to sound like a gramophone record, but we make no apology for re-enforcing this very important message - All the metrics show that the market is resilient but subdued and prices are dropping as you can see in the above data. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same. We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and money in the long run.

It is also important for sellers to choose a well-established, experienced local agent who has operated in challenging markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents such as Strike and Purple Bricks are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or good practice.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed ahead of a move in 2024 or 2025 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.