Whether you're thinking of selling, buying, or simply keeping an eye on the market, we’ve got you covered. This month, we explore what's really happening behind the headlines, how Cheadle is performing compared to surrounding areas, and what it all means for your next move. It's smart, it's local – and it’s essential reading if you want to stay ahead in this fast-changing market.

May 2025 was anything but quiet – and not just in the property world. Nationally, the housing market continues to tread a cautious path, with Rightmove reporting a slight seasonal uplift in new listings, while mortgage approvals remain steady thanks to continued speculation around potential interest rate cuts later this summer. Locally in SK8 and SK3, demand has stayed resilient, particularly for well-presented family homes, though buyers remain price sensitive and value driven. Beyond the property scene, the UK political theatre continued. Meanwhile, across the Atlantic, the US continues to be chaotic under the presidency of Donald Trump, and globally, Eurovision brought some much needed sparkle to our screens (yes, Sweden know how to do Eurovision) even if Austria won.

With sunshine, uncertainty, and plenty of headlines, May has given us a lot to talk about – both in bricks and mortar, and beyond.

So, as we always do, let’s start by taking a look at the national picture, and to see how the SK8 and SK3 markets are performing by comparison and whether we are mirroring the national market or are somewhat of an anomaly.

Here are the headlines from the Nationwide May Property Index.

Annual house price growth edged higher in May

• Annual rate of house price growth increased marginally in May to 3.5%, compared to 3.4% in April

• House prices were up 0.5% month on month

• House prices in predominantly rural areas have risen by 23% over the last five years, compared to 18% in more urban areas

The average house price in the UK now stands at £273,427, up from £270,752 in April ( not seasonally adjusted ) * (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“Annual UK house price growth was marginally stronger in May at 3.5%, compared with 3.4% in April. House prices rose by 0.5% month on month, after taking account of seasonal effects.

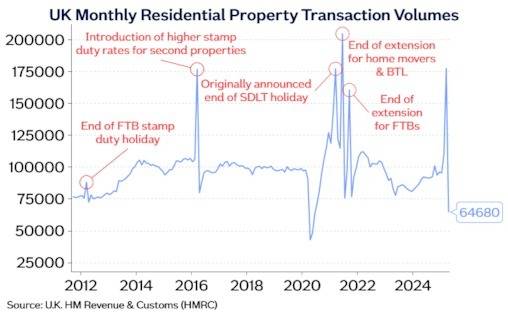

“Official data confirmed that there was a significant jump in residential property transactions in March, with buyers bringing forward their purchases to avoid additional stamp duty costs. Owner occupier house purchase completions were around twice as high as usual and the highest since June 2021 (which was also impacted by stamp duty changes).

“Nevertheless, mortgage approvals data suggests that market activity appears to be holding up well following the end of the stamp duty holiday. Despite wider economic uncertainties in the global economy, underlying conditions for potential home buyers in the UK remain supportive.

“Unemployment remains low, earnings are rising at a healthy pace (even after accounting for inflation), household balance sheets are strong and borrowing costs are likely to moderate a little if Bank Rate is lowered further in the coming quarters as we, and most other analysts, expect.

Price of countryside homes ploughs ahead of urban properties

“Our recent special report identified that average house price growth in predominantly rural locations has continued to outpace more urban areas. Between December 2019 and December 2024, house prices in predominantly rural areas increased by 23%, compared with 18% in areas that are largely urban.

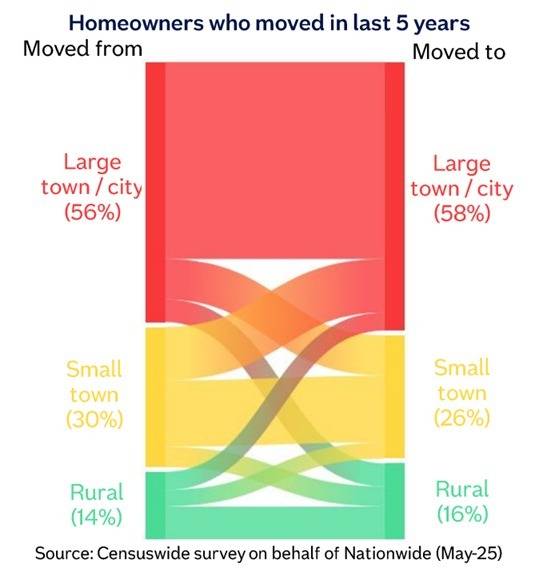

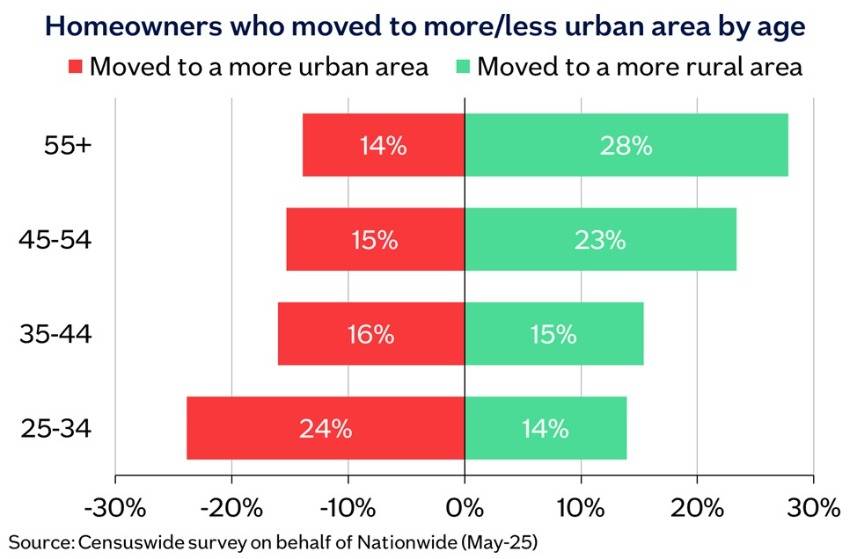

“The pandemic had a significant impact on housing demand during 2021 and 2022, with a shift in preferences towards more rural areas, particularly amongst older age groups. Whilst these effects have now faded, less urban areas have continued to hold the edge in terms of house price growth.

“In our latest housing market survey1, we focused on homeowners who have moved in the last five years. Our findings indicate that the majority (63%) of house moves were within the same type of area, with the biggest flow being within large towns or cities (as shown in the diagram above). Around 9% of moves were from towns/cities to rural areas (villages or hamlets), although this was partially offset by 7% who moved from rural to more urban areas.

“However, amongst those who moved to a different type of area, there was a significant difference by age group, with younger people (those aged 25-34) tending to move to more urban areas, and older age groups, particularly 55+, favouring more rural areas (see chart above)

Now lets take a look at Zoopla's market analysis for May 2025.

Key takeaways

• The number of sales agreed in May is the highest it’s been for 4 years and up 6% on last year

• The rise comes as the market rebounds after the Easter lull and initial reaction to stamp duty relief ending

• House price growth is stable with a 1.6% rise compared to a year ago

• More sellers are listing their homes for sale, with a 13% rise on last year

• Northern regions of England are seeing the strongest growth in sale numbers and annual house price rises of 3%

• Southern regions have more homes for sale and lower house price growth of less than 1%

• There’s a wide variation in house price growth across UK cities, from modest falls in Brighton and Aberdeen to 5%+ gains in Blackburn and Belfast

• The housing market is on track for 5% more sales and 2% price inflation over 2025

Key figures

The average house price in the UK is £268,250 as of April 2025 (published May 2025). This is a rise of 1.6% or £4,330 over the past year.

Rebound in sales after initial reaction to end of stamp duty relief

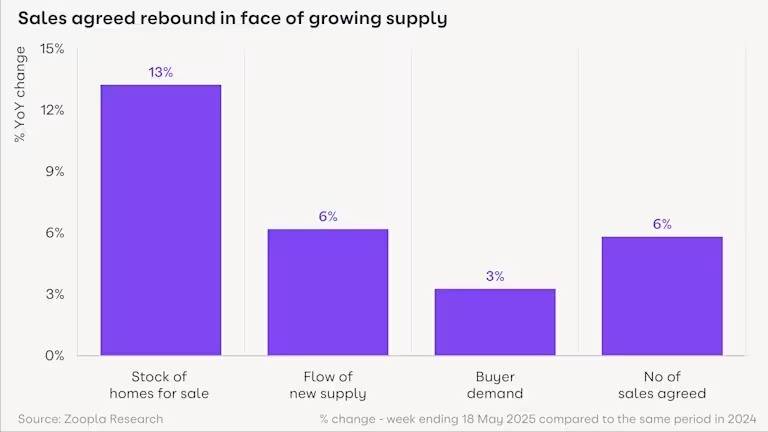

The number of housing sales is on the rise with home buyers returning to the market after the end of stamp duty relief and the Easter holidays.

The latest data shows the number of sales agreed per estate agent at this time of year is running at the fastest rate for 4 years, since the pandemic boom of 2021.

This is due to a high number of homes for sale and improvements in mortgage rates and availability.

There are 13% more homes for sale than a year ago. The average estate agent office has 35 unsold homes. Most of these home sellers are also buyers, which means plenty of interest for well-priced homes. More mortgage products with sub-4% rates, together with changes to how mortgage affordability is calculated, are encouraging buyers to make offers, supporting a 6% growth in sales agreed.

The average UK house price is 1.6% higher than a year ago at £268,250, which is an increase of £4,330 over the year.

Zoopla data shows the average home sale is currently being agreed at 3% (or £16,000) below the average asking price, a level that has been stable over recent months.

6% more agreed sales in May 2025 than a year ago

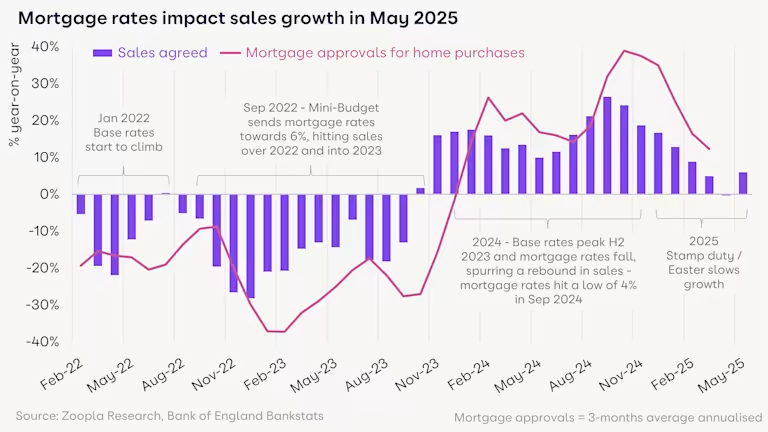

The shift to higher mortgage rates over the last 3 years has impacted growth rates for housing sales and mortgage applications. Sales declined sharply in 2022/23 as mortgage rates reached 6%.

The growth in sales rebounded over 2024 as mortgage rates fell, which also boosted demand for mortgages. However, the growth in sales and mortgage approvals has slowed in recent months to more sustainable levels.

Sales have now started to increase once again as confidence improves and those using a mortgage are able to borrow up to 20% more due to changes in affordability testing.

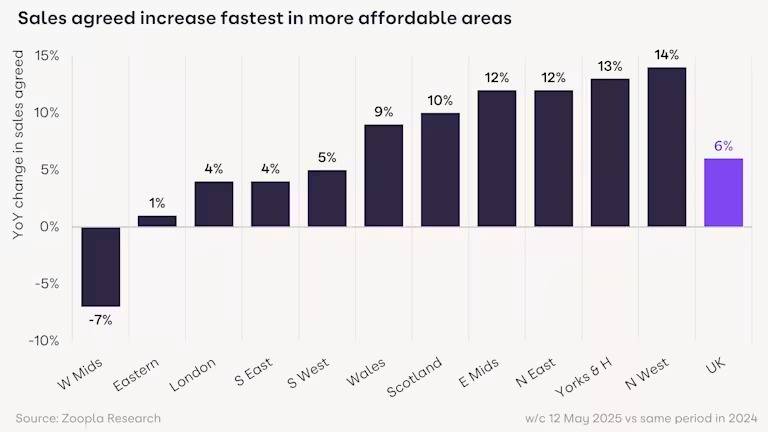

Most affordable areas record fastest sales growth

Housing market activity and house price inflation are currently strongest in areas where homes are more affordable. In broad terms, this covers most areas outside the southern regions of England.

The latest data shows northern regions of England, Scotland and the East Midlands are registering the fastest growth in agreed sales compared to a year ago. However, affordability constraints are behind a slower growth in sales across southern regions of England, with a decline in sales in the West Midlands compared to a year ago.

The number of homes for sale is an important influence on market activity and house prices. More homes for sale boosts buyer choice and keeps price growth in check. Faster growth in sales erodes the number of homes for sale, limiting what is available and supporting faster house price growth.

More homes for sale across southern England

The number of homes for sale has grown most quickly across southern regions of England, boosting choice. There are 21% more homes for sale in the South West compared to a year ago, with 17% more in London and 15% more in the South East.

Slower growth in sales and more homes for sale explains why house price growth is less than 1% across all regions of southern England - ranging from 0.5% in the South East to 0.9% in the South West.

Fewer homes for sale in the North supports price inflation

In contrast, there are just 3% more homes for sale in the North West and 5% more in Scotland than a year ago. Lower availability of homes for sale, better affordability and faster growth in sales explain why house prices are 3% higher across the North West and 2.9% higher in Scotland, with above-average price rises across northern England and Northern Ireland.

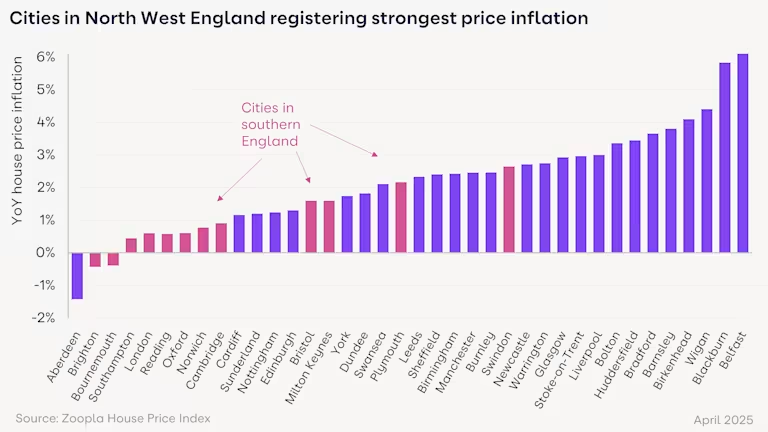

House prices rising by up to 6% in some UK cities.

Looking below the regional level, house price inflation varies widely at a city level - from small price falls in Aberdeen, Brighton and Bournemouth to prices increasing by over 5% in Blackburn and Belfast. The fastest-growing markets tend to be outside southern England.

Cities across the North West are registering the highest rates of price growth, as rising employment growth boosts demand and prices. Higher home values and rents in large cities like Manchester are pushing demand into adjacent and accessible areas, boosting house prices.

Price increases remain subdued in southern cities of England, where affordability remains a constraint on how much prices can rise. Aberdeen is under-performing the Scottish market because of weaker economic conditions due to low investment in the oil and gas industry.

Zoopla expect this variation in price inflation to continue over the rest of the year as home values rise in more affordable areas.

Outlook for the housing market in 2025: modest price gains and more sales

Strong competition in the mortgage market and less stringent affordability testing is set to support buyer demand and sales volumes over the second half of 2025.

The different trends in supply and demand across the country have important implications for how sellers approach the pricing of their homes if they are serious about selling in 2025. Buyers also need to adapt to local market conditions in how they pitch offers to buy.

Overall, the housing market is well set for 5% more sales in 2025 compared to last year, with just enough house price inflation to keep sellers and buyers entering the market and making bids for homes.

Local Outlook – More houses for sale but sales remain subdued

Now it is time to take a look at how the local SK8 and SK3 markets have been performing and compare and contrast local trends with the national picture.

Listings continue to rise at record rates across SK8 and SK3

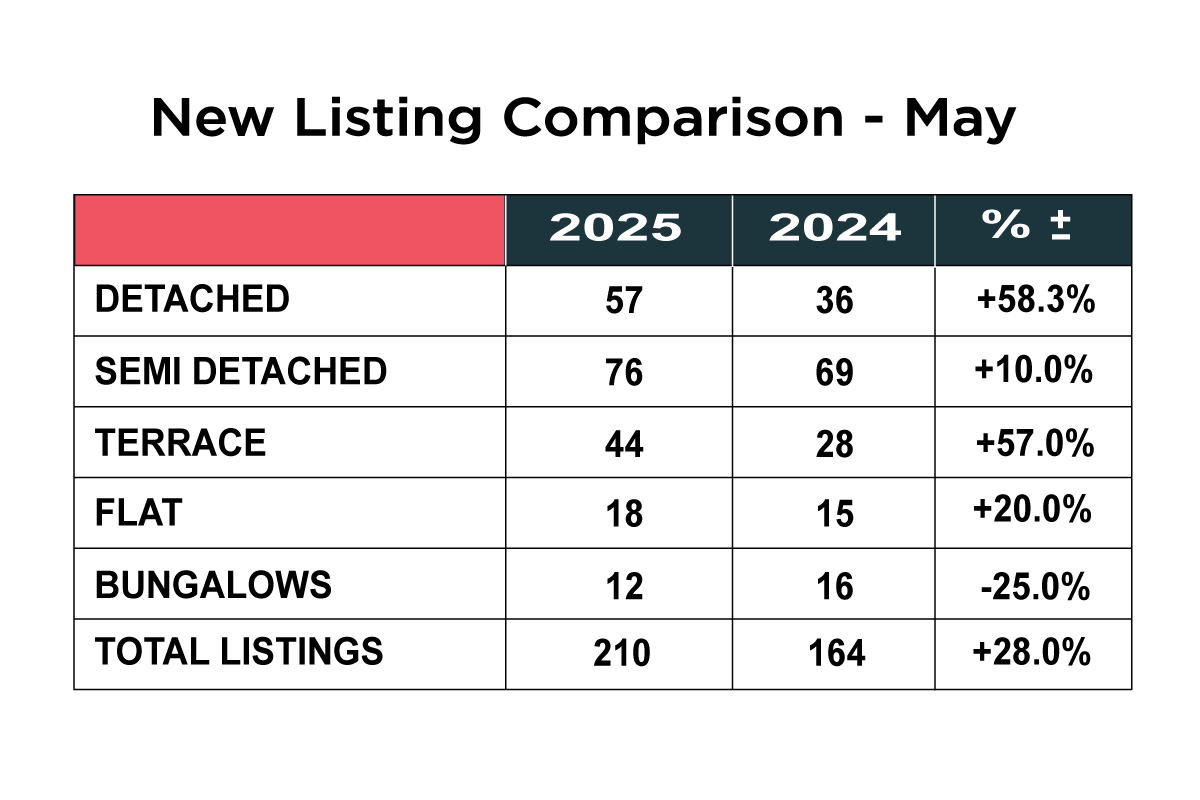

The number of new properties coming onto the market in May continued at record levels, up another 28% on the previous year, up from 164 to 210.

We saw an increase in the number of new instructions in 4 of the 5 categories, with the biggest increase in the number of detached and terraced homes, up 58% and 57% respectively, with detached homes going up from 36 in 2024 to 57 in 2025. The number of flats for sale was next, up 20% in 2025, from 15 to 18. There was an increase of semi- detached homes, up 10% from 69 to 76. The only category where there was a drop in instructions was bungalows, down 25% from 16 in 2024 to 12 in 2025.

Stock levels still rising will keep pressure on prices

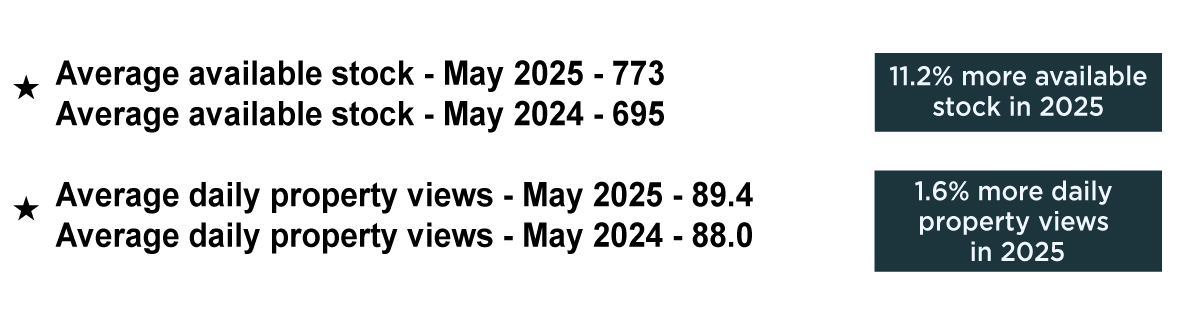

The average stock available in May 2025 was a record 773 homes, against 695 for the same period in 2024. That is an increase of 11.2% on last year.

The average number of daily property views on Rightmove has remained consistent year on year but says a lot really when there is more stock available. It is clear that many prospective buyers are still not fully engaged with the buying process.

SK8 house prices by type

The average price of a property in SK8 now stands at £355,916, which is down 3.0% from the previous year, the third month in succession that house prices have come down in SK8, which equates to around £10,000 per property in actual monetary terms.

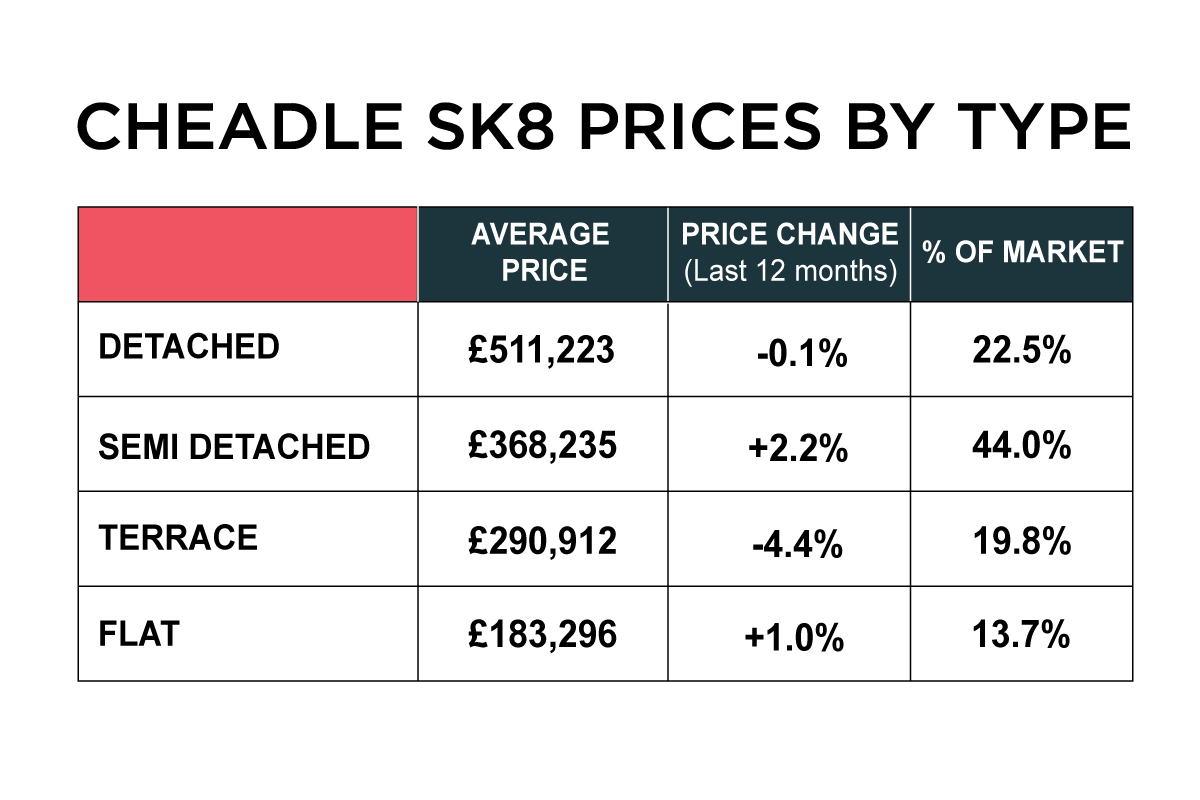

When we look at the individual property types, detached homes are 0.1% cheaper than they were 12 months ago, standing at an average of £511,223. Semi-detached homes are now at an average price of £368,235, up 2.2% from a year ago. Terraced homes are down 4.4% from a year ago, which equates to an average price of £290,912 and flats have risen 1.0% over a twelve-month period and now stand at an average of £183,296.

What’s happening to property prices by type in SK3?

The average price of a property in SK3 currently stands at £256,057 which is an impressive 10.3% up year on year, or if you want to see what that equates to in pounds, shillings and pence, that’s an average increase of over £25,000 which is in contrast to the slight drop in prices in SK8 over the same period. The infrastructure changes around Stockport are beginning to have an effect on values in the surrounding area.

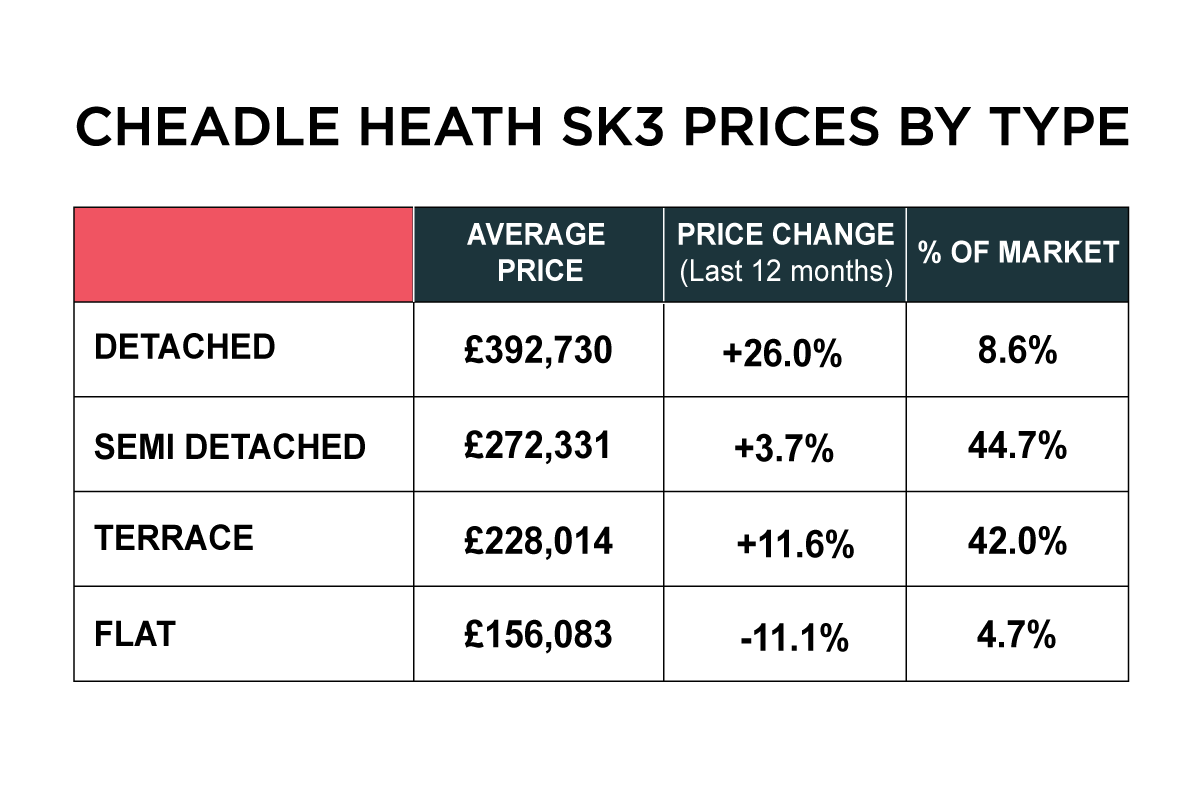

Detached homes now stand at an average value of £392,730, which has shown some significant fluctuation in recent months but is still a very impressive 26% up year on year. Semi-detached homes now average £272,331, which is up 3.7% over the last twelve months. Terraced houses now average £228,014, which is up 11.6% year on year and £9,000 more than January this year. Flats now average £156,083 which is down 11% from their peak this time last year.

Sales figures levelled out in April 2025

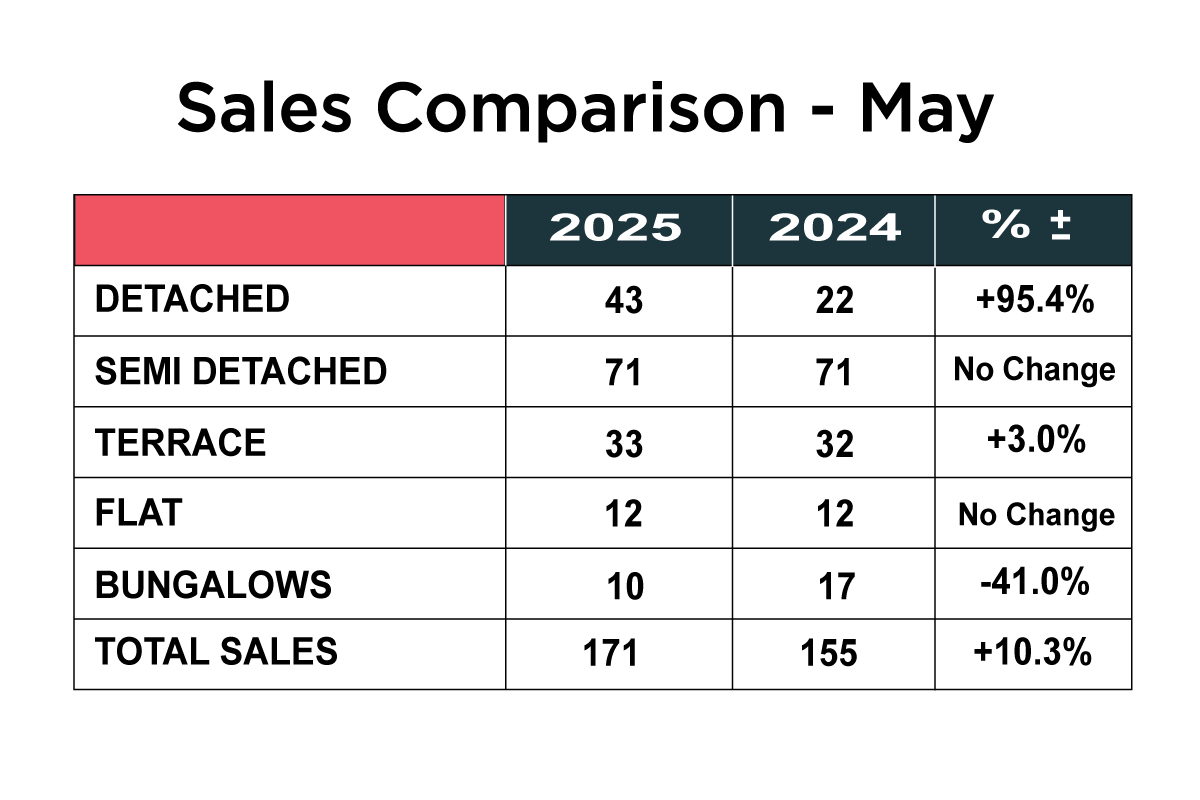

May 2025 showed an upturn in property sales – a rise of 10% on this time last year.

The total number of sales rose from 155 in 2024 to 171 in 2025, which on the face of it looks pretty good. However, when we factor in the largest stock of houses currently available for 12 years, you might expect a higher number of sales, but at least the direction of travel is positive!

The largest increase was in the number of detached homes which were sold in May – up 95% on the previous year from 22 to 43. There was no change in the number of flats or semi-detached homes sold, but terraced house sales were up 3% from 32 to 33, whilst there was a significant drop in the number of bungalows sold from 17 to 10 – a drop of 41% from this time last year.

How are the SK8 and SK3 Rental Markets currently performing?

The new Renters Rights Reform Bill continues to go through parliament and the house of lords and various amendments continue to be made, so whilst some elements of the bill are likely to be implemented shortly, the majority has been pushed back to later in the year.

The ongoing uncertainty and press speculation is causing many landlords to offload some or all of their rental portfolio as they worry about what effect the law changes will have, but this of course impacts on supply and keeps the upward pressure on rents.

The average rental price for a house in SK8 is now £1673, which is 3% lower than a year ago and for a flat it is £1048. The yield is a very respectable 5.41%, which despite landlords fears about the new legislation, still make renting a property out financially viable, particularly if the property doesn’t have a buy to let mortgage on it!

In SK3, the average rent for a house and flat are bizarrely virtually the same at £1200 per calendar month, which still gives landlords a very healthy yield of around 6.18%. With the number of new flats being built in the Stockport area, rents and yields are likely to rise over the next few years in the area.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a pre-qualified database of high calibre tenants waiting for the right home. Call Patrick, Joe or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website https://www.mkiea.co.uk/landlord-services

Also, if you have any questions or concerns about the Renters Rights Bill and how it might affect you please do get in touch.

Looking Ahead - What’s Next for the Local SK8 and SK3 Market?

As we move through the remainder of Q2 and into the second half of 2025, we expect to see the local property market in Cheadle, Cheadle Hulme, Gatley and Heald Green remain resilient – but increasingly competitive.

Stock levels are likely to continue rising as more homeowners look to take advantage of the peak summer selling season, giving buyers more choice and placing greater importance on how homes are presented and marketed.

Buyer demand is expected to stay strong, particularly for well-positioned family homes and properties near schools, transport links, and green space. However, with affordability under pressure due to elevated mortgage rates (currently averaging 4.54%), price sensitivity will become more apparent – especially for properties that lack standout features or are priced too ambitiously.

We also anticipate more activity from first-time buyers and younger families keen to put down roots in areas that offer lifestyle value as well as financial sense. This growing demographic will play a vital role in keeping the local market moving.

That said, securing the best price in this changing landscape will depend on intelligent pricing, compelling presentation, and a strategic marketing plan designed to generate strong early interest.

If you're looking for tailored insights based on your unique circumstances or wish to understand how the market could affect your future investments, Maurice Kilbride is here to help. As the only local member of the FIA, a network of high-quality UK independent estate agents, we take pride in delivering personalized, expert services that cater to the individual needs of our clients.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2025, please contact Joe, Patrick or Maurice to arrange for a FREE marketing advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.