Welcome to this month’s Cheadle Property Market Update – your trusted snapshot of what’s really happening in the local and national housing market as we head towards the end of 2025.

Whether you’re thinking about selling in the New Year, actively house hunting, or simply keeping an eye on your property’s value, this report is designed to cut through the national noise and focus on what matters here in Cheadle SK8 and Edgeley SK3 – real data, local trends, and what they mean for your plans going into 2026.

The National Picture – November Data Round-Up

After a quietly resilient autumn, November’s numbers show a market that is slightly dropping but still relatively stable. Prices are edging up in some reports, dipping in others, but the overall story is of a calm, balanced market which is still extremely price sensitive, with still record stock levels of available homes.

Nationwide (November 2025)

-

+0.3% monthly change (seasonally adjusted)

-

+1.8% annual change (down from 2.4% in October)

-

Average UK price: just under £273,000

Nationwide describe the market as “fairly stable”, with modest price growth despite consumer caution and a softer labour market. They highlight that affordability is slowly improving as wages grow faster than prices and suggest that further, gradual rate cuts in 2026 could support demand. Nationwide

Halifax (November 2025)

-

0.0% monthly change (prices broadly flat, up just £139 on October)

-

+0.7% annual change – the slowest since March 2024

-

Average UK price: £299,892 (a new nominal record)

Halifax emphasises stability and improving affordability, with first-time buyers now said to be in their strongest position in a decade, thanks to slightly lower mortgage rates and better income-to-price ratios. The Guardian

Zoopla House Price Index (published November 2025 – data to October)

-

+1.3% annual house price growth across the UK

-

Average UK price: £270,200

-

North West values: around +2.9% higher than a year ago

Zoopla’s take is that the market has been remarkably resilient given higher borrowing costs. Most regions outside the south of England are seeing above-average price inflation, with the North West still one of the better performing areas. They also note that unchanged stamp duty bands mean more buyers are nudged into higher tax brackets, which is restraining some move-up buyers. Zoopla

Rightmove (November 2025 Asking Price Index)

Average new seller asking price: £364,833

-

Monthly change: -1.8% (-£6,591) – the largest November fall since 2012

-

Typically November sees a -1.1% drop, so this is a sharper than usual seasonal adjustment

-

Around 34% of homes on the market have had a price reduction, with an average cut of 6.6%

Rightmove’s data underlines a key theme for sellers: you can still sell well, but not at last year’s wish prices. Where properties launch at realistic levels, buyer interest remains solid and agreed sales in 2025 are very similar to 2024 – but over ambitious asking prices are being chipped back.

National takeaway:

-

Prices are broadly stable, with gentle growth in sold prices but sharper adjustments in asking prices where sellers started too high.

-

First-time buyers are in a stronger position, especially outside the South, helped by improving affordability. The Guardian

-

Markets expect the Bank of England to begin trimming rates in 2026, which would further help sentiment, although borrowing costs remain higher than pre-Covid. Reuters

The Official Numbers – Land Registry & ONS (September 2025)

The official UK House Price Index (HPI) always lags by a couple of months, but it gives a solid, verified snapshot of where we are.

UK Overview (September 2025)

-

Average UK price: £272,000–£271,500 (depending on series)

-

Monthly change: -0.6% vs August

-

Annual growth: +2.6%

So despite the small monthly dip, prices are consistent with the “slow and steady” story from the lenders.

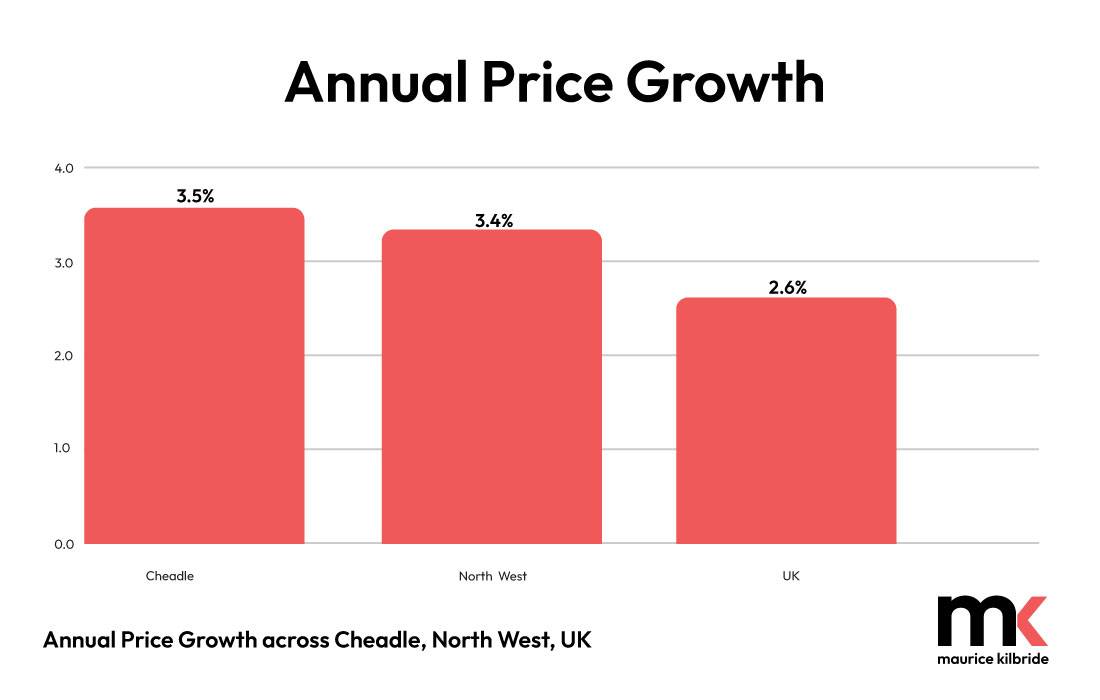

Regional Focus: The North West

-

Average price: £215,030

-

Monthly change: -0.9%

-

Annual growth: +3.4%

The North West continues to outperform the UK average, showing that relatively affordable regions are still attracting buyers, even in a higher rate environment.

Local Detail – Stockport (SK8 & SK3)

-

Average house price (Sept 2025): £306,000

-

Annual price growth: +3.5% vs Sept 2024

-

Stockport now has the third highest average house price in the North West

-

Average private rent (Oct 2025): £1,069 per month

-

Annual rental growth: +5.3%

That puts Stockport and by extension Cheadle SK8 and Edgeley SK3 – comfortably ahead of the national average for both capital values and rental performance.

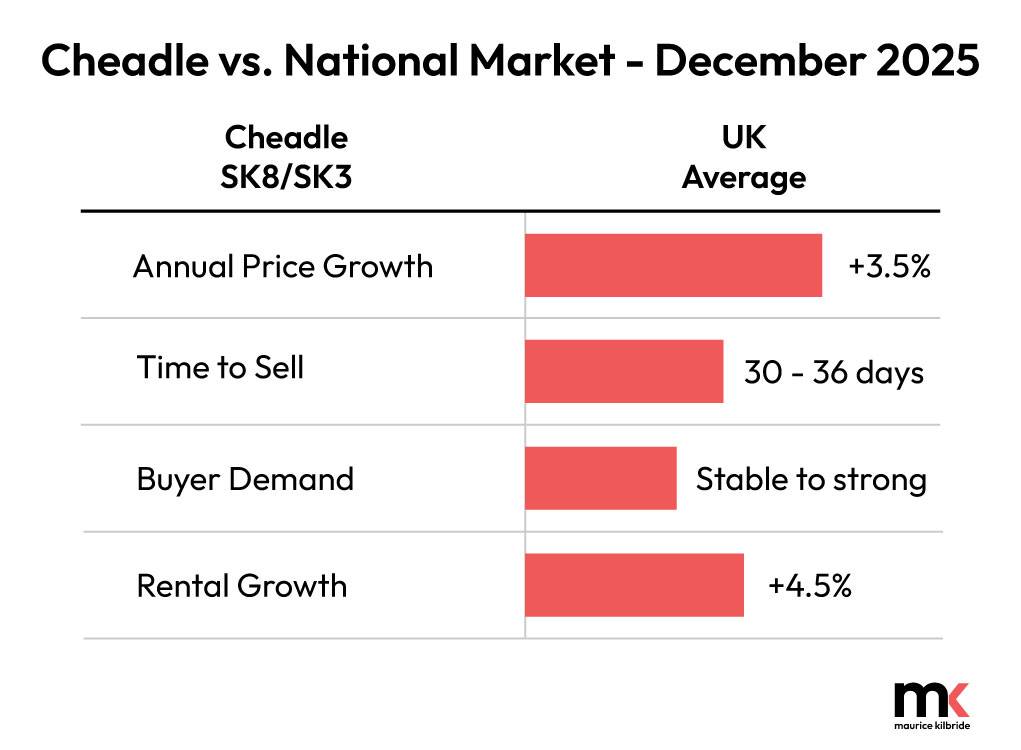

Cheadle & Stockport Market Snapshot

Here’s how the local picture lines up against the wider market as we move into December:

| Indicator | National | North West | SK8/SK3 (Stockport area) |

|---|---|---|---|

| Annual price growth | +1.8% (Nationwide) Nationwide | +3.4% (ONS HPI) GOV.UK | +3.5% (ONS Stockport) Office for National Statistics |

| Average sale time | ~37 days (Zoopla) Zoopla | 33–40 days (typical) | 30–36 days (MK data, well-prepared homes) |

| Buyer demand (YoY) | Slightly down vs 2024 | Marginally down | Flat to slightly up – particularly for family homes |

| Typical asking-price reduction | 2–3% (often more where over-priced) | 1.5–2% | 1–2% on realistically priced stock (more where vendors started too high) |

Local insight

On the ground in Cheadle, Cheadle Hulme, Cheadle Heath, Gatley, Heald Green and Edgeley we’re seeing:

-

Strong interest in 3 bed semis and traditional terraces between roughly £280,000–£450,000.

-

Well-presented, correctly priced homes still going under offer within five to six weeks in most cases.

-

Properties that launched too high in late summer now sitting longer and needing price reductions to unlock new interest – exactly what the Rightmove national figures are highlighting.

-

Buyer quality remains good: fewer “tyre kickers”, more serious movers aiming to complete in early-mid 2026.

What’s Driving the Market Locally?

A few key factors explain why SK8 and SK3 are holding up well:

-

Affordability vs South Manchester

Nearby areas like Didsbury and Chorlton remain significantly more expensive, so Cheadle, Gatley and Edgeley offer better value for similar commute times, especially for upsizing families. -

Post-Budget stability

The Autumn Budget in late November did not radically reshape stamp duty, which has reassured many movers that the rules won’t suddenly change underneath them. Combined with expectations of lower rates in 2026, that’s keeping confidence bubbling. -

Mortgage competition

Lenders are continuing to trim fixed-rate deals and compete for good quality borrowers. For many local buyers, repayments look more manageable than they did 12 months ago, even if rates are still higher than the pre-Covid era. The Guardian -

Solid employment base

Greater Manchester’s jobs market remains relatively robust, providing the income security buyers need to commit to a move. -

Lifestyle & connectivity

Strong schools, village style high streets, and easy access to Manchester, the airport and the M60 keep Cheadle and Edgeley on the shortlist for relocators from across the region.

Local Highlight: SK8 & SK3 Micro-Trends

A rough guide to what we’re seeing by property type, based on recent Land Registry data, Zoopla sold prices, and our own sales evidence: Zoopla

| Property Type | Typical Price Range (SK8/SK3) | Market Movement (last 12 months) | Buyer Activity |

|---|---|---|---|

| 2-bed terraced | £245,000–£275,000 | Gently higher vs 2024, helped by first-time buyers | Strong – popular with FTBs and downsizers |

| 3-bed semi-detached | £330,000–£410,000 | Solid growth, especially for well-modernised homes | Very strong – core family market |

| 4-bed detached | £500,000–£650,000 (more for prime roads) | Broadly stable; buyers more price-sensitive above £600k | Moderate – good interest but longer decision times |

| Flats/apartments | £160,000–£210,000 | Close to flat, with modest growth in best blocks | Steady – investors selective, FTBs focusing on good transport links |

| Typical gross rental yields | c. 5.0–5.5% depending on type and condition | Supported by ~5%+ rental growth and strong tenant demand Office for National Statistics | High tenant demand, particularly 2–3 bed houses up to ~£1,300 pcm |

So let't now take a look at the individual trend for property by type, which show some interesting shifts in the dynamic, especially amongst buyers.

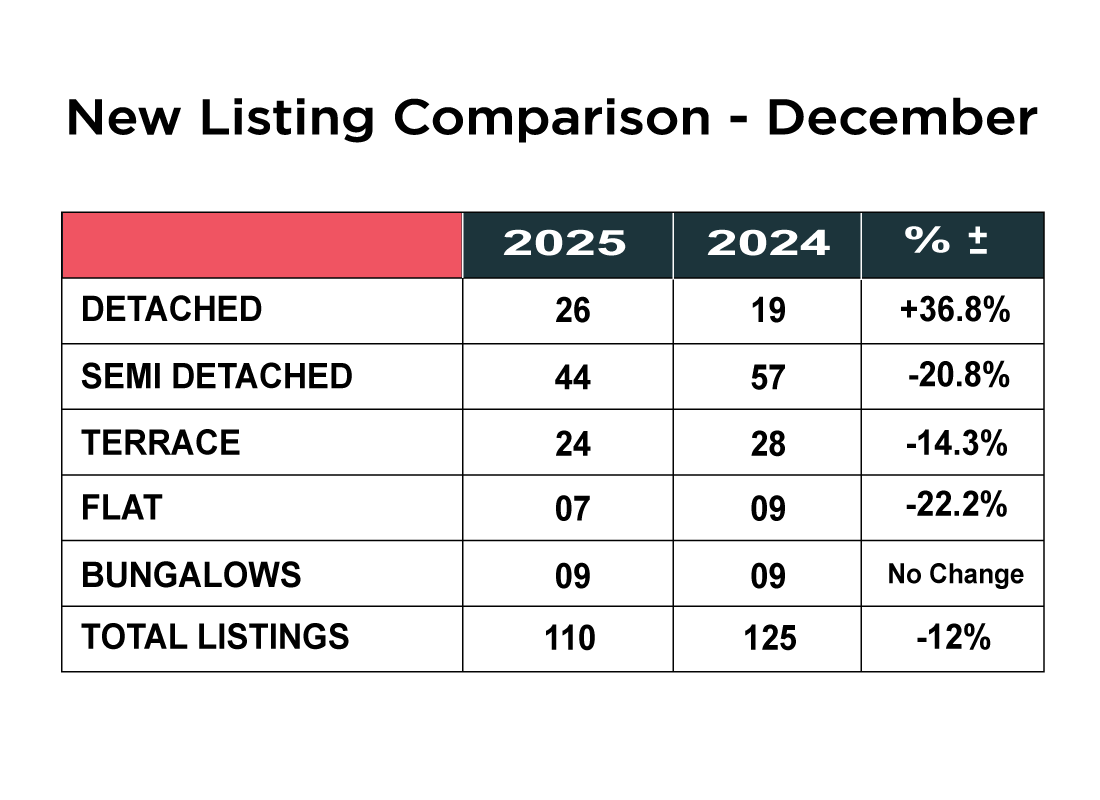

The local new listings in SK8 and SK3 showed a slight reduction of 12% in November, with 110 properties coming to market compared to 125 over the same period last year.

Detached homes were the strongest performers, up an impressive 36.8% (19 to 26), which might be an indicator that some people are looking to move and downsize. However, every other category showed a reduction and weaker performance than the same period 2024. Flat's showed the bigest drop in percentage terms, down 22.2 % and semi detached homes down 20.8%. The number of terraced homes was down from 28 to 24 - a drop of 14.3%. There was no change in the number of bungalows between 2025 and 2024.

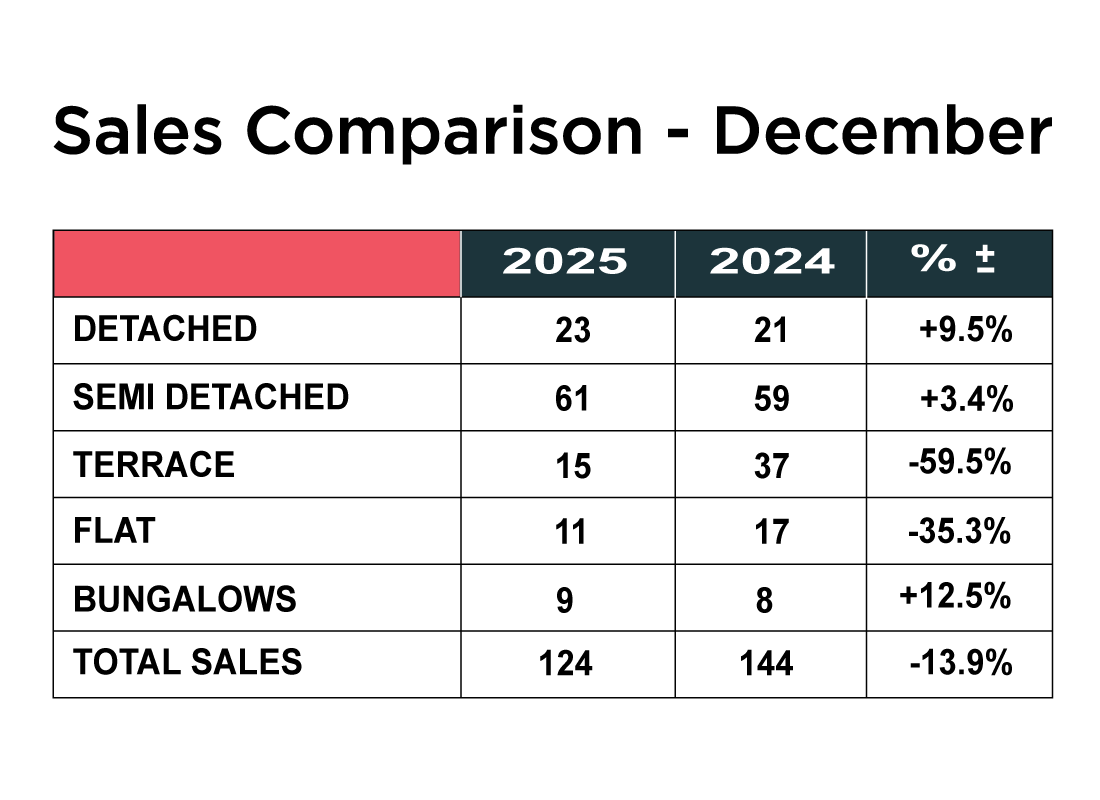

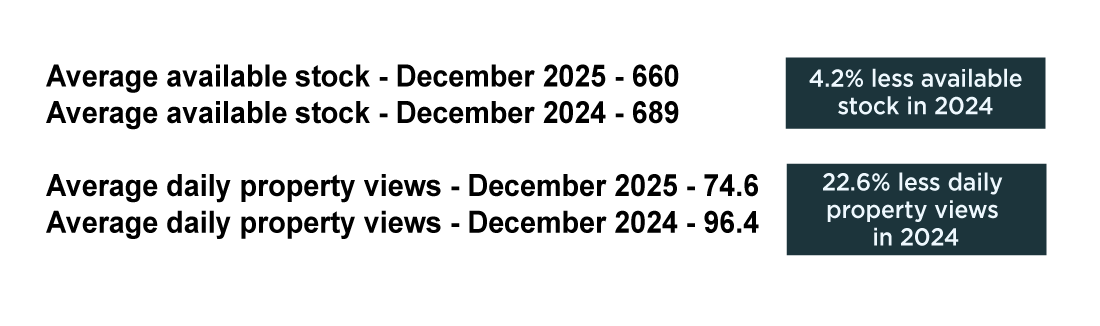

December 2025 saw quite a shift in the buyer market and not in a positive way.

Buyer engagement has softened dramatically. Daily property views on Rightmove were down 22.6% year on year from 96.4 in November 2024 to just 74.6 in 2025 - the lowest for over 3 years and a sharp contrast to the stability we saw in the Summer. This decline indicates that fewer buyers are actively browsing, reflecting both seasonal slowdown and lingering caution over the general economic climate, affordability and interest rate pressures.

The combination of continued high supply levels and reduced buyer activity means a competitive environment for sellers, which is likely to get worse before it gets better with a tradtional spike in now homes coming to the market in the New Year, therefore homes that aren’t priced correctly or presented to stand out risk being overlooked more quickly than before.

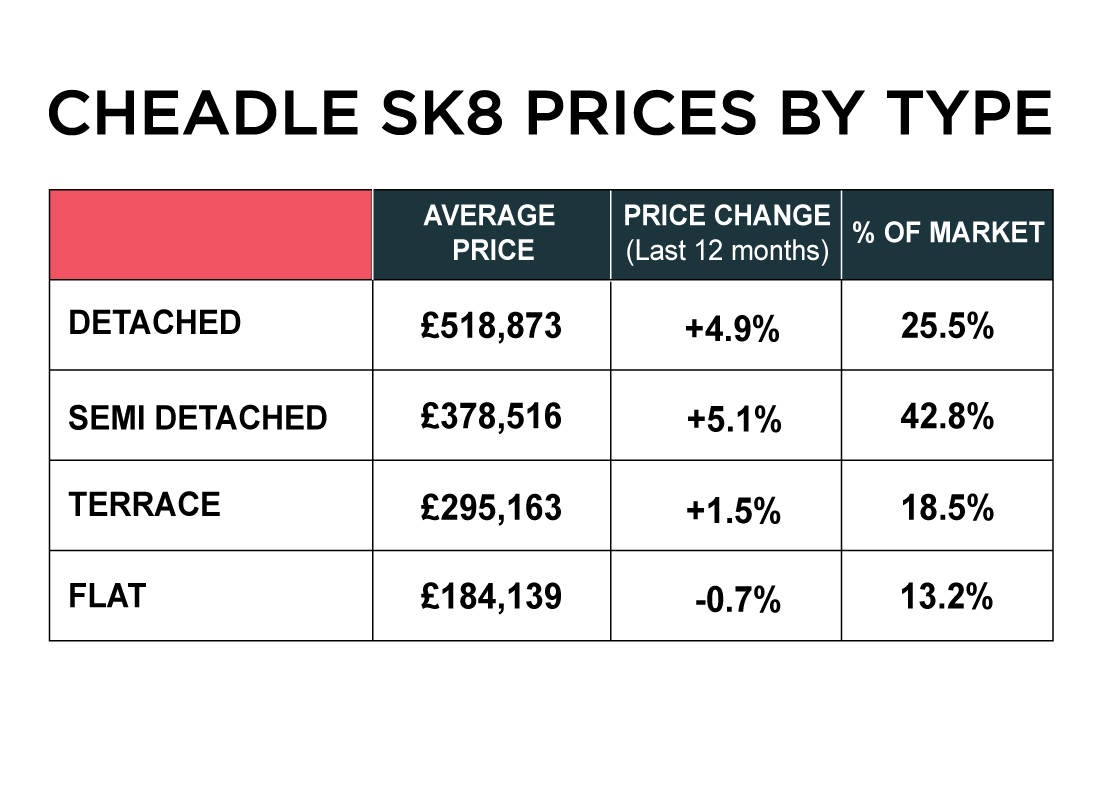

The average property price in SK8 now stands at £370,041, a 3.3% increase year on year. Prices are up in all types of property, other than flats.

Detached homes: Now averaging £518,873, values are actually up 4.9% year on year. Larger family homes in popular school catchment areas continue to perform strongly.

Semi detached properties: Remain the most popular type of property across SK8. Prices have climbed 5.1% year to date, with an average of £378,516. With strong family appeal, semis continue to drive much of the activity across SK8.

Terraced homes: Averaging £295,163 terraces have seen values increase 1.5% over the past year. This reflects affordability pressures in the first time buyer segment, where higher mortgage costs are most keenly felt.

Flats: Now at an average of £184,139 values are down just 0.7% year on year. While this is a relatively small reduction, the flat market remains subdued with limited investor appetite, lender indifference and leasehold issues.

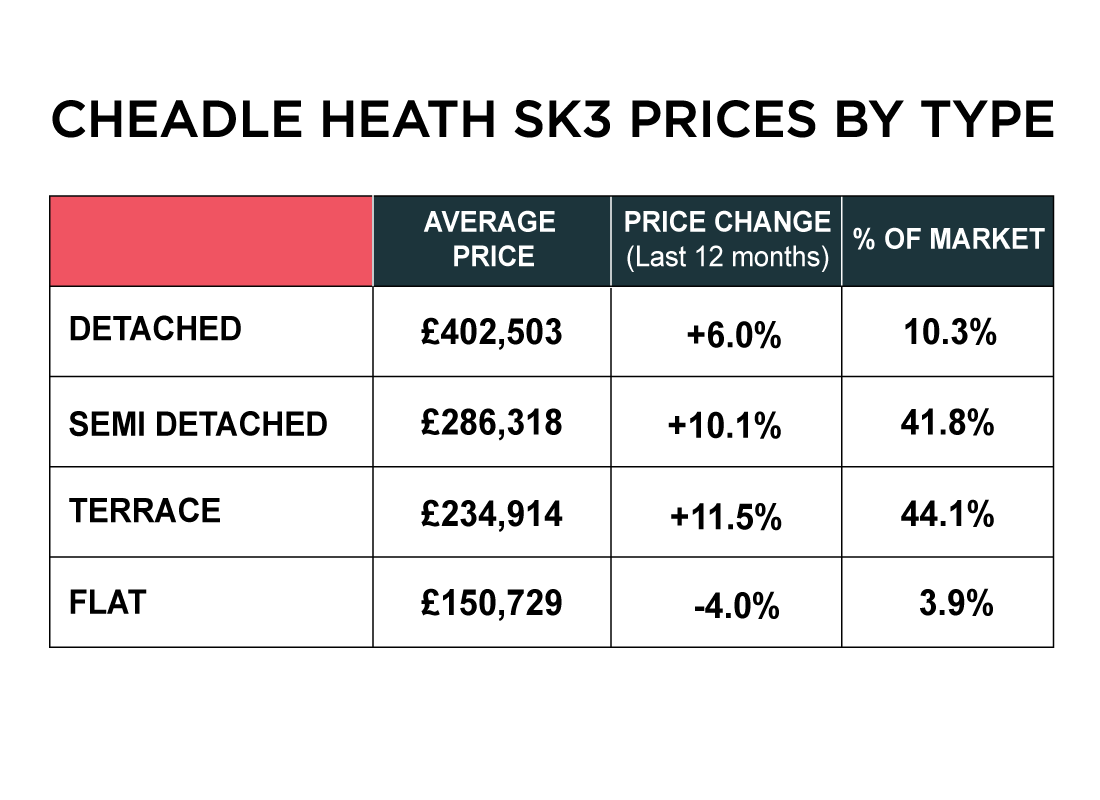

The average property price in SK3 now stands at £268,042 an impressive14% increase year on year — one of the strongest growth rates we’ve seen locally and reflects the continued investment into Stockport and the number of new build properties which are coming to the market.

Detached homes: Now averaging £402,503, values are up an impressive 6.0% year on year. Detached properties remain highly sought after and continue to show impressive growth.

Semi detached properties: Averaging £286,318, values are up a robust 10.1% compared with last year. With strong family appeal, semis are underpinning much of SK3’s market momentum.

Terraced homes: Prices have risen by 11.5% year on year, reaching an average of £234,914. This suggests sustained demand in the more affordable segments of the market, especially popular with first time buyers and investors.

Flats: In contrast to the wider trend, flats have dropped 4% year on year, with average values now at £150,729. This sector remains weaker, held back for the same reasons as mentioned in the SK8 individual property type review above.

Property sales across SK8 and SK3 saw a decline in November, with 124 homes sold, down from 144 in the previous November - a drop of 13.9% year on year. Again, a reflection of the softening market in Q4 of 2025.

Ironically, every invidual property type recorded growth in November — except terraces, where the drop off was quite significant and reflects the fact that first time buyers are showing reticence to commit.

Detached homes: Sales rose from 21 to 23 (+9.5%) steady growth at the higher end of the market.

Semi detached homes: The largest share of activity, climbing from 59 to 61 (+3.4%), with families driving strong mid market demand.

Terraced homes: Down substantially from 37 last year, to just 15 in 2025 (-59.5%), which reflects the lack of first time buyers who have been in the market over the last couple of months.

Flats: Also down signficantly, from 17 to 11 (-35.3%) Again, this is reflecting the general market for flats and reduced demand from first time buyers and investors.

Bungalows: Modest growth in sales from 8 to 9 (+12.5%), highlighting some downsizing from older people moving from larger family homes, releasing some equity and buying single level dwellings.

What This Means for You

If You’re Selling

-

Realistic pricing is essential. National and portal data show that around a third of homes have needed price reductions this year – usually where the initial asking price was too optimistic. Rightmove

-

In SK8/SK3, well-presented homes priced sensibly are on average still achieving strong offers within six weeks.

-

Presentation pays. Neutral décor, good kerb appeal and professional photography routinely add thousands to the eventual sale price and reduce the risk of a fall-through.

-

December can surprise: there may be fewer viewings, but those who are looking now often need to move – for a school place, job move or life change in early 2026.

If You’re Buying

-

Choice remains good, with more stock and slightly less competition for each property.

-

There is usually room for negotiation, especially on homes that have been on the market since late summer or have already had a price reduction.

-

Don’t assume you can’t afford to buy: recent reports show mortgage costs as a share of income have improved to the best levels in about three years for many first-time buyers. The Guardian

-

Having an agreement in principle, a clear budget and flexibility on move in dates will put you in a strong position to secure the right home.

If You’re a Landlord

-

Rents across Stockport continue to rise, with official figures showing private rents up just over 5% year on year. Office for National Statistics

-

Tenant demand for 2–3 bed houses near transport links remains very strong, and void periods are still relatively low.

-

Gross yields around 5–5.5% are still achievable in many parts of SK8 and SK3, especially where properties are well-maintained and energy efficient.

-

Keep an eye on tax and regulatory changes following the Budget and ongoing rental reform discussions – EPC standards and compliance will remain crucial to long-term returns. Zoopla

The Market Outlook – Winter 2025/26

-

Short term (next 3 months):

Expect a seasonal slowdown over Christmas, but we anticipate prices in SK8/SK3 to hold broadly steady rather than fall sharply. Well priced listings in January typically attract a spike in pent-up demand. -

Medium term (early–mid 2026):

If the Bank of England does begin to gently reduce rates, we’d expect a pickup in buyer enquiries and agreed sales, particularly from people who have been “waiting to see what happens” through 2025. -

Long term:

The fundamentals for Cheadle and the wider Stockport area remain very strong – excellent schools, strong transport links, local amenities and continued demand from people moving out of pricier suburbs. That underpins both capital values and rental demand over the longer run.

Maurice Kilbride’s Oulook:

Despite all the headlines, what we're seeing locally in Cheadle SK8 and Cheadle Heath/Edgeley SK3 is a calm, if slightly subdued market. Buyers are cautious - taking their time with there still be a large selection of available property to choose from, but they are still out there and they will pay a fair price for the right home in the right location. Over pricing is where things come unstuck and remains the biggest barrier and why record stock levels are not really coming down.

As we head into the New Year, the key ingredients for a successful move are realistic pricing, great presentation and smart marketing. Get those three right and 2026 can still be the year you make your move – without having to give your home away.

Thinking of Selling in 2026?

If you are considering your next move, now is the perfect time to plan ahead. We offer:

-

A free, data backed valuation

-

Local insight using live buyer demand and AI buyer profiling for your postcode

-

A tailored marketing strategy that goes beyond simply listing your home

Because as we go into 2026 listing a property isn’t enough – selling it requires a strategy, and that has been our approach for more than 25 years in the Cheadle area.

📞 0161 428 3663

📩 sales@mkiea.co.uk

💻 Request a free valuation, marketing and strategy meeting