Welcome to this month’s Cheadle Property Market Update – your trusted snapshot of what’s really going on in the local housing market. If you’re considering selling, actively searching for your next home, or simply staying informed, this update is tailored for you. We cut through the national headlines to focus on what matters here in Cheadle: pricing trends, buyer demand, and how our local market stacks up against nearby areas. Whether you're planning a move or just keeping your options open, this is insight worth having on your side.

June brought more than just property updates. Nationally, Halifax, Zoopla and Nationwide all reported flat house prices in June — Halifax showed the average at £296,665, up 2.5% year on year but unchanged month on month. Meanwhile, UK unemployment nudged higher and the job market softened slightly, raising questions about affordability, though wage growth and anticipated interest rate cuts still offer hope.

Closer to home, the Bank of England’s decision to hold base rates provided some stability, even as Cheadle buyers continued to balance caution with opportunity. On the brighter side, the Wimbledon fortnight started a buzz in local TV rooms, a truly quintessential nod to British Summertime — and perhaps even inspired some homeowners to get out into their gardens and try to create Wimbledon lawns of their own! And in one quirky local moment, a Cheadle based community footrace saw participants donning full cricket whites mid run — a cheeky nod to summer’s sporting tone and timely reminder that Cheadle life is always more than bricks and mortar.

Let’s begin by stepping back to look at the national housing picture before zooming in on how the SK8 and SK3 markets are behaving in comparison. Are we moving in line with the broader trends, or carving out our own path locally? Here's what the latest Nationwide June Property Index reveals.

Annual house price growth softens in June

• Annual rate of house price growth slowed to 2.1% in June, from 3.5% in May

• Northern Ireland remained the top performing area, with annual house price growth of 9.7%

• East Anglia weakest performing region, with 1.1% year-on-year rise

The National and Regional Picture – A Focus on the North West

According to the latest Nationwide House Price Index, UK house prices edged down by 0.8% in June (seasonally adjusted), following a modest 0.4% rise in May. On an annual basis, growth slowed to 2.1%, down from 3.5% the previous month. The average UK house price now stands at £271,619, compared to £273,427 in May.

.png)

Nationwide’s Chief Economist, Robert Gardner, noted that the recent softening could be linked to the April stamp duty increase, which may have tempered demand in the short term. However, with low unemployment, rising real wages, and potential interest rate reductions on the horizon, the outlook for the remainder of the year remains cautiously optimistic.

Looking at the regional data for Q2, the North West continues to perform solidly, if not spectacularly. While some cooling has been seen across the UK, Northern England — including the North West — recorded a 3.1% annual increase, outpacing Southern England’s 2.2%. In fact, the North as a broader region led the national table with 5.5% annual growth.

.png)

Closer to home, this aligns with what we’re seeing in the SK8 and SK3 markets: steady buyer activity – but lower than in previous years especially in well presented lower end of the market terraced and semi-detached homes, which Nationwide data also confirms have seen the strongest year on year price growth (3.6% and 3.3% respectively). While flats saw more modest increases nationally (just 0.3% year-on-year), demand for family homes remains resilient in our local area, supported by stable employment, good schooling, and strong transport links.

As always, it's not just about the national headlines, the housing market is very much regional and even town by town, so understanding how our local market compares is key to making confident decisions when selling or buying.

Zoopla Market Update – June 2025: What It Means for Sellers in Cheadle and the North West

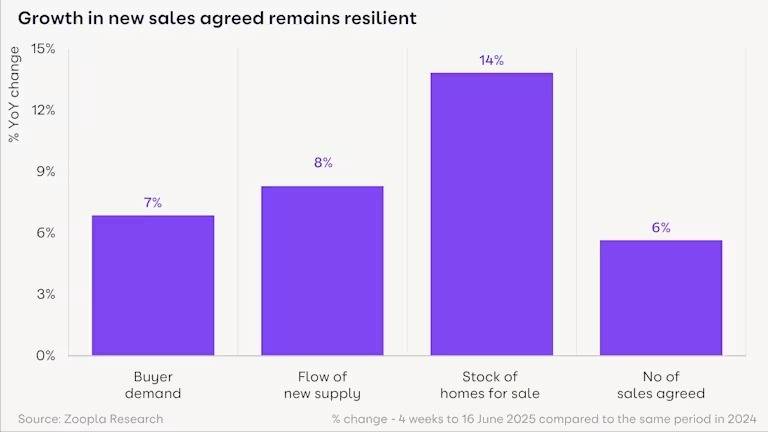

June’s data from Zoopla paints a steady but mixed picture of the UK housing market. While buyer demand remains steady, house price growth continues to moderate particularly in higher-value regions.

Key highlights:

• House prices grew by 1.4% year-on-year, bringing the UK average to £268,400

• Sales agreed are at their fastest rate in four years

• 14% more homes for sale than this time last year, offering more choice to buyers

• The average time to sell remains at 45 days, consistent with June 2024

While this may seem modest, it reflects a healthier and more balanced market, particularly in regions like the North West where supply continues to outpace demand.

Spotlight on the North West – Modest Prices, Steady Performance

Crucially for sellers in Cheadle, Stockport, and the surrounding SK areas, the North West remains one of the UK’s most resilient regions. Zoopla notes that areas with lower average property values, such as parts of the North West, have seen stronger price growth. In fact, places like Wigan, Blackburn and wider Greater Manchester recorded annual price increases of 3.5% or more, outperforming many more expensive regions in the South. Why? Supply in our region has increased modestly compared to the 16–19% surge seen in the South East and London. In the Cheadle area, new listings were up 12.2% in June. This relative scarcity of quality homes continues to support local pricing, especially for terraced and semi-detached properties, which Zoopla reports rose by 2.0% and 2.5% respectively over the past year.

Comparing Zoopla & Nationwide – A Consistent Theme

While Nationwide’s June data suggests slightly stronger national annual growth at 2.1%, both reports agree on the same key message: Affordable, well-marketed homes in balanced regional markets like ours are outperforming the national trend.

Nationwide shows Northern England, including the North West, up 3.1% annually, which aligns closely with Zoopla’s regional insights.

Both sources stress that pricing is critical in 2025 — not just for attracting interest, but for ensuring the sale goes through. Sellers still holding out for early-2022 prices may find their properties sitting on the market for months, a fact backed by Zoopla’s finding that 22% of listings remain unsold after six months.

Locally, we’re seeing exactly what the national data confirms:

• Realistic pricing is key, but there's still a reasonable appetite from buyers

• Well-presented homes in sought after areas are moving within a few weeks

• Buyers are cost and price conscious, but motivated to move — especially with more competitive mortgage options gradually returning

At Maurice Kilbride, we’re seeing positive results for clients who are well positioned, well presented, and well marketed. As always, we’ll continue to monitor both national and local trends closely to help our clients make smart, informed decisions.

Now let’s turn our focus to where it really matters — here on the ground in SK8 and SK3. While national averages offer useful context, it’s the local trends that truly shape your sale. How are Cheadle and Stockport performing compared to the broader market? Are we keeping pace with national growth or forging our own path? Here’s how the numbers stack up locally.

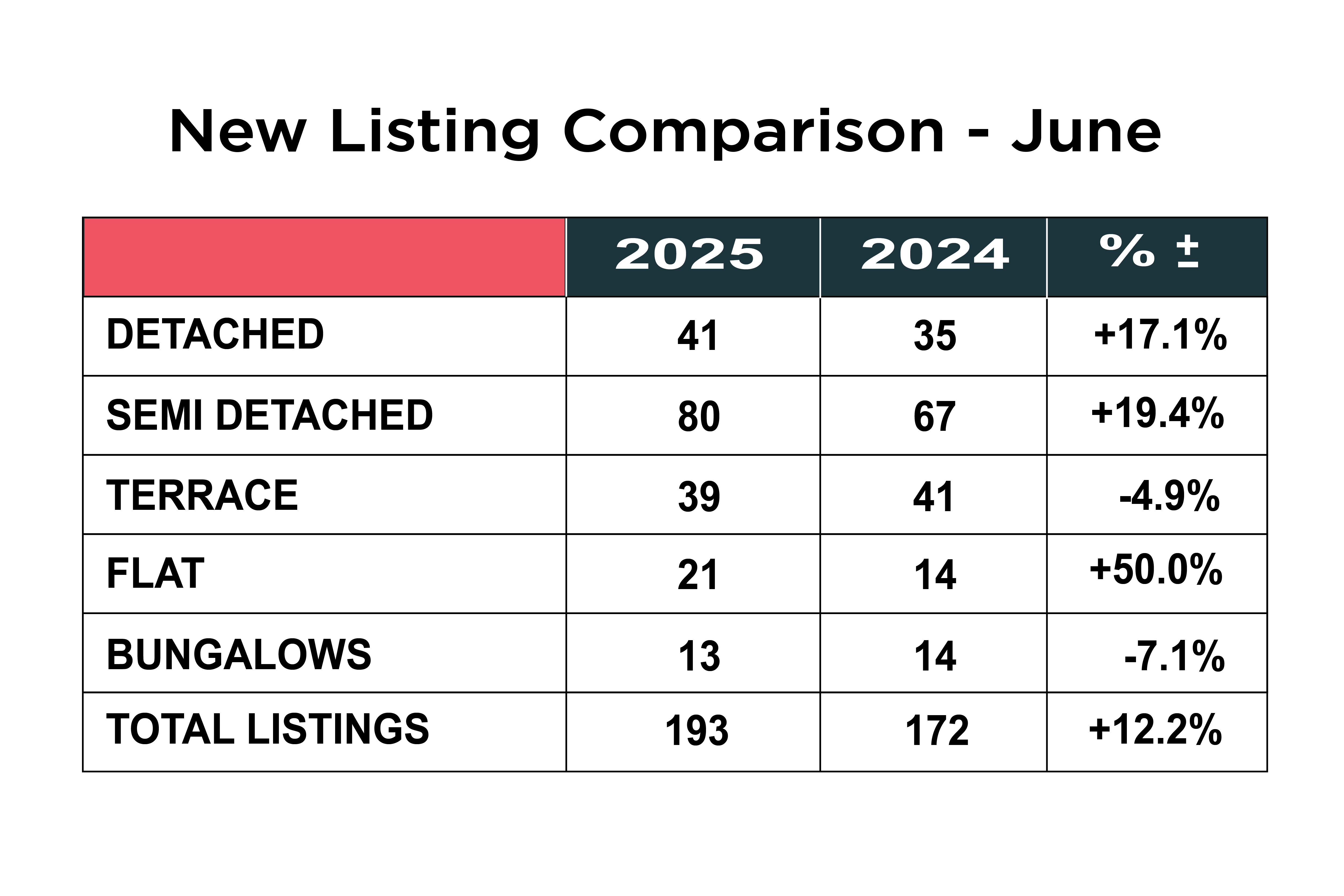

The data reflects continued seller optimism, particularly among owners of larger family homes and traditional terraces, aligning with the regional trend of reasonable demand in more affordable, well connected areas.

More Listings, More Choice – But Pricing Remains Crucial in a Sensitive Market

The local property market in SK8 and SK3 saw a healthy increase in new listings in June 2025, with 193 properties coming to market compared to 172 in June 2024 — an uplift of 12.2% year on year. This rise offers buyers greater choice, but it also reinforces the importance of sensitive, well-informed pricing strategies as competition grows.

Semi-detached homes led the way, with listings up 19.4%, rising from 67 to 80. Detached homes also saw a notable increase, up 17.1%, from 35 to 41, as more upsizers and family sellers returned to the market.

The biggest year-on-year jump came in flats, up 50% — from 14 to 21 listings — likely reflecting increased activity among first-time sellers or landlords looking to release stock.

However, the picture wasn’t entirely upward. Bungalow listings fell by 7.1% (14 to 13), and terraced properties dipped by 4.9% (41 to 39), pointing to tighter supply in these more niche or traditionally lower-priced segments.

Overall, the rise in listings is a positive sign for market activity, but with more stock available, buyers remain selective and realistic, data driven pricing will be the key to achieving a successful sale this summer.

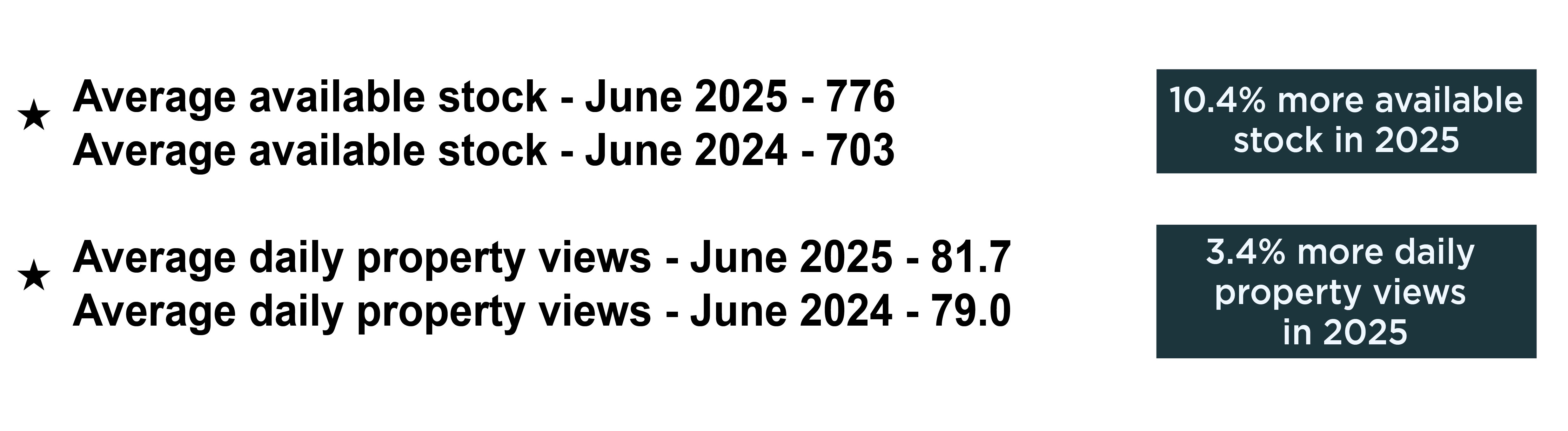

More Homes, But Fewer Clicks? Supply Outpaces Buyer Commitment in June Rise

June 2025 saw a record 776 properties available across the SK8 and SK3 markets — up from 703 in June 2024, representing a 10.4% increase in available stock. This reflects a clear rise in seller confidence and growing choice for prospective buyers.

However, the increase in available homes hasn’t been matched by a comparable uplift in buyer engagement. Daily property views on Rightmove rose by just 3.4%, from 79 last year to 81.7 this June.

This gap between supply and buyer activity suggests that while interest remains steady, many buyers are still cautious about committing, likely influenced by ongoing economic uncertainty and the increased sensitivity to pricing.

The takeaway? More homes on the market doesn’t automatically mean faster sales — sellers need to ensure pricing and presentation are precisely aligned with buyer expectations to secure attention and generate offers.

Detached and Semi-Detached Hold Firm as SK8 Market Edges into Recovery

The average property price in SK8 now stands at £360,329, marking a 1.6% decline year-on-year. However, June brought a modest but meaningful shift — the first monthly increase in four months, hinting at a potential stabilisation in local values.

Drilling into the data, detached homes have risen by 1.1% over the past 12 months, with an average price of £514,459, while semi-detached properties continue to show resilience, up 2.2% year on year to an average of £370,254.

By contrast, more affordable segments have seen downward pressure. Terraced homes have dipped by 4.1%, now averaging £290,177, and flats are down 3.6%, with average values sitting at £179,617.

The figures highlight a market where family homes remain in demand, holding their value well, while first-time buyer and investor led segments remain price sensitive amid cautious lending conditions and affordability challenges.

SK3 Defies the Trend with Double-Digit Growth as Stockport’s Regeneration Gains Momentum

The average property price in SK3 has risen sharply over the past 12 months, now standing at £257,476, representing a healthy 11.5% annual increase. This robust growth reflects the ongoing investment and regeneration in Stockport, which continues to ripple outwards and strengthen buyer confidence across the area.

Leading the charge are detached homes, which have seen an impressive 17.4% rise year on year, with average prices now at £381,367 — although they account for just 8.4% of the local market.

Terraced homes, making up 42.6% of all properties, also saw notable growth, climbing 11.6% to an average of £229,103. Meanwhile, semi-detached homes have increased by 7.4%, with average values now at £276,307.

In contrast, flats are the only category to see a decline, down 10.7% year on year, with an average price of £156,083 — a drop that likely a more cautious approach among first-time buyers and investors, as flats continue to receive a bad press in respect of Leasehold issues, management fees and ongoing concerns over cladding.

Overall, SK3 continues to buck the wider trend with strong capital growth across the core housing types, especially family homes, as Stockport cements its place as one of Greater Manchester’s fastest evolving property hotspots.

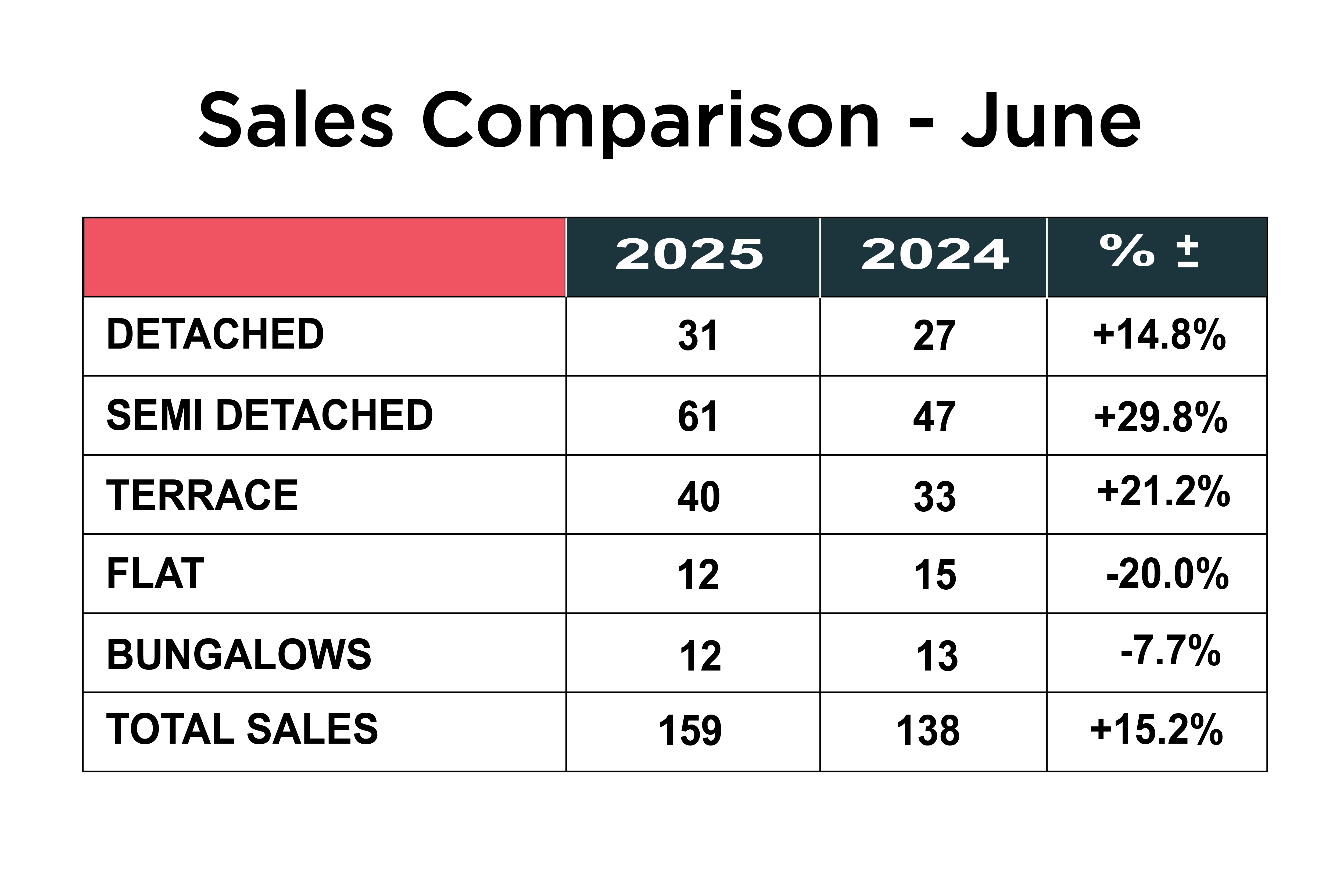

Sales Headed in the Right Direction – But Supply Surge Tempers Expectations

Property sales across SK8 and SK3 saw a 15.2% year-on-year increase in June 2025, with 159 homes sold, up from 138 in June 2024. On the surface, this is an encouraging sign of returning confidence — and it marks a positive shift in momentum for the local market.

However, with the highest number of available properties recorded in over a decade, one might have expected a sharper rise in transactions. Still, the upward trend offers reassurance that buyer activity is responding, albeit cautiously, to increased supply.

The standout performer was the semi-detached sector, with sales jumping 30%, from 47 to 61, reflecting strong family buyer demand in mid-range price brackets. Terraced homes also saw a healthy rise, up 21% (from 33 to 40), while detached home sales increased by nearly 15%, from 27 to 31.

In contrast, flats saw a 20% drop in sales, down from 15 to 12, and bungalow sales dipped slightly, falling from 13 to 12, a 7.7% decrease — likely a result of tighter supply rather than falling demand.

While not a surge, the direction is encouraging — suggesting that, with the right pricing and presentation, well-positioned homes are still converting to sales, even in a more competitive landscape.

SK Rental Market Update: Strong Yields Amid Ongoing Uncertainty

The local rental market in SK8 and SK3 remains active and resilient, despite ongoing uncertainty around the government’s long-debated Renters Reform Bill.

The proposed legislation — which includes the abolition of Section 21 ‘no-fault’ evictions and the introduction of more structured tenancy agreements, continues to move through Parliament and the House of Lords. However, multiple amendments and delays mean that while some measures may be introduced later this year, much of the bill has now been pushed into 2026. This evolving timeline is leaving many landlords feeling uncertain about the future.

In response, some landlords are choosing to sell off part (or all) of their rental portfolio, concerned about the impact of regulation on their long-term returns. However, this reduction in supply, combined with sustained tenant demand is helping to keep upward pressure on rents, even in areas where prices have recently dipped slightly.

SK8 Snapshot

In SK8, the average monthly rent for a house now stands at £1,665, down around 3% compared to this time last year. Flats are currently renting for an average of £1,068 per month. Despite the minor price shift, yields remain strong — averaging 5.34%, which still represents a solid return, particularly for landlords who own their properties outright or have minimal borrowing.

SK3 Update

Rental values in SK3 tell a slightly different story. Average monthly rents for both houses and flats are now closely aligned, at £1,213 and £1,274 respectively. With property values in SK3 typically lower than in neighbouring SK8, this translates into very healthy yields of approximately 6.14%, making SK3 an increasingly attractive option for buy to let investors.

Looking ahead, with a growing pipeline of new apartment developments across Stockport, both rents and yields in the flat sector are expected to rise steadily over the next few years, particularly as the town continues to benefit from regeneration investment.

Thinking of Letting? We're Here to Help

If you’re a landlord with a property to let or you're considering entering the rental market — we’d love to help. We have a large, pre-qualified database of quality tenants actively seeking homes in the area right now.

Whether you have questions about the Renters Reform Bill or want advice on pricing, compliance, or finding the right tenant, our experienced team is here to guide you every step of the way,📞 Call Patrick, Joe or Maurice on 0161 428 3663

💻 Check out our landlord Services and Fees Here

Market Outlook: A Balanced Landscape of Opportunity and Caution

As we move into the second half of 2025, both the sales and rental markets in SK8, SK3 and the surrounding Stockport area are showing signs of cautious optimism — but not without challenges that demand careful navigation.

On the sales side, activity has clearly picked up. June recorded a 15.2% year-on-year increase in completed transactions, with semi-detached and terraced homes driving momentum. Stock levels are at their highest in over a decade, up 10.4% year on year, offering buyers more choice but also reinforcing the need for accurate pricing and standout presentation to cut through growing competition.

Average prices in SK8 have softened slightly over the past year, down 1.6%, although detached and semi-detached homes are still holding firm. In contrast, SK3 has seen impressive annual growth of 11.5%, underpinned by regeneration, affordability, and a steady stream of first-time buyers.

Meanwhile, the rental market continues to evolve in step with national legislative changes. The long-awaited Renters Reform Bill is progressing slowly, but its presence is already impacting landlord confidence. Despite this, rental yields remain strong — up to 6.14% in SK3 and tenant demand is resilient, particularly in well located flats and family homes.

Looking ahead to Q3 and Q4, the outlook remains broadly positive, but price sensitivity is expected to persist across both markets. Buyers will continue to weigh value carefully, and renters may face tightening supply as more landlords reassess their position. However, if interest rates begin to ease as anticipated later in the year, we could see a further boost in buyer confidence and transaction volumes.

How We Can Help

At Maurice Kilbride, we’ve been helping people move for over 25 years. In a market like this, experience, a highly personal service, local knowledge and a clear strategy matter more than ever. Whether you’re thinking of selling, letting, or simply want advice on your next move, we’re here to guide you with honest insight and proven results.

✔ Expert, realistic valuations

✔ Award-winning marketing and presentation

✔ Strong local reputation and a large, qualified database of buyers and tenants

✔ Landlord support through legislative changes and full property management options

📞 Call us on 0161 428 3663 to chat through your plans or book a free valuation and marketing strategy meeting at your own home online here:

🌐 Book a Free Market Appraisal

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.