Whisper it quietly, but the start to the New Year for the local SK8 and SK3 property market has been pretty good! January can be a long and hard month for many of us after Christmas and with it being a five-week month, but the early signs are that more buyers are venturing back into the market.

There remains much conflicting opinion and statistical information on where the market is heading nationally, that we will of course chew over in our regular monthly market update, so let’s dive straight in and take a look at what the major players are saying.

What to expect in the housing market in 2024

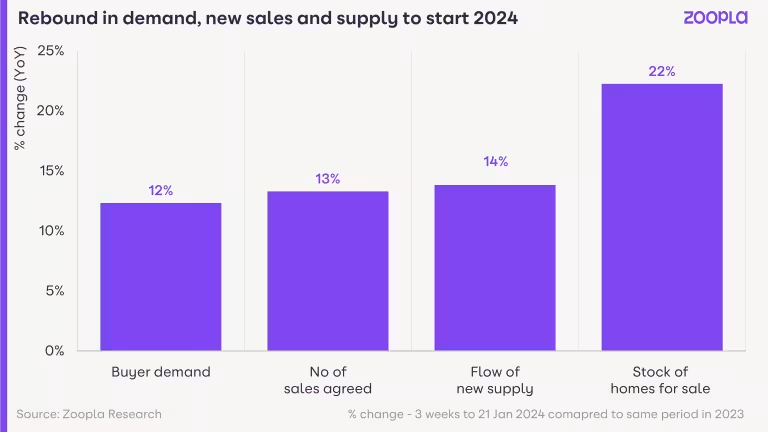

According to the property portal Zoopla, the adjustment to higher mortgage rates was always going to take longer than a year, especially given the only modest fall in house prices in 2023 at around 0.8% and the average asking price now stands at £264,600.

It seems unlikely that mortgage rates will fall much further in the near term, remaining in the 4% to 5% range and the best deals will be for those with the bigger deposits. We have seen some lenders cutting rates, even though the Bank of England held the base rate at 5.25% earlier this week and it likely that lower mortgage rates, welcome as they are, are more likely to support sales rather than price rises in 2024.

The Bank of England language was interesting and considerably softer than on previous occasions, opening the door to interest rate cuts but said it first required “more evidence” that inflation would continue falling.

After the meeting of the Monetary Policy Committee on Thursday, the BoE signaled it was ready to consider lowering rates for the first time since inflation surged following the coronavirus pandemic. With headline inflation now 4 per cent compared with its 2022 peak of more than 11 per cent, the bank has ditched its previous warnings that “further tightening” of monetary policy might be needed. Instead, the BoE said it would “keep under review” how long rates should be held at current levels.

The meeting marked a pivot more than two years after the central bank embarked on an aggressive rate-raising campaign that took borrowing costs to their highest level in 15 years. BoE governor Andrew Bailey said the bank had seen “good news on inflation over the past few months”. But he cautioned: “We need to see more evidence that inflation is set to fall all the way to the 2 per cent target, and stay there, before we can lower interest rates.” Bailey said that with service price inflation still high and the negative contribution of falling energy prices set to fade in coming months, the BoE could not yet declare that “the job is done”.

Let's not get carried away: we’re still in a buyers’ market

It’s good to see renewed activity in the market but it’s important not to over-interpret what this might mean for 2024.

Last year, mortgage rates fell to 4.2% in the first 3 months of the year, which supported sales volumes and led to only modest price falls. Zoopla expects current mortgage rates to have the same effect this year, supporting sales volumes rather than hugely impacting house prices. Zoopla see how price growth being kept in check by several factors including:

• A greater supply of homes for sale giving buyers more choice, especially for larger family homes.

• Half of those with a mortgage are yet to refinance onto a higher mortgage rate, keeping people price-sensitive and focused on value when they move house.

• A small but not insignificant number of sellers cutting their asking prices to attract interest, continuing the 2023 trend.

• 1 in 5 sellers accepting more than 10% off the asking price.

• If you’re selling your home, price realistically if you’re serious about moving. Improved market conditions will help you get a sale - but don’t take that to mean you’ll get a result at a higher price.

Nationwide sees a “more positive” outlook for the UK property market

The Nationwide Building Society was also more upbeat in its monthly forecast and said that the outlook for the UK housing market is “more positive” as prices improved at their strongest rate in a year.

The building society’s index found that the average house price had increased by 0.7% in January on the previous month – a significant turnaround from the December figures, which showed a 1.8% decline in prices.

The average UK house price in the Nationwide indices was £257,656 in January and was down just 0.2% on a year earlier.

Robert Gardner, Nationwide’s chief economist, said: “While a rapid rebound in activity or house prices in 2024 appears unlikely, the outlook is looking a little more positive.”

He said this had been driven by “encouraging signs” for buyers with mortgage rates continuing to trend down.

He added: “This follows a shift in view among investors around the future path of interest rates with investors becoming more optimistic that the Bank of England will lower rates in the years ahead.”

Nationwide also pointed to data from the Royal Institute of Chartered Surveyors (RICS) that suggested the decline in inquiries from new buyers had halted, and there were signs that more homes were coming on to the market.

Nationwide cautioned that the path of interest rates over the coming months would be crucial as affordability pressures continued to hamper the market and held back activity in 2023.

Currently, a borrower earning an average UK income and buying a home with a 20% deposit had a monthly mortgage payment equivalent to 38% of take-home pay – well above the long-term average of 30%. Pressure remains worse in the South, where mortgage payments run at the equivalent of 55%!

It said mortgage rates would need to trend towards 3% to bring the affordability measure back down to 30% of take-home pay and this may be the crux that keeps a lid on activity and prices for the foreseeable future.

In 2022-23, nearly half of first-time buyers had some help raising a deposit, either in the form of a gift or loan from family or friends, or through inheritance, which has nearly doubled from 27% in the mid-1990s.

Tentatively promising new year start as buyer and seller activity jump says Rightmove

As always, the most bullish and positive outlook for the market, comes from the leading property portal Rightmove, who in their January forecast stated the following:

• Average new seller asking prices rise by 1.3% (+£4,571) month-on-month to £359,748, the biggest December to January increase in prices since 2020, though average prices are still 0.7% lower than at this time last year

• There has been some tentatively promising activity in the first week of the year, markedly stronger than a year ago, as more prospective buyers and sellers seem to have the confidence to get their 2024 moving plans started early:

o The number of new properties coming onto the market for sale is 15% higher than in the same period last year

o Buyer demand in the first week of 2024 is also 5% higher than in the same period last year. However, competitive pricing from sellers is still vital, with the number of new properties coming to market outpacing the rise in demand

o The number of sales agreed is 20% higher than during the first week of last year, indicating a strong return of buyer confidence when compared with the unsettled post-mini-Budget period a year ago

• Since Christmas, Rightmove has seen nine of its ten busiest days on record for people getting a Mortgage in Principle to see what they can afford to borrow, another early sign of movers getting their 2024 plans in place

• The average 5-year mortgage rate is now 4.86%, compared to 6.11% at the July 2023 peak. While there may be more surprises to come, early indicators suggest a more stable year for the mortgage market after its volatility from September 2022 onwards

What has happened in SK8 and SK3 during the last month?

So, as the National commentators start the year with cautious optimism, what have we been seeing in SK8 and SK3 and what are the early signs for buyers and sellers locally.

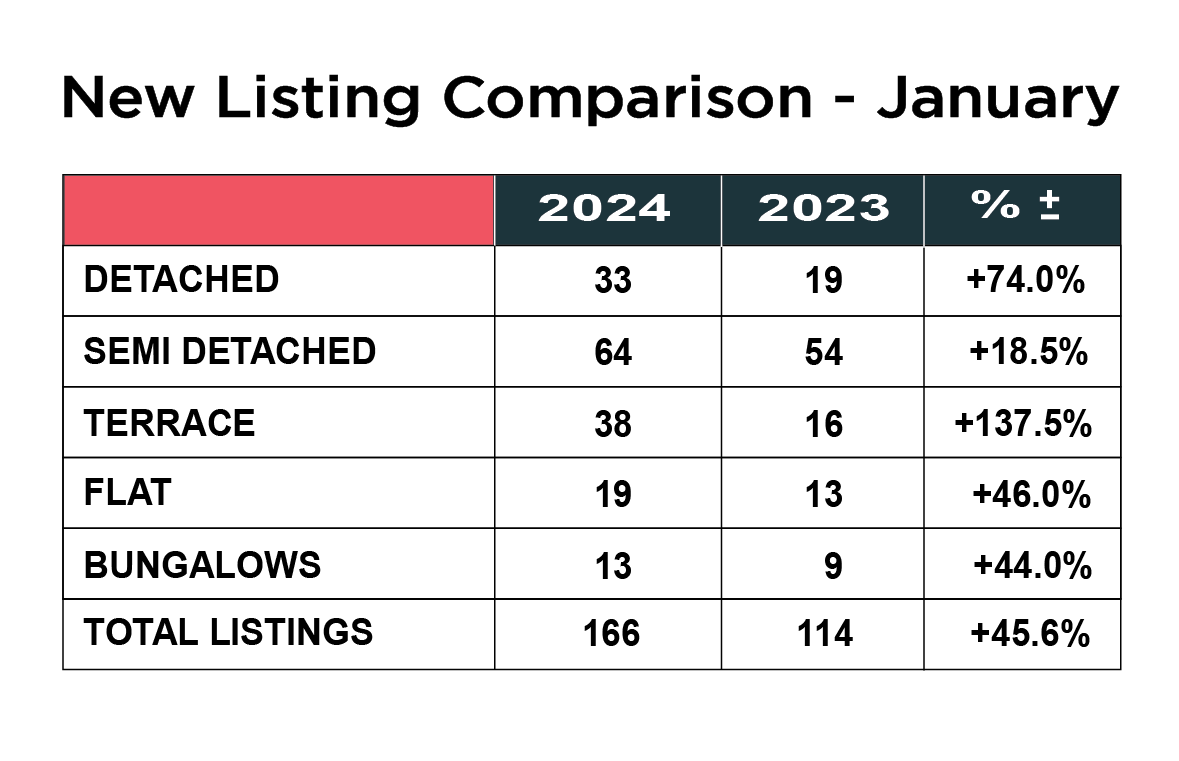

In keeping with the national picture, the number of new properties coming onto the market has soared this January, compared with last year, up a whopping 45.6% from 114 in 2023 to 166 in 2024.

Breaking the figures down by property type, there was a huge increase in the number of terraced and detached homes coming for sale, up 137.5% and 74%. The jump in terraced listings went from 16 in 2023 to 38 in 2024 and detached homes increased from 19 to 33. There were also significant increases in the number of flats, up 46% from 13 last year to 19 in 2024 and bungalows, up from 9 to 13, an increase of 44%. The number of semi-detached homes was up to 18.5% from 54 in 2023 to 64 in 2024.

At this stage it is difficult to gauge why there has been such a rise in the number of people selling, but we suspect it is a combination of seasonal, peoples fixed rate mortgage deals coming to an end and new mortgage costs becoming prohibitive and some selling before there is any further decrease in property values. It’s one we will be keeping a very close eye on as we head towards the Spring.

Stock levels and buyer interest both on the rise!

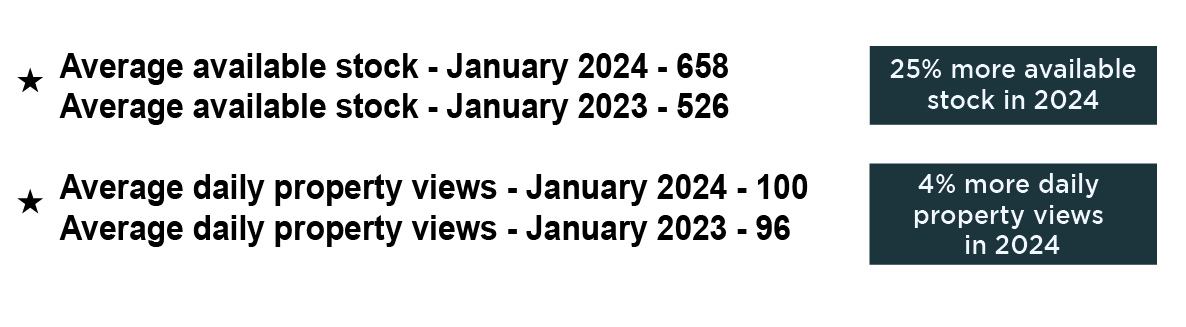

The second set of figures is very interesting and continues to demonstrate the biggest challenge facing home sellers in SK8 and SK3.

The average available stock in January 2024 was 658, against 526 this time last year. The is a 25% uplift on last year. This of course can work one of two ways, yes, more choice may encourage more buyers to start looking, but such a bigger choice will keep the pressure on prices and sellers will need to remain realistic in their pricing expectations if they want to attract the serious buyers.

The number of daily property views on Rightmove has also risen and now, for the first time in fifteen months, has climbed above the comparison last year. It is evident that a number of buyers remain cautious, however a significant number are feeling more bullish. This is reflected in the number of viewings for us in Cheadle being up 37% on January last year.

What is happening with individual house type prices in SK8?

The average price of a house across SK8 now stands at £367,181 which is 4.8% higher than this time last year. As stated, many times before, most of the indexes run several months behind, in particular the Governments own data from the Land Registry, which shows actual sold prices and is our preferred indices of choice, so these figures might be slightly lower in reality and the general trend is definitely down, albeit the rate of decease has definitely started to slow.

When we break it down by property type, detached homes now stand at £512,851 which is up 4.2% on twelve months ago. Semi-detached homes are now an average of £371,185 up 3.0% on a year ago. Terraced houses now average £320,899 which is up 14.9% on the previous twelve months- the most of any property type and the only one showing a double-digit increase. Flats are actually down 2.2% year on year and now stand at an average of £180,512

What changes have there been to individual house prices in SK3?

The average price of a property in SK3 is now £242,691 which is up 6.9% year on year.

Detached homes now stand at an average of £384,938 and are up a very healthy 19.4% year on year. Semi-detached homes now average £269,439, which is up 4.9% year on year. Terraced houses are now an average of £216,307 up 9.2% from this time in January 2023 and flats now average £170,937, which is up 3.7% on the same period last year.

Signifcant rise in the number of sales

For the second time in three months, we have seen a significant uplift in the number of sales. There was a total of 130 sales in January 2024, compared with just 96 in 2023. That is in an increase of 35.4%

The biggest increase was the number of bungalows sold, up from 5 last year to 9 in 2024 – a huge 80% uplift! There was also a massive 71.4% increase in the number of terraced homes sold, up from 21 to 36. There was a 33% increase in the number of flats sold from 9 last year to 12 in 2024 and a 32% uplift on semi detached home sales from 44 to 58. Finally, the number of detached homes sold is up from 11 to 12, an increase of 9%

At this stage of the year, it is difficult to be completely certain whether these improved figures are a reflection of an improving market or just the fact there are so many more homes for sale, it stands to reason there would be an increased number of sales. Answers on a post card please!

Renting in SK8 and SK3

The plight for those looking to rent is quite the opposite to those hoping to buy. It is a chronic lack of stock and properties to choose from. Recent stats from the government indicated that they expect rents to rise again this year, albeit at a slower rate than in 2023.

In SK8 rents are up 4.8% year on year and the average yield is 5.01%. The average rent for a house is £1512 and for a flat it is £933. Rents are up 6.9% and average yields are a healthy 5.60%. The average rent for a house in SK3 is £1069 and £826 for a flat.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a huge database of waiting high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees.

Summary

The new year has definitely had a more positive feel too it, with a number of metrics on the up.

The noises coming out from the major stakeholders is also refreshingly positive – The Nationwide, Rightmove, Zoopla – even the governor of the Bank of England!

However, what we can see is that affordability remains the biggest barrier to buyers entering the market. There has been talk that the government are considering introducing 99% mortgages in the upcoming budget, but in an uncertain market, we feel that would be reckless and not what is required to make a long-term sustainable market and we could easily see the unwanted return of negative equity.

The rising number of new properties coming onto the market is positive, but also should keep a dampening effect on prices, but as we have seen already, properties coming onto the market at the right price, are generating a lot of interest and viewings and multiple offers, which has enabled up to negotiate upwards for our seller clients and a fair few properties have already ended up going for above the asking price.

Our advice to sellers remains consistent. Price your home to reflect the current market from the outset. There is no mileage in the old “we aren’t in a hurry so happy just to stick it on the market and see” That is not a good strategy in the current climate and could ultimately cost you money. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same? We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time and money in the long run.

As we say every month, it’s so important for sellers to choose a well-established, experienced local agent who has operated in difficult markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Agents now need to roll their sleeves up, dig deep, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2023 ahead of a move in 2024 and to find out about our proven strategy to get you moving, please contact Joe, Patrick or Maurice to arrange for a FREE market advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.