We can’t believe it is December already and Christmas is literally days away.

And what an awful year it has been in many respects with the world a more unstable place than it has been in a number of years and at home, a change of Government, which has had a few teething problems, an economy that isn’t showing any signs of growth and interest rates remaining higher than at any point in the last decade.

So, it has been a tough year for home sellers and home buyers across the country, albeit here in SK8 and SK3 we have enjoyed a better year for sales than in 2023, so not everything is all doom and gloom.

As always, we will take a look at the broad outlook across the country via the Nationwide Property Index and Zoopla, the property portal’s monthly index and then dig down in more granular detail to look at what is happening in the SK8 and SK3 property markets and also this month, get out our crystal ball and try to look ahead and see what the local housing market has in store for 2025.

Let’s start with the headlines from the Nationwide November Property Index:

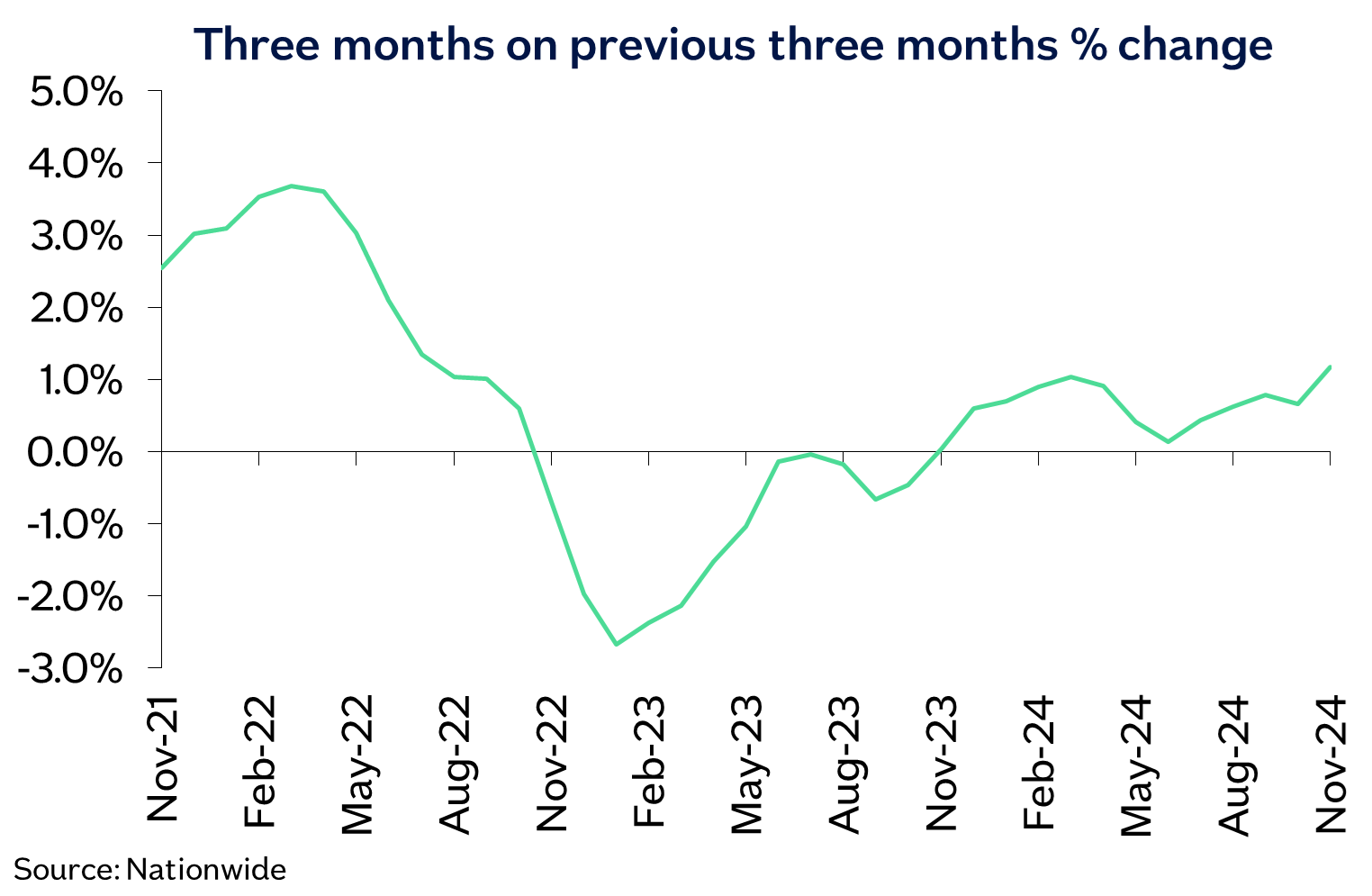

Annual house price growth rebounds in November

UK house prices rose 1.2% month on month

Annual growth rate rebounded to 3.7%, from 2.4% in October – fastest since November 2022

House prices now just 1% below all-time peak

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“The price of a typical UK home rose by 3.7% year on year in November, a strong rebound from the 2.4% recorded the previous month and marking the fastest rate of annual growth for two years (November 2022). House prices increased by a robust 1.2% month on month, after taking account of seasonal effects, the largest monthly gain since March 2022. House prices are just 1% below the all-time high recorded in the summer of 2022."

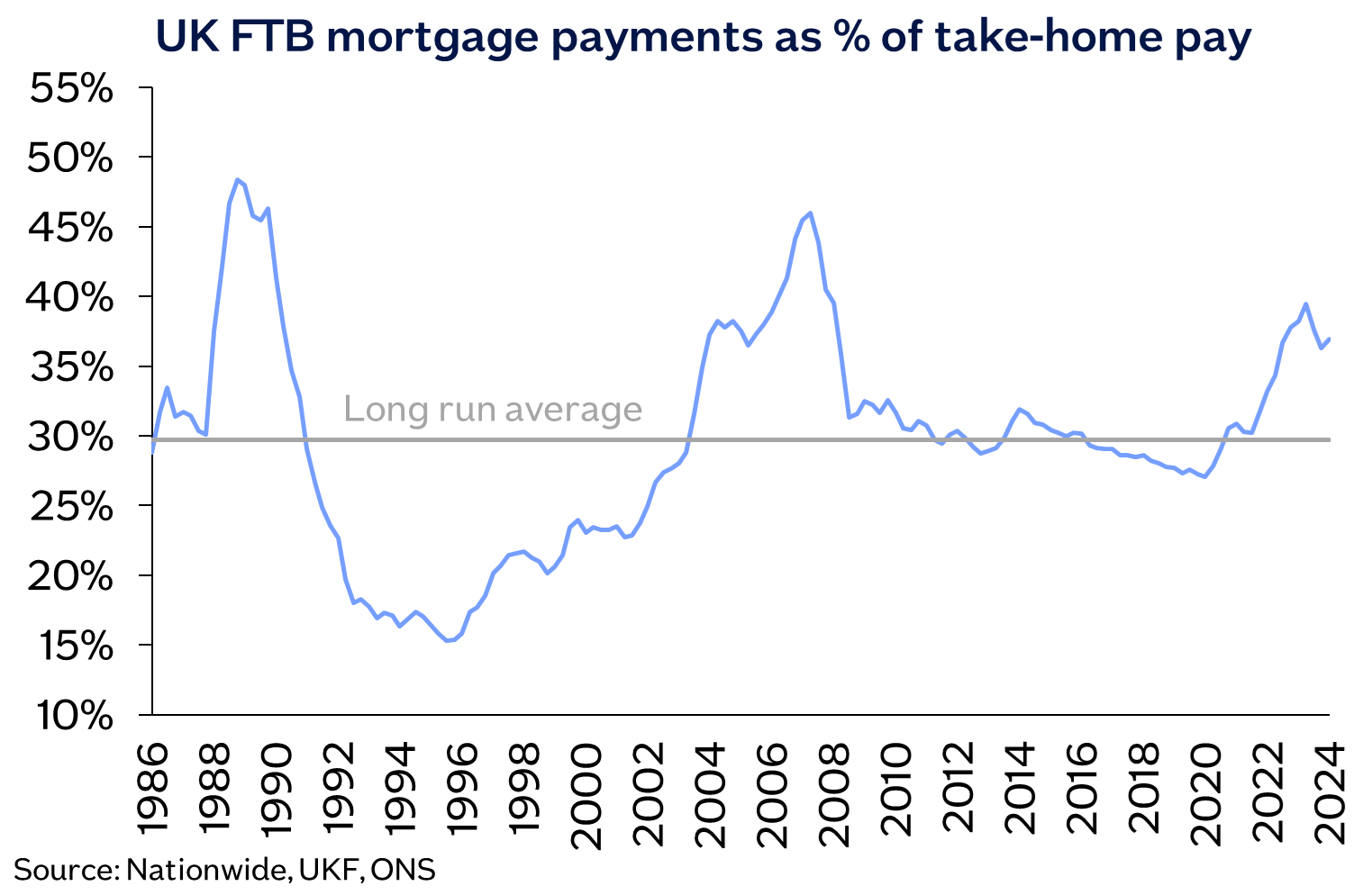

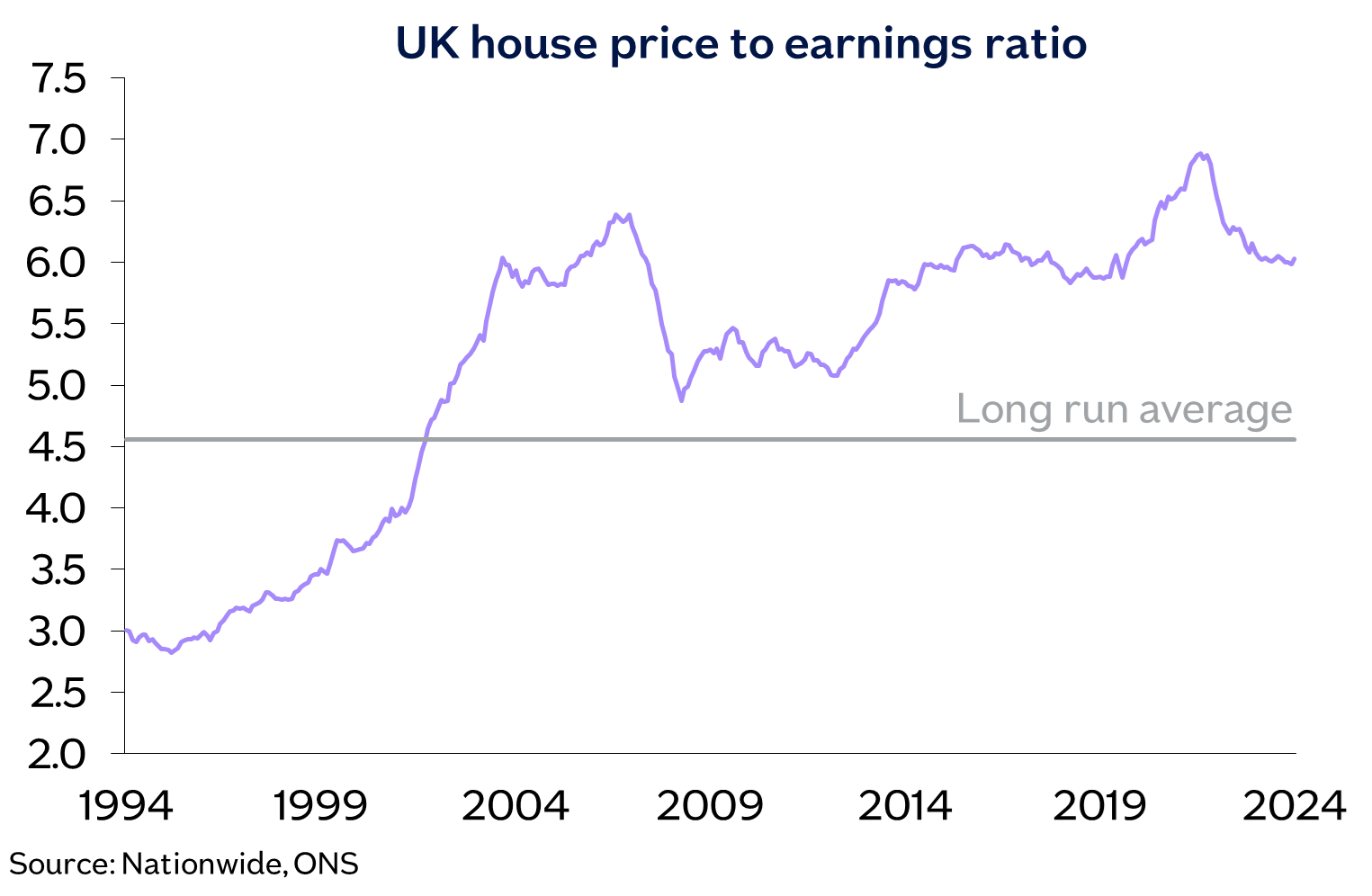

The acceleration in house price growth is surprising, since affordability remains stretched by historic standards, with house prices still high relative to average incomes and interest rates well above pre-Covid levels.

“The pickup in price growth is unlikely to have been driven by upcoming stamp duty changes[1], since the majority of mortgage applications commenced before the Budget announcement.

“Housing market activity has remained relatively resilient in recent months, with the number of mortgage approvals approaching the levels seen pre-pandemic, despite the higher interest rate environment.

“Solid labour market conditions, with low levels of unemployment and strong income gains, even after taking account of inflation, have helped underpin a steady rise in activity and house prices since the start of the year. Household balance sheets are also in good shape with debt levels at their lowest levels relative to household income since the mid-2000s (see chart).

“Gauging the underlying strength of the market will be more difficult in the coming months as the upcoming stamp duty changes will provide an incentive for buyers to bring forward house purchases to avoid paying additional tax.

“Gauging the underlying strength of the market will be more difficult in the coming months as the upcoming stamp duty changes will provide an incentive for buyers to bring forward house purchases to avoid paying additional tax.

“This is likely to lead to a jump in transactions in the first three months of 2025 (especially in March) and a corresponding period of weakness in the following three to six months, as occurred in the wake of previous stamp duty changes. This has the potential to shift the demand/supply balance in the near term and impact price movements.

“But, providing the economy continues to recover steadily, as we expect, the underlying pace of housing market activity is likely to continue to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.”

Let’s now compare and contrast with the Zoopla Monthly Property Index for November 2024:

Key takeaways

Housing market returns to growth in 2024, supported by rising incomes and lower mortgage rates

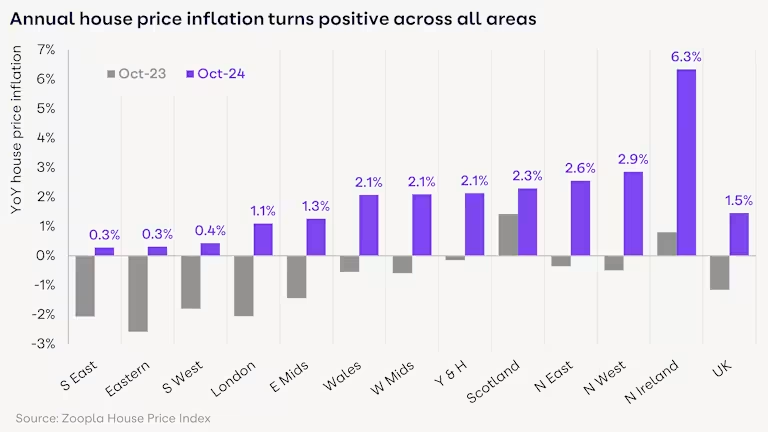

All regions and countries recorded positive year-on-year growth, with the UK average at +1.5%, up from -1.2% a year ago

Housing market has now largely adjusted to higher borrowing costs

UK house prices are projected to rise by 2.5% in 2025, with a 5% increase in the volume of housing transactions, predicted at1.15m

More buyers will pay higher stamp duty in England and Northern Ireland, which will act as a drag on price inflationMortgage rates are unlikely to change over 2025 but we expect lenders to innovate affordability assessments to support demand

Key figures

The average house price in the UK is £267,200 as of October 2024 (published in November 2024)

Property prices are now at +1.5% inflation compared to a year ago. However, the average UK house price is set to rise by 2% by the end of the year

The graph below shows how the UK’s average house price has changed in the last 10 years.

The outlook for the sales market in 2025

The housing market has returned to growth in 2024, with more sales and higher house prices compared to 2023. The sales market has performed better than we expected a year ago, thanks to faster growth in household incomes and lower mortgage rates.

This report focuses on the prospects for the sales market over 2025 and the factors shaping the outlook. We expect house prices and sales volumes to edge higher in 2025, despite Budget changes and uncertainty about whether mortgage rates will continue to fall.

Lower mortgage rates support a return to house price growth

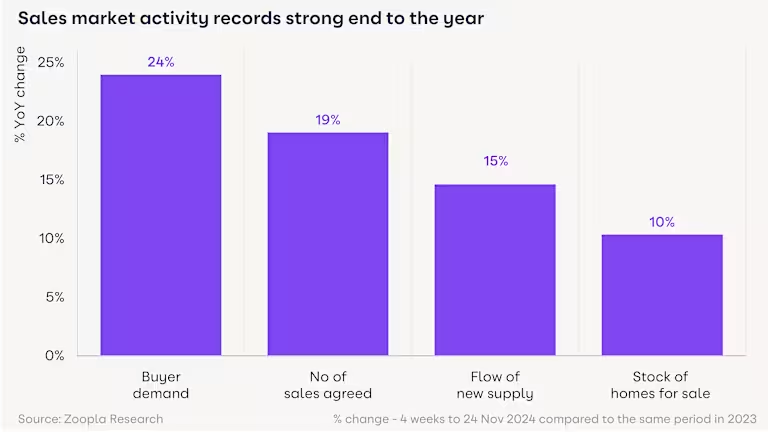

Over 2024, sellers (and buyers) returned to the market with a healthy stock of homes for sale, which has supported sales volumes.

The number of new sales being agreed is ending the year strongly, as serious buyers look to lock in sales in order to beat the return of higher stamp duty rates from April 2025. Sales agreed are 19% higher than this time last year, with buyer demand 25% higher.

More sales and greater buyer confidence have fed into higher house price inflation, which stands at 1.5% in the year to October 2024, compared to prices falling by 1.2% a year ago.

House price inflation has now turned positive across all regions and countries of the UK, with the fastest price gains registered in Northern Ireland (6.3%) and the North West region (2.9%).

However, across Southern England, where affordability pressures remain a drag on house price growth, price inflation remains below 1%.

This north-south divide is evident at a local level, with the fastest price rises registered in the Oldham (OL, 3.7%), Wigan (WN, 3.9%), and Belfast (BT, 6.5%) postal areas. In contrast, modest price falls are still being recorded in pockets of southern England led by Ipswich (IP, -1.1%), Truro (TR, -1.2%) and Dartford (DT, -1.2%). Last year we stated rising incomes would need to do the hard work resetting housing affordability in the face of higher borrowing costs. However, in 2024, income growth has been stronger than expected.

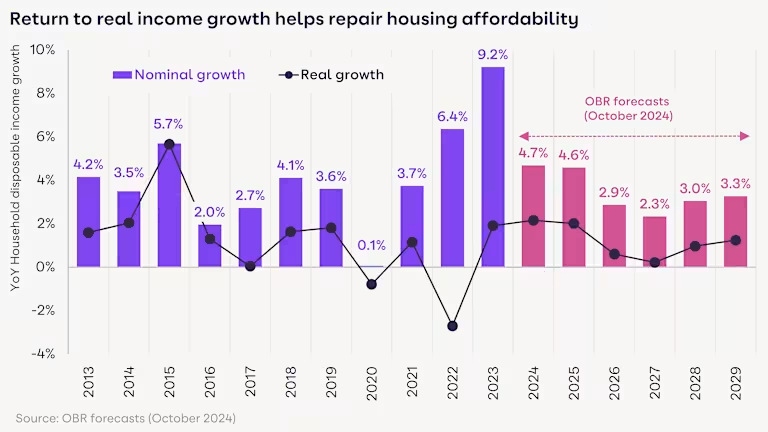

Last year we stated rising incomes would need to do the hard work resetting housing affordability in the face of higher borrowing costs. However, in 2024, income growth has been stronger than expected.

The latest Office for Budget Responsibility (OBR) data shows household disposable incomes increasing by 15% between 2022 Q2 and 2024 Q2.

House prices grew by just 1.5% over the same period, a trend that has helped to repair housing affordability without the need for additional house price falls. Incomes are forecasted to grow more modestly after 2025, according to the OBR.

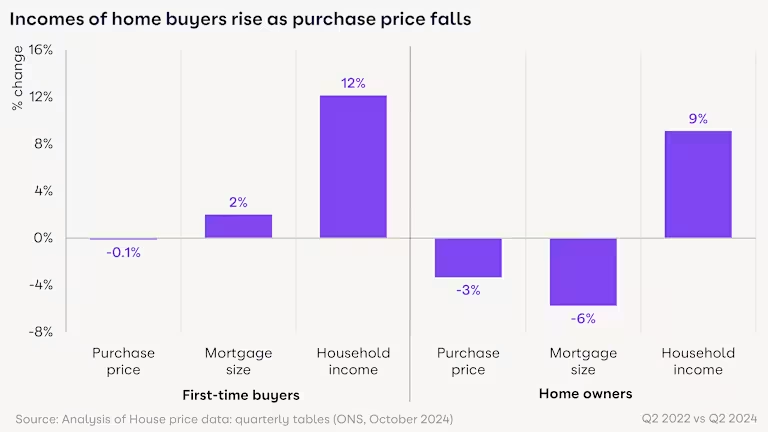

Data on home buyers using a mortgage shows the average household income of first-time buyers and existing homeowners has risen by between 9% and 12% respectively over the last 2 years.

Data on home buyers using a mortgage shows the average household income of first-time buyers and existing homeowners has risen by between 9% and 12% respectively over the last 2 years.

However, homeowners have chosen to buy less expensive properties with smaller mortgages for their next move as they adjust to higher borrowing costs.

This trend is most notable in southern England, where higher mortgage rates have hit demand the hardest. In contrast, first-time buyers have made fewer compromises on the price of property they are seeking to buy while taking slightly larger loans.

Mortgage rates to hold steady at current levels

Mortgage rates to hold steady at current levels

Mortgage rates for home buyers have fallen by 1% in the last year to a current average of 4.1%. While mortgage rates have drifted higher in the wake of the Autumn Budget, we expect borrowing costs to remain at around 4.25% for a 75% loan-to-value 5-year fixed-rate loan.

In addition to the mortgage rate paid by a home buyer, lenders will also test new borrowers to see if they can afford a ‘stressed’ rate, which is currently closer to an average of c.8%. This has been a major affordability hurdle for home buyers as borrowing costs have risen.

We expect lenders to innovate around how they assess affordability for those taking fixed-rate mortgages of 5+ years, which will support buying power and levels of market activity over 2025 and into 2026 without any further reduction in headline borrowing costs.  Housing affordability improves over 2024

Housing affordability improves over 2024

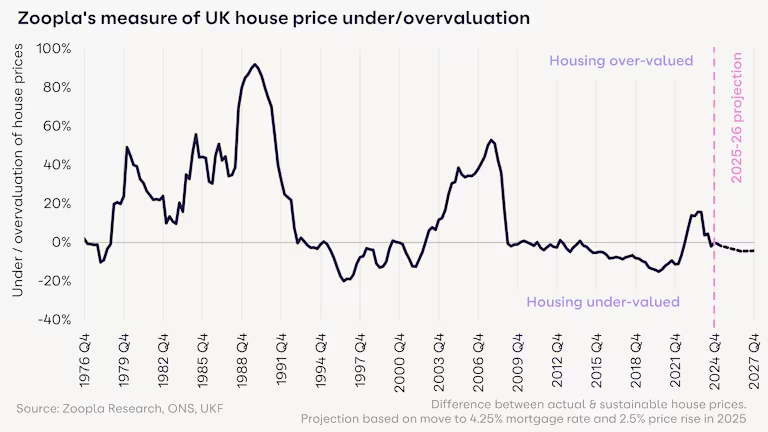

In addition to the economic outlook for jobs, incomes and borrowing costs, another key factor influencing the outlook for the sales market is whether current house prices appear cheap or expensive.

The cheaper prices appear, the more likely they are to rise. Conversely, if homes appear too expensive, house prices are less likely to rise.

Zoopla has a model that tracks whether homes are under or over-valued. In 2007, at the time of the global financial crisis, house prices were over 40% over-valued and fell sharply over 2008/9.

The jump in mortgage rates over 2022/23 led to UK homes being 16% ‘over-valued’ on the same measure. But strong income growth and lower mortgage rates have repaired this over-valuation throughout 2024 without the need for price drops.

Looking forward, we expect UK house prices to remain undervalued over 2025. This assumes an average mortgage rate of 4.25%, house prices rising by 2.5% and income growth of 4.6%. In the 3 years to the end of 2027, we expect house prices to grow by 7.5% in total.

Stamp duty - an extra drag on house price inflation

Stamp duty is another factor likely to impact price growth over 2025.

Stamp duty is another factor likely to impact price growth over 2025.

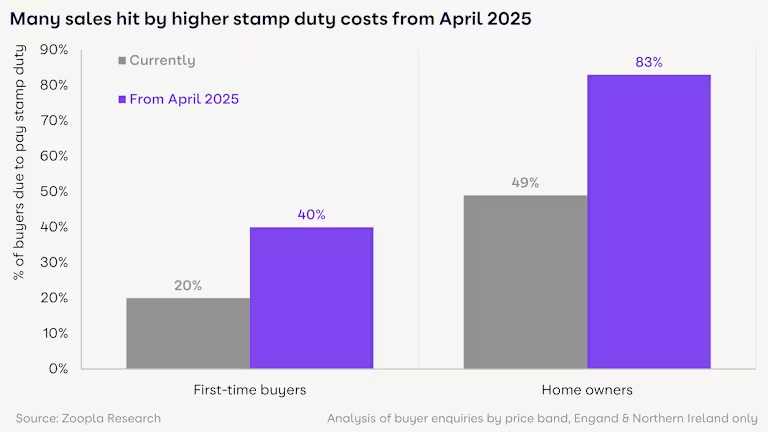

Many home buyers will pay higher stamp duty land tax (SDLT) from April 2025 in England and Northern Ireland, as the 2% band for owner movers returns and relief for first-time buyers (FTB) is scaled back.

Using buyer demand data, we estimate that half of existing owner movers pay SDLT today. It’s due to rise to over four-fifths (83%) from next April - with nearly all movers paying £2,500 more. The proportion of FTBs having to pay stamp duty from next April will double to 40%.

Buyers faced with higher purchase costs will want this reflected in the purchase price. This will act as a drag on house price growth over 2025, especially in the lower to mid-market price range (£125,000 to £250,000), where SDLT will represent 1% of the purchase price.

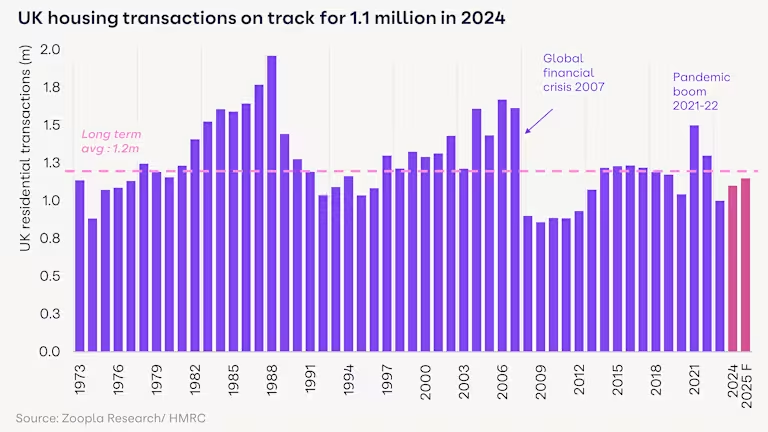

1.15m housing sales in 2025

The sales market is on track for 1.1m sales completions over 2024 - 10% higher than 2023. The pipeline of sales is also 30% larger than this time last year. This pipeline will support sales completions and deliver a boost in H1 2025.

The key question is whether the current momentum in sales will continue over 2025. We believe it will, supported by rising incomes and changes in the way lenders assess affordability.

We expect further growth in sales over 2025 to 1.15 million, 5% higher than in 2024. First-time buyers will remain the largest buyer group, supporting housing chains and the ability of existing owners to move.

There is a wide range of motivations for people to sell and move home, which have become more rooted in needs-driven motives than aspirations. An ageing population, rising running costs and changing working patterns will continue to impact moving decisions, in addition to the desire to seek a better home or location.

Summary

Summary

The housing market has been very resilient in the face of higher borrowing costs over the last 2 years. Higher income growth and 4% mortgage rates have done much to repair headline affordability.

We expect house prices to rise by 2.5% over 2025, with sales agreed ending 5% higher at 1.15m sales. House price inflation in southern England will continue to lag behind the UK average. Incomes need to continue to rise faster than prices to help reset affordability and price more households into the market.

First-time buyers will remain an important buyer group, but existing homeowners looking to move need more support to help realise their ambitions, with more and more having to look further afield to find better value for money.

So, that is the national picture covered, it seems that both Zoopla and the Nationwide are suggesting a modest rise in house prices which is likely to continue into 2025 and a slight increase in house sale numbers, which may be because of the continuing high stock levels, but are likely to be maintained, at least for the first half of 2025. Obviously, a lot will still depend on the wider economy and how that performs over the next twelve months and of course interest rates.

Now let’s take a look at what has been happening in the SK8 and SK3 property market over the last month and see how the local market compares with the national picture.

Number of new listings up – but rate of increase slows

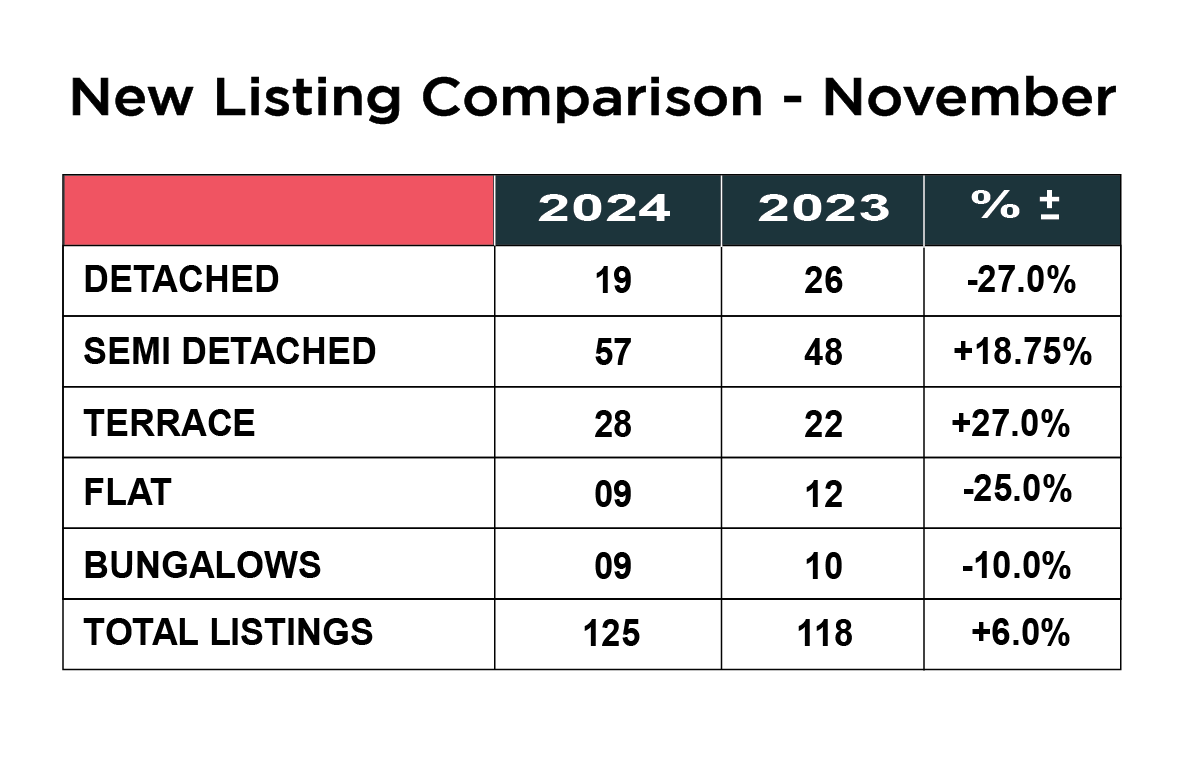

November saw a modest increase in new stock coming to the market, up 6% from 118 properties in 2023 to 125 properties in 2024. Some of this will be the traditional seasonal slow down and we expect to see stock levels rising again in the New Year as people gear up to move in 2025.

November saw a modest increase in new stock coming to the market, up 6% from 118 properties in 2023 to 125 properties in 2024. Some of this will be the traditional seasonal slow down and we expect to see stock levels rising again in the New Year as people gear up to move in 2025.

It was interesting to see the wide variation in the type of property that came to the market, after last month when we saw an increase in every type. This month the biggest increase was in the number of terraced homes coming to the market, up 27% from 22 last year to 28 this year. Next came semi-detached homes, which were up 19% from 48 to 57. The other three main categories were all down. The number of detached homes was down 27% from 26 to 19. Flats were down from 12 to 9, a drop of 25% and bungalows saw a 10% drop from 10 to 9.

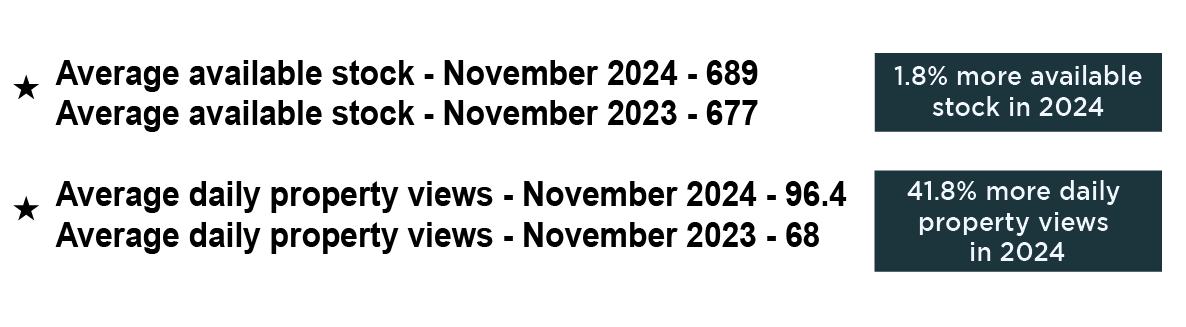

Stock levels drop to lowest level in twelve months but buyer views increase

For the first time in almost a year, stock levels are almost on a parity with last year. There are now just 689 average available stock, just 1.8% up on the same period last year, which stood at 677.

For the first time in almost a year, stock levels are almost on a parity with last year. There are now just 689 average available stock, just 1.8% up on the same period last year, which stood at 677.

The average number of daily property views rose last month, which is interesting and is now 41.8% higher than the same period last year, which is encouraging as we enter 2025

What is popular in SK8 and what is not!

The average price of a property in SK8 now stands at £358,136, which is down £6,000 from October and that is almost £15,000 over the last three months so prices are clearly coming down in the SK8 area. The drop now stands at 5% year on year.

When we look a bit closer and break it down by property type, we can see that the average price of detached homes in SK8 has dropped below £500,000 for the first time for several months and now stand at £499,061, which is a drop of around £9,000 since last month and represents a 4.1% drop year on year. The average price of a semi-detached home is now £367, 362, down £4,000 from the month before and 1.9% down year on year. Terraced homes have seen a drop of 6.2% over the last year and now stand at £292,275, which is £5,000 less than last month. Flats on the other hand have maintained their value and are up 3% on the year.

What is happening with SK3 house prices by individual type?

Very much like last month, whilst house prices in SK8 have taken a bit of a hit, prices in SK3 are holding firm.

Very much like last month, whilst house prices in SK8 have taken a bit of a hit, prices in SK3 are holding firm.

The average price of a property in SK3 currently stands at £239,159 which is down £2,000 on October or almost £8,000 over the last four months, which is now 0.8% down year on year.

Detached homes now stand at an average value of £402,735, which is up £30,000 from last month, and up 23% on the year before. This probably means a few more expensive properties in the area sold last month, which has pulled the average price up and it will be interesting to see how it looks next month or two. Semi-detached homes now average £268,019, which is down £2,000 from the previous month and 1.5% up over a twelve-month period. Terraced houses now average £213,575, which is virtually no monthly change but up 1.5% on this time from a year ago, and flats now average £162,368, which is actually a drop of almost £3,000 on last month, down 0.8% year on year.

Sales continue to increase in November

Sales are up for the fourth month running, which is encouraging and hopefully a sign of increasing confidence amongst home buyers.

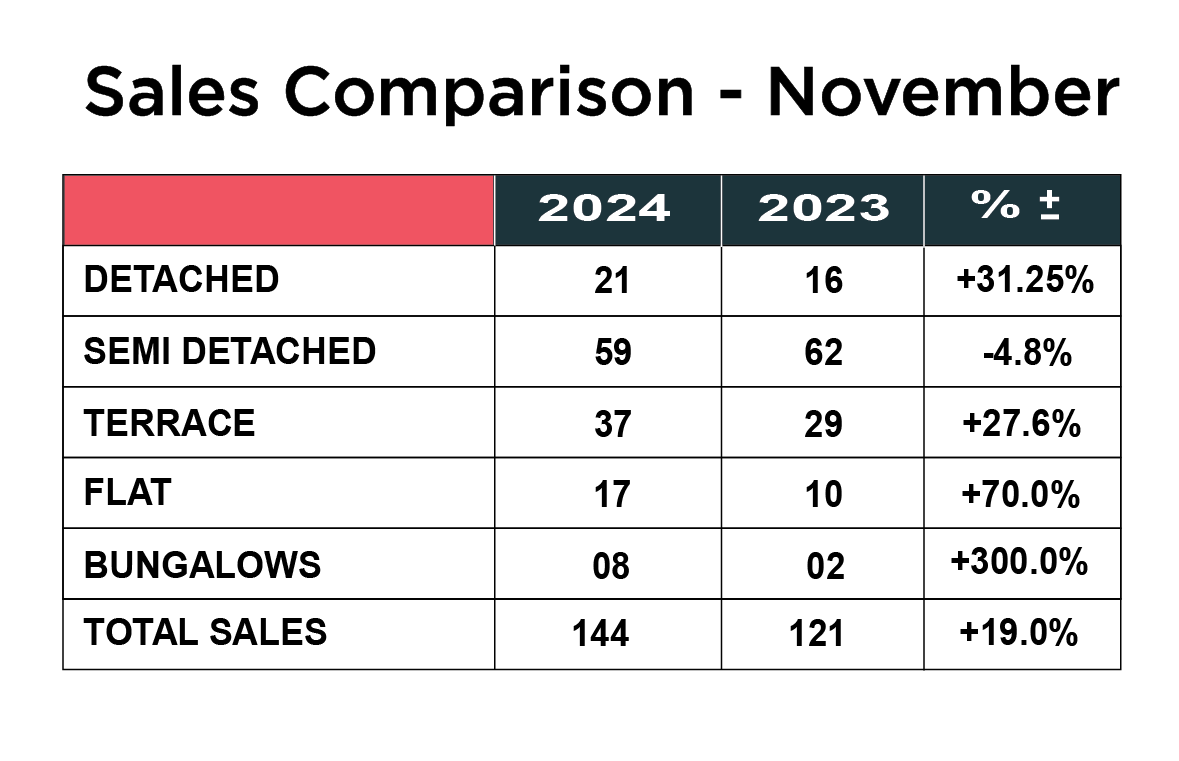

The total number of sales across SK3 stands at 144, which is up 19% from last year’s total of 121.

When we break down the number of sales by type, the biggest increase was in the percentage number of bungalows sold, up an eye catching 300% from 2 in 2023 to 8 in 2024. Flat sales were also up significantly, from 10 last year to 17 in 2024 – up 70%. The number of detached home sales has increased from 16 to 21, a 31% uplift and the number of terraces sold up from 29 to 37 – an increase of 28%. The only blip on the landscape was a drop in the number of semi-detached homes sold, down 4.8% from last year, with 59 sales versus 62 in 2023.

What is the rental market in SK8 and SK3 saying?

There continues to be a shortage of rental stock across the Cheadle area. A number of landlords are selling their investment properties, as they continue to query the viability of continuing to rent with tax increases, higher mortgage rates and of course the looming flagship piece of legislation from the new government – the renters reform act.

In SK8 rental values have actually dropped for the third month in succession and are now 5% lower than they were a year ago. The average rental price for a house is now £1629 and for a flat it is £965. The yield is a very healthy 6.74%.

In SK3 rents are down 0.8%. The average rent for a house in SK3 is now £1182 and a flat stands at £1078. The yield is also a very attractive 5.98% If you are a landlord with a property to rent out, we would love to hear from you, as we have a pre-qualified database of waiting, high calibre tenants. Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website CHECK OUT OUR LANDLORD SERVICES AND FEES

Summary and Outlook for 2025

There is no doubt that 2024 has been a difficult year for the housing market nationally, although SK8 and SK3 have faired better than most.

There also appears to be a degree of cautious optimism heading into 2025 from the significant players, like Nationwide and Zoopla, who are both predicting modest house price growth and a slightly increased number of house sales in 2025, although some of the over priced stock that remains unsold, will need to come down to be competitive with the new stock which comes to the market.

We never like to make predictions, there are too many variables and outside influences that can affect the market; however, a lot depends on affordability, house prices and mortgage rates, plus employment and wage rises. What we always hope for is stability and consistency, rather than highs and lows, but given the current economic outlook we can only envisage prices staying the same or a very modest increase in the Cheadle market and a similar number of house sales, which will be front loaded to the first half of the year, as buyers scramble to beat the stamp duty deadline in April.

What will remain important for Cheadle home sellers is choosing the right estate agent to sell their home in a more difficult and competitive market.

A well-established, experienced local agent who has operated in challenging markets before and is equipped with the widest marketing mix to reach the serious buyers looking for a property now. Simply listing a house on the property portals such as Rightmove or Zoopla and relying on those enquiries is not going to expose the property to enough people. Online agents and personal brand agents are at a serious disadvantage and have limited avenues to attract buyers. Agents now need to roll their sleeves up, dig in, nurture genuine buyers, have a good social media presence, and know who will be a good fit for the houses they are marketing. We call this traditional estate agency or just plain good practice.

We can demonstrate our ability to deliver a strategy that puts more money in your pocket at the end of the transaction.

Pricing your property correctly is also massively important. Please remember it is all about the differential between what you achieve for your own home and what you pay for another. If you have to take £10,000 less than you hoped for, but pay £10,000 less for another property, it’s exactly the same, but that is how we get the market moving more briskly.

We appreciate nobody likes to take less for their house than they think it is worth, but holding out for an unrealistic and unachievable price will just cost you time, disappointment, and ultimately money. There is no mileage in putting your house on the market with the mindset “ We aren’t in any hurry and happy to sit and wait to get our price” It is completely the wrong strategy.

If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed ahead of a move in 2025, please contact Josh, Patrick or Maurice to arrange for a FREE marketing advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link Book a Free sales and marketing consultation

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.