Welcome to this month’s Cheadle Property Market Update – your trusted snapshot of what’s really happening in our local housing market.

If you’re thinking about selling, actively looking for your next home, or simply keeping an eye on your property’s value, this report is for you. We cut through the national noise to focus on what matters here in Cheadle, and the surrounding Stockport area – real data, local trends, and what they mean for your plans this winter and into 2026.

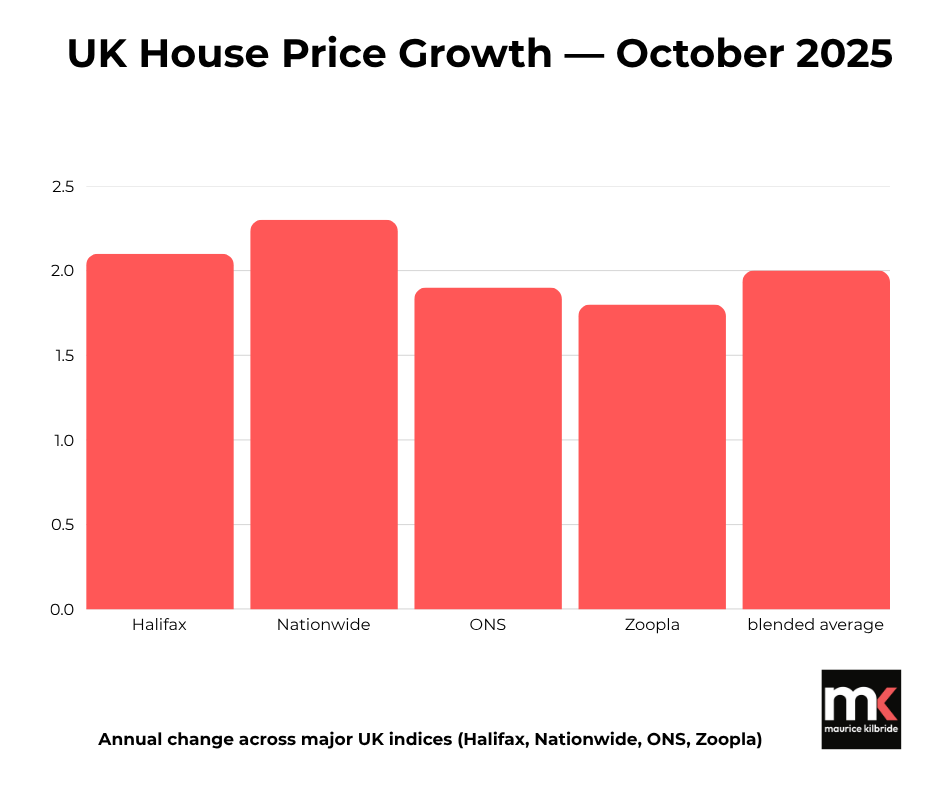

The National Picture – October Data Round Up

After a subdued September, October brought signs of quiet resilience. The cost of living pressures and pre Budget uncertainty have taken some heat out of the market, but overall prices have stayed remarkably steady.

🏠 Nationwide (October 2025)

-

+0.3% monthly change

-

+2.4% annual change

-

Average UK price: £272,226

Nationwide’s Chief Economist, Robert Gardner, notes that the market “continues to show surprising resilience,” helped by wage growth outpacing inflation and the first hints that interest rates may begin to ease in early 2026.

📉 Halifax (September 2025 – latest release)

-

-0.3% monthly change

-

+1.3% annual change

-

Average UK price: £298,184

Halifax described the autumn market as “broadly stable but cautious,” with affordability still stretched and buyer confidence mixed. The October figures are due later this month and will give us the first post party conference view of sentiment.

📊 Zoopla House Price Index (October 2025)

-

+1.3% annual house price growth

-

Buyer demand: down 8% year on year

-

Sales agreed: down 3% year on year

-

Average time to sell: 37 days

-

Sales pipeline: 350,000 homes worth £100bn (largest in 4 years)

Zoopla reports the first year on year dip in new sales agreed in nearly two years, driven mostly by higher value southern markets.

By contrast, Northern regions – including the North West – continue to post steady price growth, around 2–3% annually.

The Official Numbers – Land Registry & ONS (August 2025)

While the official figures always lag by around two months, they confirm the same story of steady, sustainable performance:

-

UK average price: £272,995

-

+0.8% monthly change

-

+3.0% annual growth

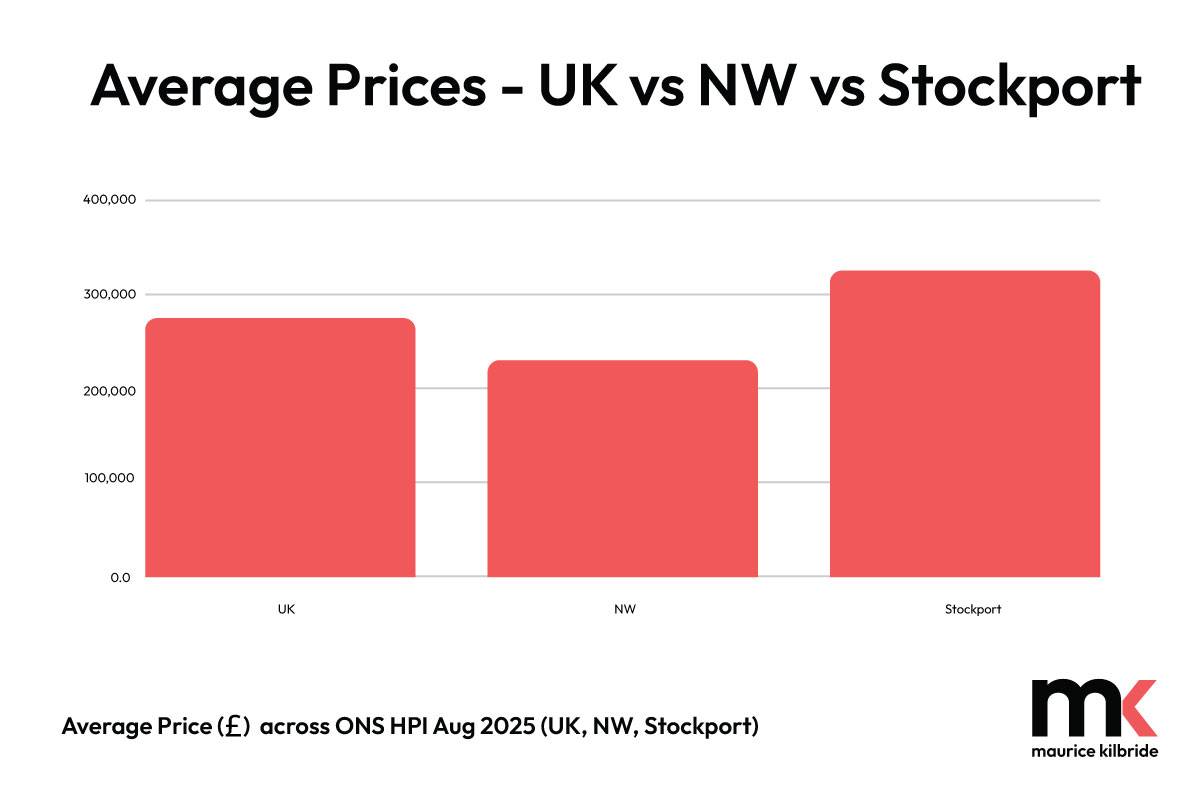

🔍 Regional Focus: The North West

-

Average price: £222,400

-

+3.9% annual growth

📍 Local Detail – Stockport (proxy for SK8 & SK3)

-

Average property price: £309,000

-

+4.5% year-on-year

-

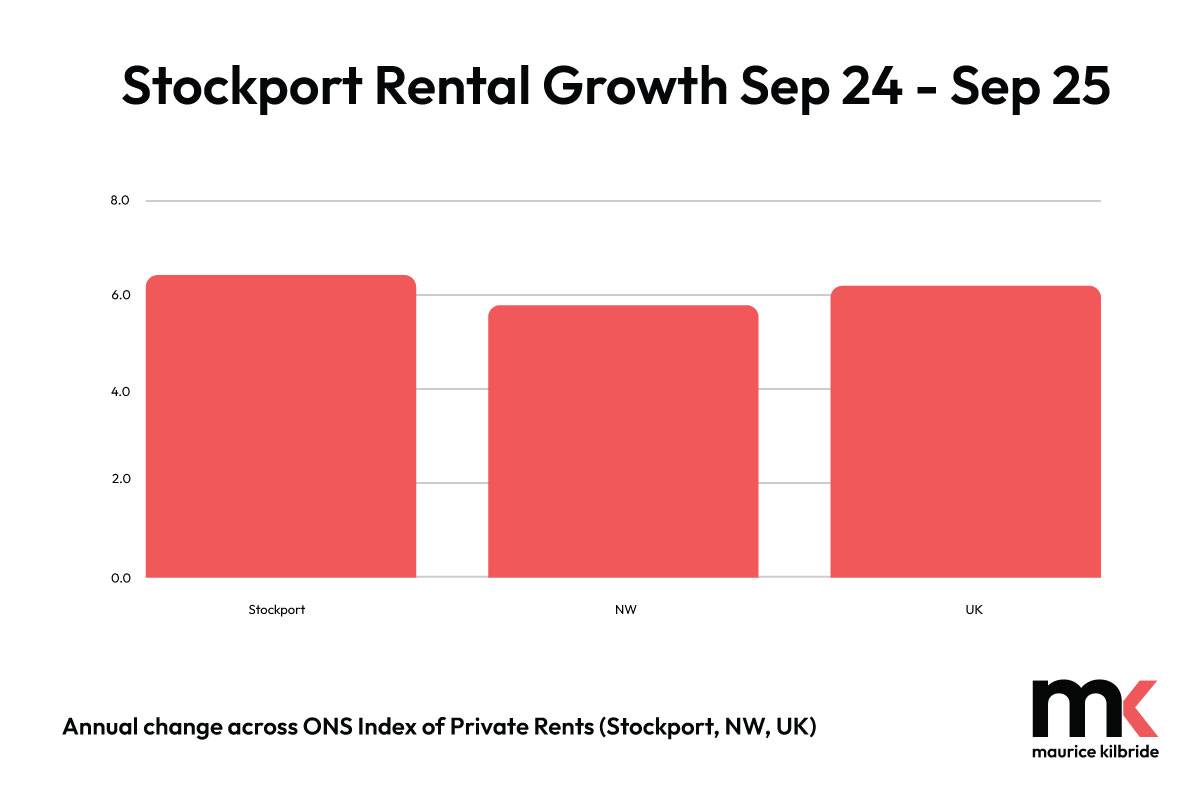

Average private rent (Sept 2025): £1,067

-

+5.7% rental growth over the year

This places Stockport firmly in the top quartile of UK growth areas, outperforming the national average and illustrating the ongoing appeal of our commuter links, schools, and lifestyle balance.

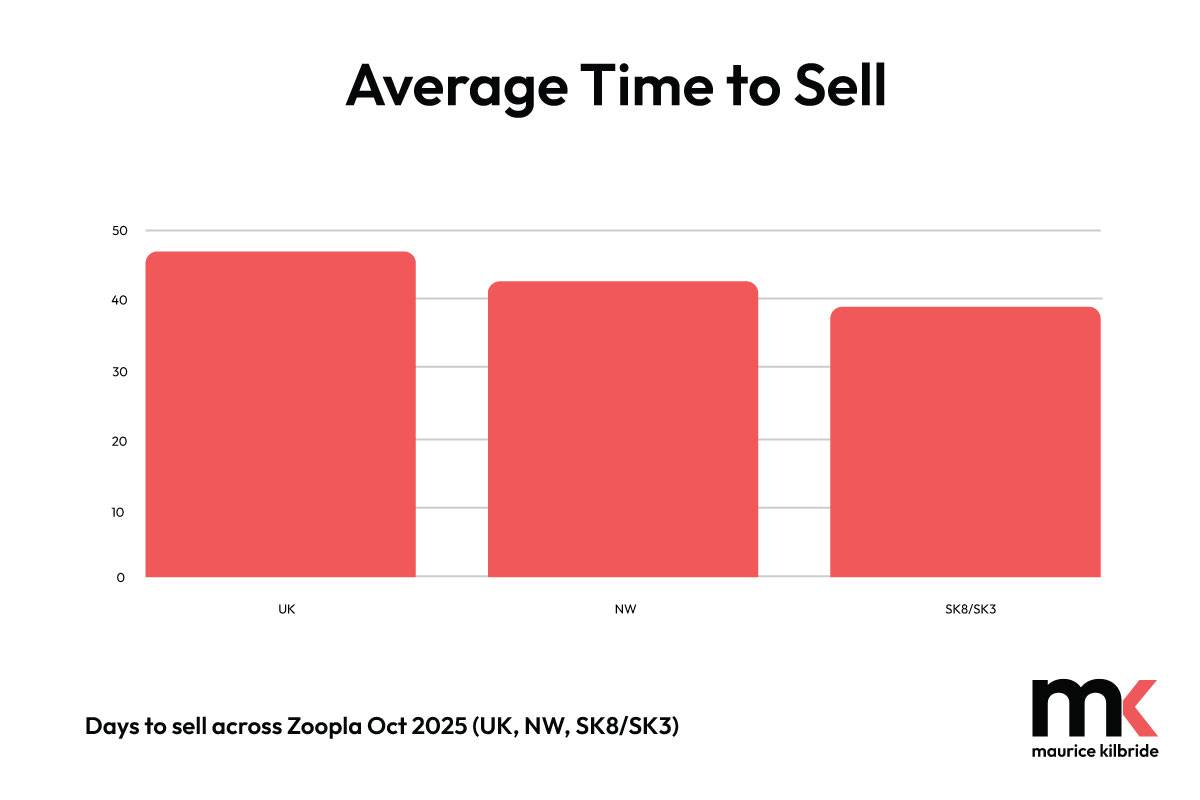

Cheadle & Stockport Market Snapshot

Here’s how the local picture stacks up against the national scene:

| Indicator | National | North West | SK8/SK3 (Stockport) |

|---|---|---|---|

| Annual price growth | +2.4% (Nationwide) | +3.9% (ONS) | +4.5% (ONS/Local) |

| Average sale time | 37 days (Zoopla) | 33–38 days (avg) | 30–35 days (MK data) |

| Buyer demand (YoY) | -8% | -3% | Flat to -2% |

| Typical asking price reduction | 2–3% | 1.5–2% | 1–2% (realistic stock only) |

Local insight:

Family homes in Cheadle, Cheadle Hulme, Cheadle Heath, Gatley, Heald Green and Edgeley remain the most sought after, especially 3 bed semis and traditional terraces in the £280k–£450k range. Overpriced listings still stall quickly and then are taking a long time to sell - if at all, while competitively priced homes can still go sold subject to contract within three or four weeks.

At the upper end (£500k+), buyers are more cautious, sales are taking longer, with more negotiation around condition and price.

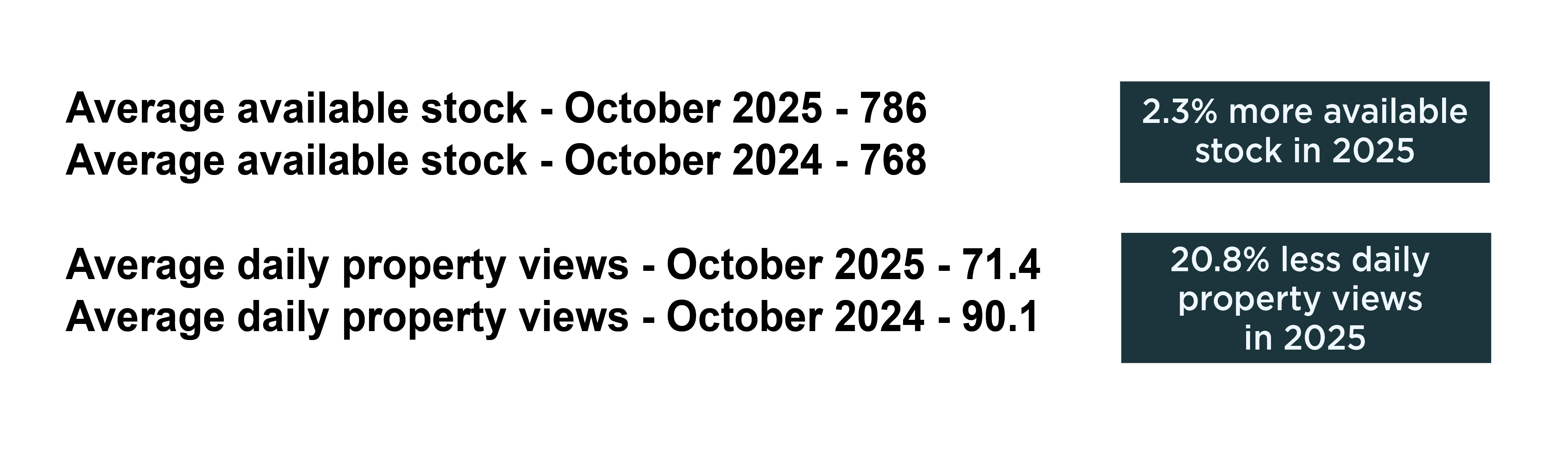

What’s Driving the Market Locally?

-

Affordability: The North West remains one of the most affordable regions in the UK. This continues to underpin activity despite higher borrowing costs.

-

Mortgage competition: Several lenders reintroduced sub-5% fixed rates in October, hoping to attract more would be buyers.

-

Supply levels: Stockport listings were up 9% on the year, less than the 16–19% seen in southern markets, helping to support local pricing.

-

Employment: The North West’s unemployment rate (4.1%) remains below the national average, keeping household incomes stable.

-

Commuter appeal: Easy access to Manchester, the airport and the M60 continues to draw relocators from pricier South Manchester suburbs.

📍 Local Highlight: SK8 & SK3 Micro-Trends

| Property Type | Typical Price | Market Movement | Buyer Activity |

|---|---|---|---|

| 2-bed Terraced | £245,000–£265,000 | +2.5% y/y | Strong – popular with FTBs |

| 3-bed Semi | £330,000–£390,000 | +3.8% y/y | Very strong – families & upsizers |

| 4-bed Detached | £475,000–£600,000 | +1.2% y/y | Moderate – slower over £550k |

| Flats/Apartments | £165,000–£210,000 | +0.4% y/y | Steady – investors cautious |

| Rental Yields | 5.0–5.5% | ↑ 0.3pp y/y | Stable – high tenant demand |

Source: Land Registry, ONS, Zoopla, Maurice Kilbride internal data

What This Means for You

🏠 If You’re Selling

-

Realistic pricing is critical. Overpriced homes are sitting for months; well priced homes still go under offer in weeks.

-

Presentation pays off. Move-in ready, modernised homes attract up to 8% higher offers and fewer fall throughs.

-

Timing is still on your side. November can outperform expectations before the Christmas lull. Serious buyers are out there — focus on motivation, not volume.

🔑 If You’re Buying

-

Choice has improved – there are roughly 7% more homes for sale than a year ago.

-

Room for negotiation. Serious sellers are open to offers, especially above £450k.

-

Mortgage rates are slowly edging down, and lenders are competing for new borrowers – worth checking updated deals before the Budget.

💼 If You’re a Landlord

-

Rents are still rising across SK8/SK3, averaging +5.7% year on year

-

Tenant demand remains high, particularly for 2–3 bed houses near transport links up to £1300 per calendar month.

-

Net returns: typically 5–5.5% gross depending on property type.

-

Keep an eye on potential tax and EPC changes in the upcoming Autumn Budget and the New Renters Reform Act legislation– energy efficiency remains a priority for long term yields.

📈 The Market Outlook – Winter 2025

-

Short term (next 3 months): Stable and reducing with seasonal slowdown. Expect average local prices to hold firm into 2026.

-

Medium term (early 2026): If the Bank of England begins to cut rates as forecast, demand should strengthen further in Q1.

-

Long term: The fundamentals for Cheadle remain rock solid – strong schools, transport links, and lifestyle appeal continue to attract relocators, first time buyers and upsizers from across Greater Manchester.

📣 Maurice Kilbride’s Take

"Despite all the noise and uncertainty nationally, our local market in SK8 and SK3 remains remarkably balanced. Buyers are selective, not absent. Sellers who price sensibly and present well are still moving – often faster than they expect. As we head into winter, the key is realism, timing and strong marketing – all of which continue to deliver great results for our clients. The outlook for Q1 in 2026 remains a little unclear, alot will depend on the fall out from the upcoming budget and how lenders react in terms of interest rates"

Maurice Kilbride

💬 Thinking of Selling in 2026?

If you’re considering your next move, now is a smart time to plan.

We can provide a free, data-led valuation and personal marketing strategy using live buyer demand analytics for your postcode and our 25 years experience selling homes in SK8 and SK3.

📞 Call us on 0161 428 3663

📧 Email sales@mkiea.co.uk

or request a valuation online today https://www.mkiea.co.uk/valuation

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.