Welcome to your August snapshot of the Cheadle property market. If you're thinking of selling, buying, or simply curious, this report gives you a clear, numbers driven view of how our local market stacks up against national trends and each other.

On the national stage, a steep learning curve in fiscal policy is underway, as the Treasury explores replacing stamp duty on homes over £500,000 with a more proportionate tax, raising eyebrows about future costs once, or if you reach that threshold The Guardian. Globally, hope for peace in Ukraine lifted equity markets to six month highs earlier this week. But closer to home, rising grocery prices and energy bills suggest that affordability will remain fragile, especially with the news today that inflation has risen again unexpectedly, potentially slowing buyer momentum despite a recent rate cut by the Bank of England.

Key Market Stats: Nationwide, Halifax, Zoopla & Rightmove

Nationwide

-

Monthly: House prices rose 0.6% in July, after a significant drop in June

-

Annual: Growth accelerated to 2.4%, up from 2.1% in June

-

Average Price: £272,664 in July

-

Affordability: The price to earnings ratio has dropped to approximately 5.75, the lowest in over a decade—a clear signal of improved affordability

Halifax

-

Monthly: Prices rose 0.4% in July, the largest monthly gain so far this year

-

Annual: Also clocked in at +2.4% year-on-year

-

Average Price: £298,237 in July

Zoopla

-

Annual: As of June 2025, the UK average house price was £268,400, a 1.3% rise (£3,350 increase) year-on-year

-

By Property Type (to June):

-

Flats/Maisonettes: average £191,800, down 0.8%

-

Terraced Houses: £238,100, up 1.7%

-

Semi‑detached: £276,200, up 2.3%

-

Detached: £450,400, up 0.8%

-

-

Activity & Forecast: Buyer demand up -11%, agreed sales up - 8%, with record listings—Zoopla lowered house price growth forecasts for 2025 from 2% to 1%

Rightmove

-

Monthly Asking Price: Dropped 1.3% in August to an average of £368,740—in line with seasonal trends but off summertime highs

-

Year-on-Year: Asking prices are only 0.3% higher than August last year

-

Sales Activity: July saw the highest number of sales agreed since 2020, up ~8% year-on-year; supply is ~10% higher than last year

-

Price Reductions: Approximately 34% of properties are reduced in price; reduced listings average 99 days to sell versus just 32 days for those priced right initially

-

Mortgage Rates: The average two-year fixed mortgage rate now sits at 4.49%, down from around 5.17% a year ago

Summary Table: Where the Numbers Stand

| Index | Monthly Change (Jul/Aug) | Annual Growth | Avg Price | Notable Notes |

|---|---|---|---|---|

| Nationwide | +0.6% (July) | +2.4% YoY | £272,664 | Affordability improving (P/E ~5.75) |

| Halifax | +0.4% (July) | +2.4% YoY | £298,237 | Largest monthly rise so far in 2025 |

| Zoopla | — | +1.3% YoY (to June) | £268,400 | Semi detached & terraced homes leading growth |

| Rightmove | –1.3% (Aug asking) | +0.3% YoY | £368,740 (asking price) | High supply, fast sales for well-priced homes; mortgage rates lower |

What This Means for Cheadle (SK8/SK3)

-

Price Growth: Expect modest increases, likely in line with Nationwide and Halifax (around 2–2.5% annually), though asking price softness may reflect the national summer pause.

-

Buyer Momentum: Modest activity and lower rates should be creating opportunities—especially for family homes and well priced properties.

-

Sales Strategy: Accurate pricing remains essential. Homes priced right are selling quickly (within 4-6 weeks on average) while mispriced listings face much longer waits (3-4 months plus).

-

Property Type Trends: Semi detached and terraced houses are showing stronger growth—likely reflecting local demand patterns.

Now, lets break down the data for Cheadle and the surrounding areas in greater detail.

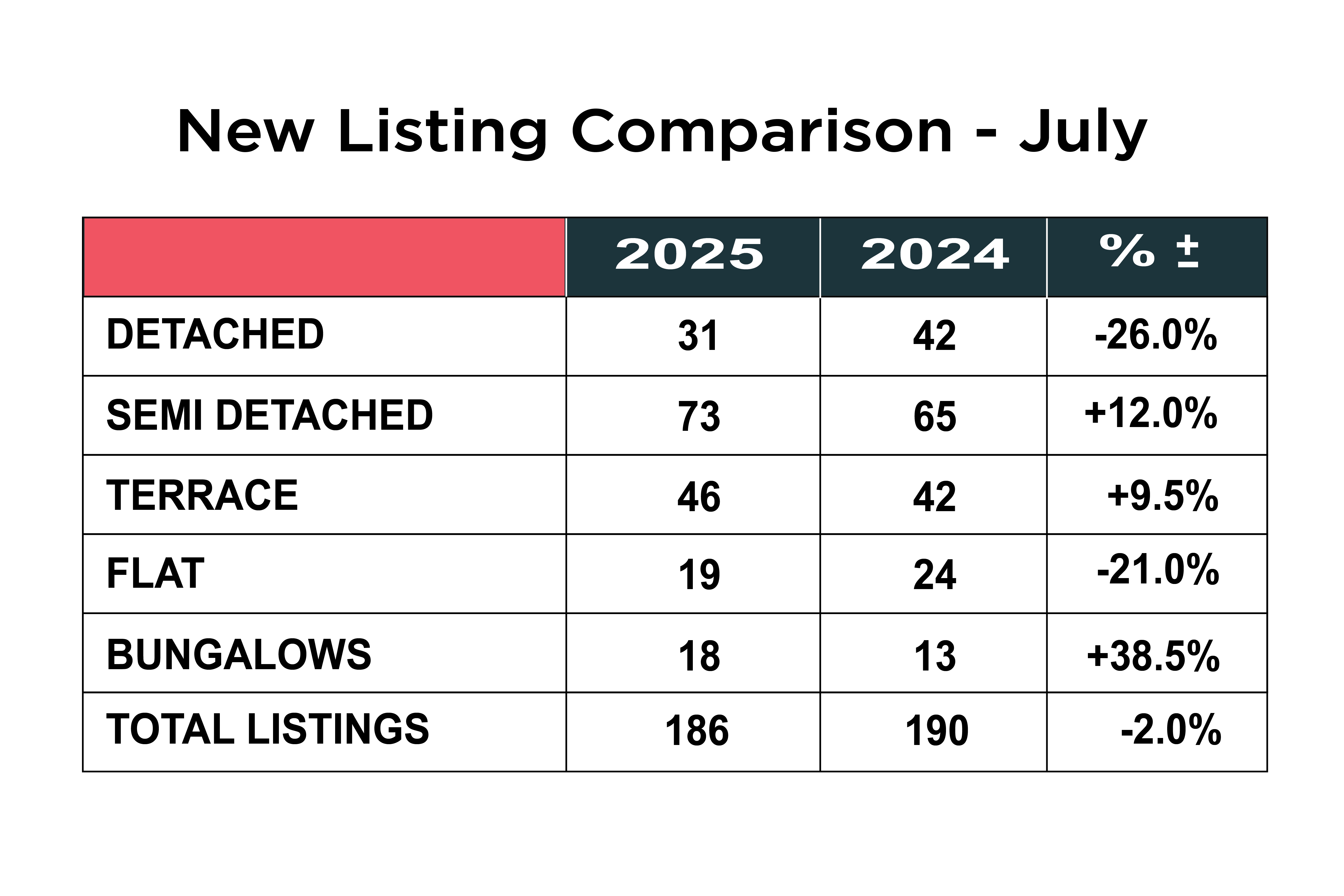

New Listings level out in 2025

The local new listings in SK8 and SK3 held broadly steady in July 2025, with 186 properties coming to market compared to 190 in July 2024, a modest 2.1% year on year decline. While the overall total shows little movement, the breakdown by property type reveals some interesting shifts in supply.

Semi detached homes were the strongest performers, up 12% (65 to 73), underlining their continued appeal to families and upsizers. Terraced homes also grew modestly, rising 9.5% (42 to 46), helping sustain activity at the more affordable end of the market.

The standout growth came in bungalows, up 38% (13 to 18). This marks a notable increase in a segment that often suffers from low availability, giving downsizers and retirement buyers more choice than in recent years.

By contrast, detached homes fell sharply, down 26% (42 to 31). This may reflect greater caution among higher value homeowners, with many choosing to delay moving in the current climate. Meanwhile, flats dropped 21% (24 to 19), limiting options for first time buyers and investors compared to last year, but may be a reflection on the recent bad press for leasehold flats.

Key Takeaways

-

The market headline figure is stable, but the profile of listings has shifted, with more choice in semis, terraces and bungalows.

-

The sharp fall in detached and flat listings could create supply gaps at both the top and bottom ends of the market over the coming months.

-

For sellers, this means pricing and presentation remain critical: competition is stronger in some sectors (e.g. semis, terraces), while reduced supply in others (detached, flats) may create opportunities to achieve premium results.

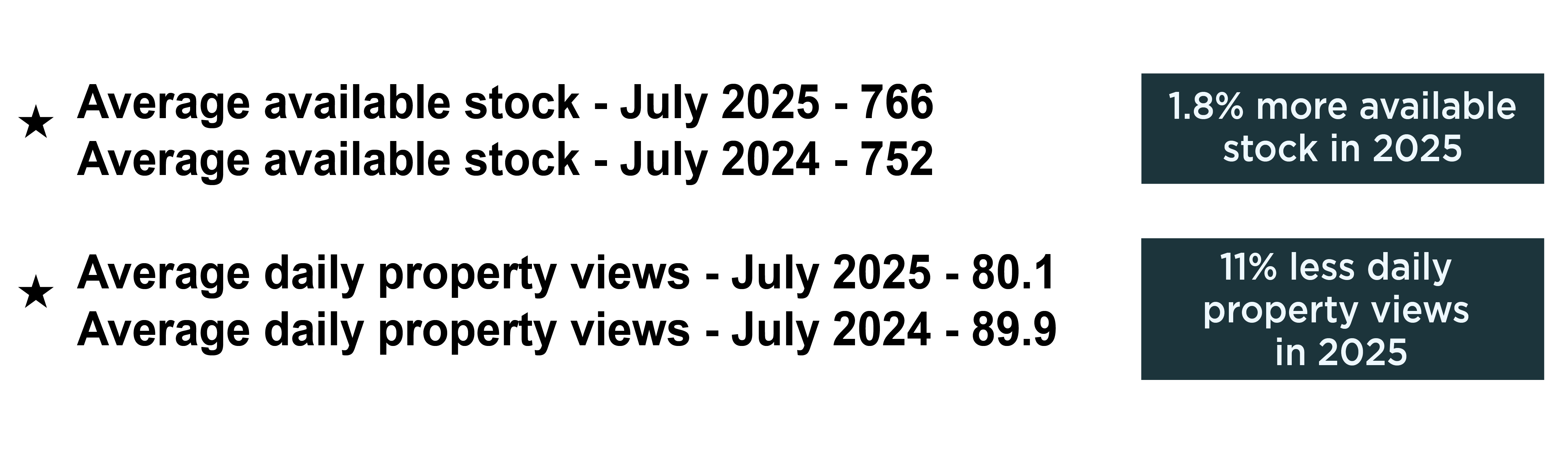

Stock Rising, Views Falling

July 2025 saw available housing stock in the SK8 and SK3 markets rise by 1.8% compared to July 2024. While this increase is modest compared to June’s double digit growth, it still points to a gradual improvement in seller confidence and a slightly wider choice for active buyers.

However, buyer engagement has softened. Daily property views on Rightmove were down 11% year on year, a sharp contrast to the stability we saw in June. This decline indicates that fewer buyers are actively browsing, reflecting both seasonal slowdown and lingering caution over affordability and interest rate pressures.

The combination of slightly higher supply and reduced buyer activity creates a more competitive environment for sellers. Homes that aren’t priced correctly or presented to stand out risk being overlooked more quickly than before.

The takeaway? With demand under pressure, sellers must be realistic and proactive — strong marketing, standout presentation, and competitive pricing are essential to convert attention into offers.

Family homes hold firm as flats and terraces feel the pinch

The average property price in SK8 now stands at £360,240, a 1.3% decline year on year. But performance varies significantly depending on property type:

-

Detached homes: Now averaging £519,983, values are actually up 2.2% year on year. Larger family homes continue to command strong demand and remain the most resilient part of the local market.

-

Semi detached properties: The standout performers. Prices have climbed 3.7% year to date, with an average of £374,995. With strong family appeal, semis are driving much of the activity across SK8.

-

Terraced homes: Averaging £290,529, terraces have seen values fall by 3.9% over the past year. This reflects affordability pressures in the first-time buyer segment, where higher mortgage costs are most keenly felt.

-

Flats: Now at an average of £183,623, values are down just 0.3% year on year. While this is a smaller decline than terraces, the flat market remains subdued with limited investor appetite.

Headline takeaway

Family homes defy the downturn — first time buyer and investor markets under pressure

Detached and semi detached homes are bucking the wider trend, holding or even gaining value thanks to sustained demand. By contrast, it would appear that terraces and flats are bearing the brunt of affordability constraints and tighter lending.

SK3 leads with double digit growth — but flat values buck the trend

The average property price in SK3 now stands at £262,572, a striking 14% increase year on year — one of the strongest growth rates we’ve seen locally. But, as always, the picture varies across property types:

-

Detached homes: Now averaging £389,105, values are up an impressive 17.5% year on year. Detached properties remain highly sought after and continue to lead price growth across SK3.

-

Semi detached properties: Averaging £283,157, values are up a robust 10.8% compared with last year. With strong family appeal, semis are underpinning much of SK3’s market momentum.

-

Terraced homes: Prices have risen by 12.6% year on year, reaching an average of £231,897. This suggests sustained demand in the more affordable segments of the market.

-

Flats: In contrast to the wider trend, flats have slipped 2.2% year on year, with average values now at £167,091. This sector remains weaker, held back by increasing supply, affordability constraints and limited investor demand.

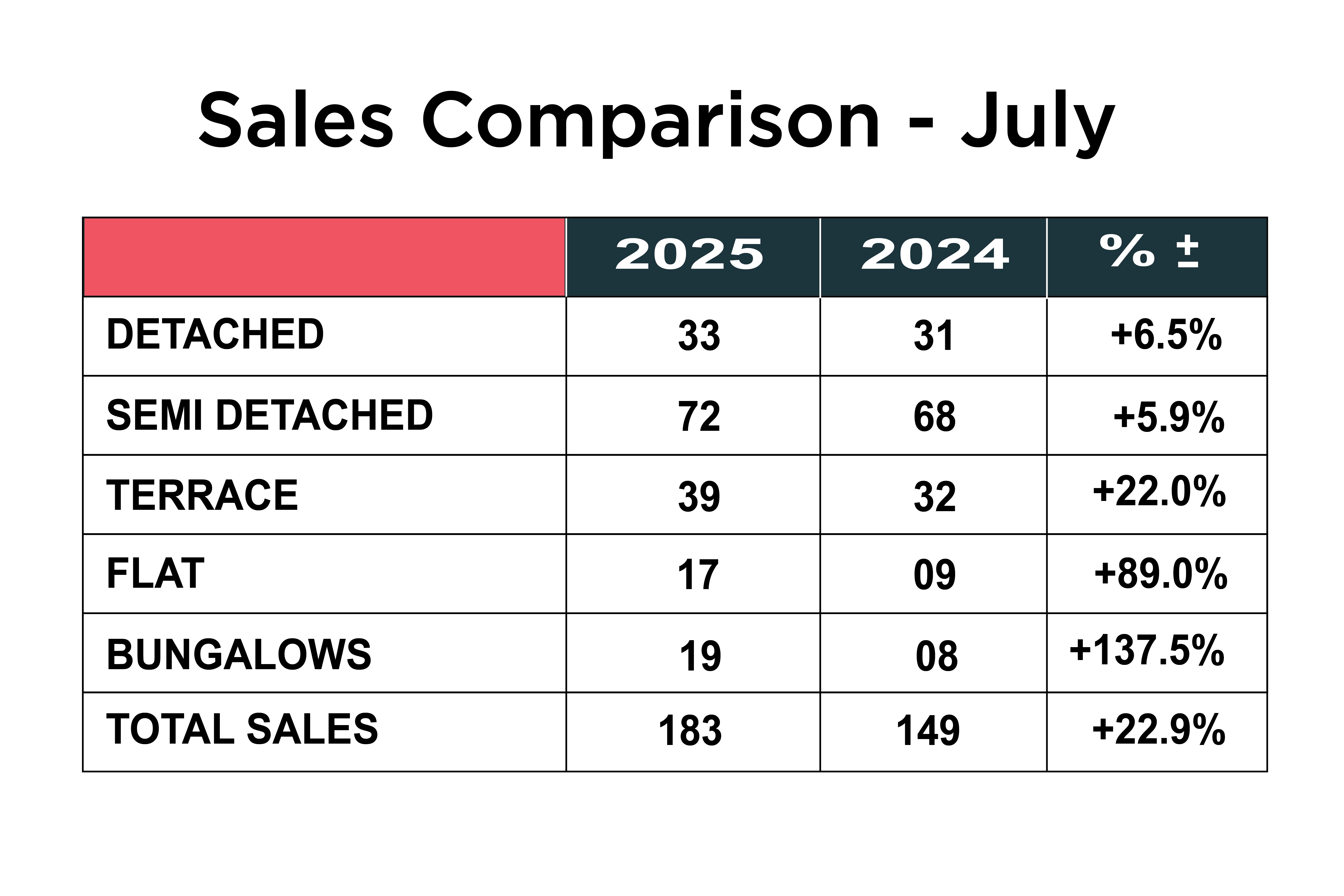

Sales Surge in July as Stock and Seller Motivation Drive Activity

Property sales across SK8 and SK3 saw a sharp 22.9% year on year increase in July 2025, with 183 homes sold, up from 149 in July 2024. This is an encouraging set of figures and reflects both the increased stock levels available to buyers and motivated sellers who are pricing realistically to secure a sale.

Every property type recorded growth in July — a sign that demand is broad based when homes are positioned correctly in the market:

-

Detached homes: Sales rose from 31 to 33 (+6.5%), steady growth at the higher end of the market.

-

Semi detached homes: The largest share of activity, climbing from 68 to 72 (+5.9%), with families driving strong mid market demand.

-

Terraced homes: A strong uplift, rising from 32 to 39 (+22%), showing continued appetite in the more affordable brackets.

-

Flats: The standout performer, almost doubling sales from 9 to 17 (+89%), suggesting renewed demand from first time buyers, downsizers and investors as sellers adjust pricing.

-

Bungalows: The sharpest rise of all categories, leaping from 8 to 19 sales (+137.5%), highlighting pent up demand in the downsizer market.

Takeaway

The July sales uplift is highly encouraging, but it is also a reminder of what’s driving success: greater choice for buyers and motivated sellers pricing to match the market. With stock levels elevated, the homes achieving sales are those that combine realistic pricing with strong presentation. Rightmove's own analysis showed only this week, that asking prices across the UK have dropped on average £11,000 in the last three months.

In today’s more competitive landscape, sellers who respond to the market and work with an agent who knows how to position their property effectively are the ones converting viewings into offers.

Rental Market Analysis – July 2025

The rental market in both SK8 and SK3 continues to show strength, with steady monthly transaction levels and competitive yields that underline the area’s appeal to landlords.

In SK8, rental activity averaged 42 lets per month. Houses achieved an average rent of £1,682 per calendar month, while flats averaged £1,065 pcm. The average annual rental yield stands at 5.28%, reflecting solid returns in a market where family homes in particular continue to attract consistent demand.

In SK3, the rental sector is even more active, with 50 lets per month on average. Houses currently let for £1,239 pcm, while flats edge slightly higher at £1,285 pcm. Yields are stronger here too, averaging 6.01% annually, making SK3 one of the most attractive buy-to-let areas locally for investors seeking reliable returns.

Takeaway for Landlords

With rental demand remaining robust across both SK8 and SK3, well-positioned landlords are continuing to see strong results — whether targeting family homes in SK8 or the higher yield opportunities in SK3.

At Maurice Kilbride, we combine local market knowledge with a proven management and marketing approach to help landlords maximise returns while reducing hassle. On average, our clients benefit from better tenant retention, stronger rental yields, and peace of mind that their investment is being looked after properly.

Discover more about our landlord services and competitive fee structure here: Maurice Kilbride Fees & Services

📊 July Market Snapshot – SK8 & SK3

The local market feels quieter this summer, even though more homes are selling — in fact, July saw one of the strongest uplifts in a while and buyers are clearly responding when properties are priced and presented right.

That said, people are still cautious. Online activity has dipped, which means the homes attracting viewings are the ones that stand out for value and presentation. Family houses continue to hold firm on prices, while SK3 in particular has been powering ahead thanks to strong demand and affordability.

The rental market remains steady too, with healthy yields for landlords and plenty of tenant demand, especially for well located homes.

At Maurice Kilbride, our mix of online and offline marketing is helping sellers and landlords cut through the noise — in fact, we’re achieving £10,389 more on average than other SK8 agents (source: Twenty EA).

If you’re thinking of selling or letting, now’s a good time to have a chat about how to position your property for success.

Call 0161 428 3663 or 🌐 Book a Free Market Appraisal

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.