Welcome to the Cheadle Property Market Update for April 2025, the most comprehensive and in depth look at both the local and national property market.

Welcome to the Cheadle Property Market Update for April 2025, the most comprehensive and in depth look at both the local and national property market.

After the end of the Stamp Duty savings window, it was always going to be a bit of an unknown, how this might affect the property market, and we have seen signs of change, which we will explore fully in this blog. What else has happened? Well, the economic forecast in this country remains gloomy, we have had 100 days of the Donald Trump mayhem, sadly lost the Pope and Liverpool are the premier league football Champions!

Returning to the property market in SK8 and SK3, we have seen a marked rise in the number of properties coming onto the market, whilst sales have hardly moved, which is not good news for sellers and means the focus must be on accurate pricing from the outset to have a realistic chance of selling.

So, as we always do, we start by taking a look at the national picture, to see how the SK8 and SK3 markets are performing by comparison and whether we are mirroring the national market or are somewhat of an anomaly.

Let’s start with our usual look at the headlines from the Nationwide April Property Index.

Annual house price growth slows slightly in April

• Annual rate of house price growth slowed to 3.4% in April, from 3.9% in March

• House prices down 0.6% month-on-month

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

"April saw a slowing in UK house price growth to 3.4%, from 3.9% in March. House prices fell by 0.6% month on month, after taking account of seasonal effects.

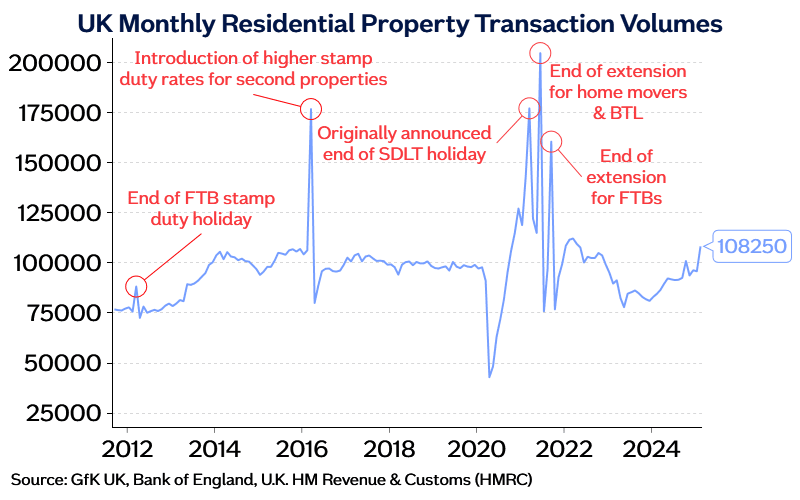

“The softening in house price growth was to be expected, given the changes to stamp duty at the start of the month. Early indications suggest there was a significant jump in transactions in March, with buyers bringing forward their purchases to avoid additional tax obligations.

“The market is likely to remain a little soft in the coming months, following the pattern typically observed following the end of stamp duty holidays.

Nevertheless, activity is likely to pick up steadily as summer progresses, despite wider economic uncertainties in the global economy, since underlying conditions for potential home buyers in the UK remain supportive.

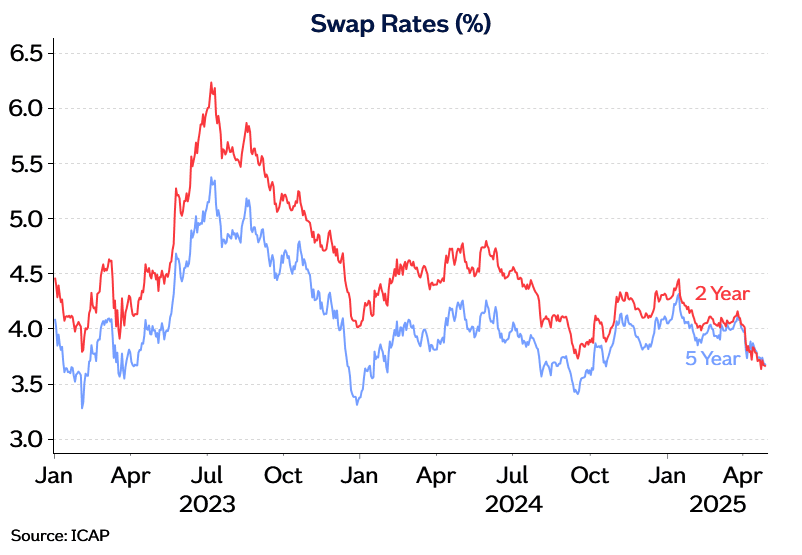

“Unemployment remains low, earnings are rising at a healthy pace in real terms (i.e. after accounting for inflation), household balance sheets are strong and borrowing costs are likely to moderate a little if Bank Rate is lowered further in the coming quarters as we and most other analysts expect. Indeed, swap rates (which underpin fixed rate mortgage pricing) have moderated in recent weeks.”

So, now let’s take a look at the Zoopla April 2025 Property Index and see how their forecast and outlook compare with the Nationwide.

Key takeaways

• House price inflation slows as demand cools and supply expands

• UK house prices increase 1.6% in year to March 2025, up from 0.2% a year ago but down from 1.9% in December 2024

• Buyer demand 1% higher than last year, tempered by the end of stamp duty relief, seasonal factors, and economic uncertainty

• Supply of homes for sale 12% higher than a year ago as more sellers enter the market. Sales agreed 6% higher than last year.

• Relaxation in stress testing of mortgage affordability by lenders could boost buying power by 15-20%, supporting sales volumes

• UK house price inflation predicted to slow towards 1% to 1.5% in the coming months, as the number of sales continues to increase by 5% on last year

Key figures

The average house price in the UK is £267,400 as of March 2025 (published in April 2025).

Property prices are now at +1.6% inflation compared to a year ago and the average UK house price is set to rise by 2.5% by the end of the year.

Buyer demand weakens but affordability boost likely

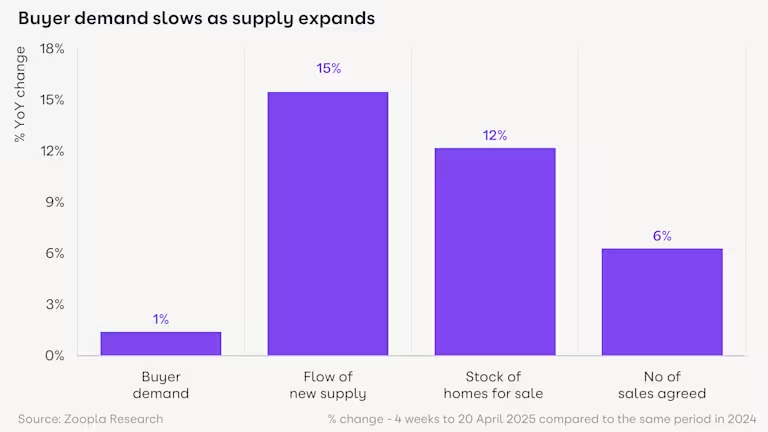

House price inflation is losing momentum as seasonal factors and growing economic uncertainty cools buyer demand, while supply continues to expand. More homes for sale are boosting choice and keeping house prices in check.

House price inflation is set to slow further in the coming months, while sales agreed will continue to increase. We expect lower base rates over 2025 to support market activity. In addition, lenders are starting to adjust how they stress test the affordability of new mortgages. We estimate this could boost buying power by 15-20%, supporting demand and sales agreed rather than boosting house prices.

House price inflation slows to 1.6% as supply expands

Image: Comparing 4 weeks to 20 April 2025 with same period in 2024

Average house prices have increased by 1.6% over the last 12 months to March 2025, down from 1.9% at the end of 2024. House price growth remains higher than the 0.2% recorded a year ago. The average price of a home is £268,000, an increase of £4,270 over the last year.

Buyer demand was running 10% above last year in the early months of 2025, ahead of the end of stamp duty relief in England and Northern Ireland. Demand has cooled in recent weeks and is broadly in line with the levels recorded a year ago.

The weakening in buyer demand is partly seasonal, reflecting the Easter holidays, while global events and uncertainty over the economic impact of tariffs are likely to be causing hesitation amongst some buyers. Sales agreed are holding up 6% higher than a year ago.

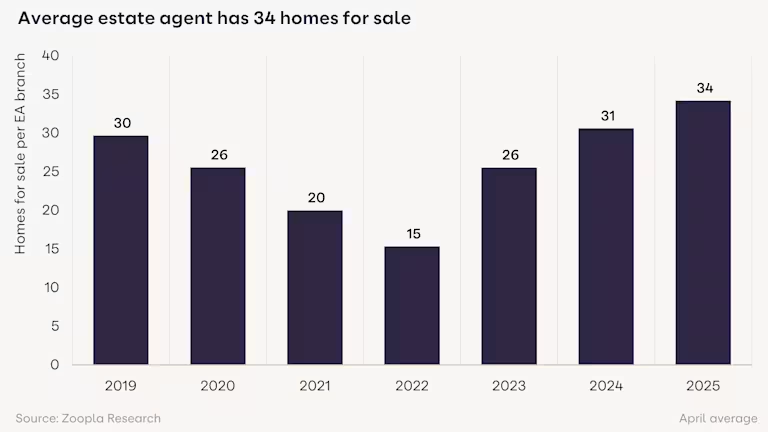

One area of the market where there is robust growth is the number of homes for sale. There were 15% more homes listed for sale in the last month compared to a year ago. The average estate agent currently has 34 homes for sale, compared to 31 this time last year and a low of 15 in 2022 during the pandemic boom. Many of these sellers are also buyers, which explains why sales agreed continue to increase.

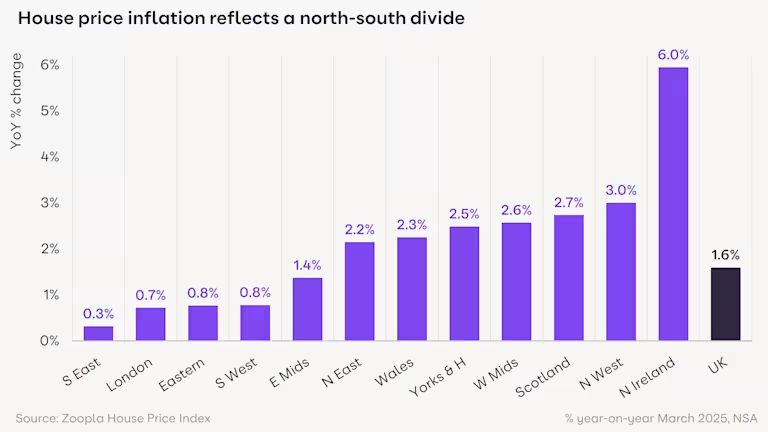

North-south divide in house price inflation

Image: ONS Earnings Index - Whole Economy Year on Year Three Month Average Growth (%): Seasonally Adjusted Total Pay Excluding Arrears

House price inflation is starting to slow across all regions and countries of the UK, mirroring the national trend. However, the current rate of price growth remains higher than a year ago across all areas.

The number of sales agreed is also higher than a year ago across all areas. Sales agreed are up by double digits in Wales (14%), the North West (10%) and the North East (10%). The market needs only modest price rises to support sales activity.

House price inflation is still sitting at less than 1% across southern regions of England where affordability pressures are greatest. House prices in these regions are high relative to household incomes, while the recent end of the stamp duty boost has damped demand.

In contrast, prices are rising by between 2.2% - 3% across the West Midlands, the Northern regions, Wales and Scotland. Prices are 6% higher in Northern Ireland. House prices are lower in these areas, and buying a home is accessible to a greater number of households.

Uncertainty to temper demand in the short term

We expect market activity to continue to track in line with 2024 levels. However, ongoing uncertainty around the impact of tariffs on the UK's economy will continue to weigh on demand in the coming weeks.

While UK economic growth is expected to be weaker in 2025, growth in average earnings (5.6%) remains well ahead of general inflation. Current expectations are that the Bank of England may have scope to further lower the UK base rate this year. This would ensure the cost of average fixed-rate mortgage remains in the 4-5% range.

This points to a general continuation of current housing market trends, with slow growth in sales as more sellers come to the market, but with house price inflation remaining in check.

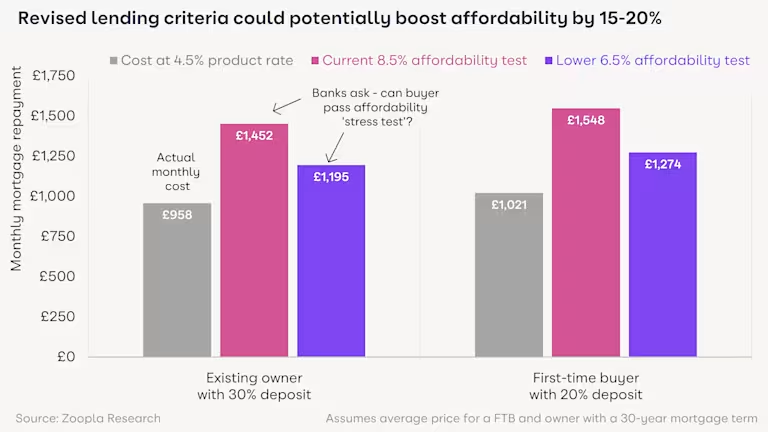

Boost to buying power from changes to affordability tests

Image: The analysis uses average house prices from the house price index and for first-time buyers to assess mortgage payments at different mortgage rates applied to a 30- year mortgage, at different loan-to-values.

One emerging trend that we expect to positively support market activity in the coming months is a relaxation in how lenders assess the affordability of new mortgages. While buyers focus on the mortgage rate they will pay, lenders also check whether the borrower can afford a 'stressed mortgage rate' at a higher level than the borrower will pay.

While the average 5-year fixed rate mortgage is around 4.5% today, many lenders are currently 'stress testing' affordability at 8-9%. This makes it harder to secure a mortgage without a large deposit. If average mortgage stress rates were to return to pre-2022 levels of 6.5% to 7%, this would deliver a 15-20% boost to buying power.

An average first-time buyer with mortgage repayments of £1,020pcm at a 4.5% mortgage rate would typically have to prove they could afford monthly repayments of £1,550pcm at an 8.5% stress rate. If the stress testing is relaxed to 6.5%, repayments would fall to £1,275pcm, boosting buying power. It's a similar pattern for the average homeowner, while the actual impact will vary by lender and type of borrower.

This change would consequently be supporting demand and sales volumes, helping to clear the stock of homes for sale, rather than boosting house prices. Other existing rules and regulations that remain in place will continue to impact the availability of mortgage finance.

National Outlook – slower price growth, more sales

The housing market has been resilient to external forces over the last 2 years and is facing further headwinds. The growth in the number of homes for sale is evidence that there are many homeowners in the market looking to move home, despite wider macro trends.

We expect house price growth to slow towards 1% to 1.5% in the coming months. The market remains on track for 5% more sales in 2025 as long as sellers remain realistic on pricing.

Local Outlook – More houses for sale but sales slow

Now it is time to take a look at how the local SK8 and SK3 markets have been performing and drawing comparisons between local trends and the national picture.

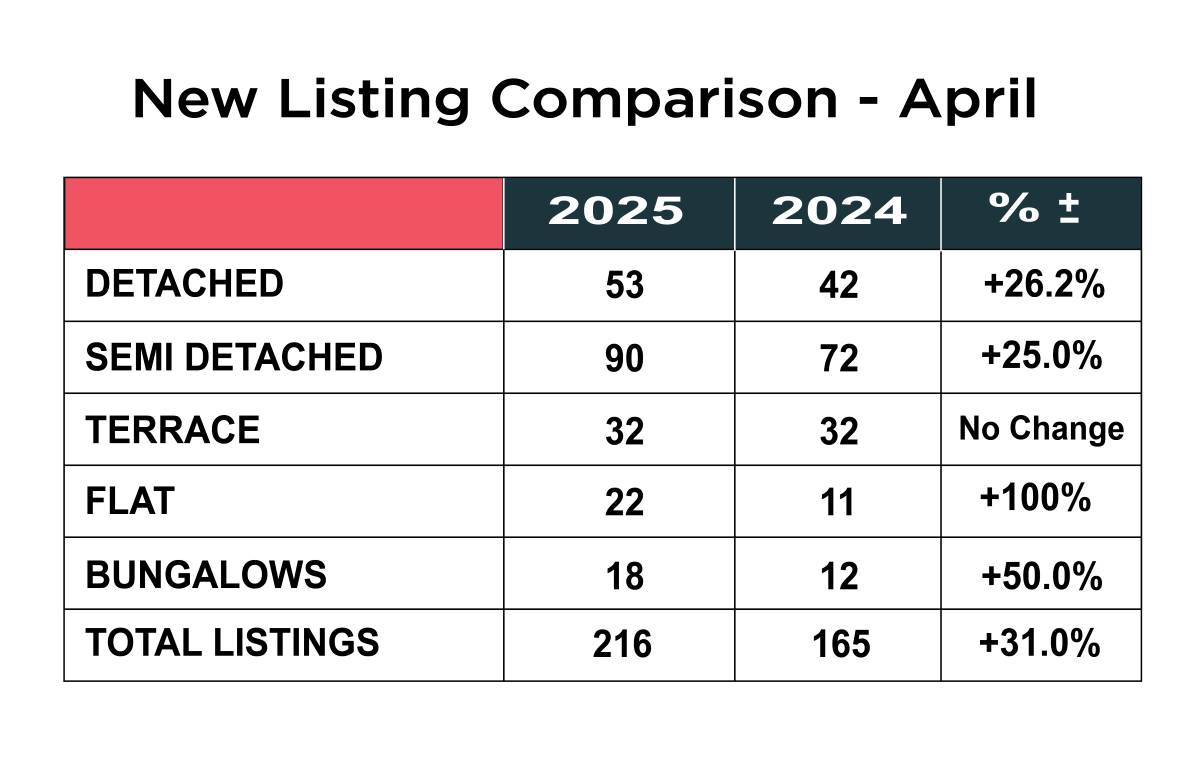

Listings show significant uplift in April 2025

The number of new properties which came to the market in April showed a marked increase over the same period in 2024, with an uplift of 31% from 165 to 216 in 2025.

We saw an increase in the number of new instructions in 4 of the 5 categories, with the biggest increase in the number of flats for sale, up from 11 to 22, a jump of 100%, second was the number of bungalows which came onto the market, up from 12 in 2024 to 18 in 2025, which is an increase of 50%, followed by a rise in the number of detached homes, up from 42 to 53, an increase of 26.2%. There was also an increase in the number of semi-detached homes, up from 72 last year to 90 this year – an increase of 25%. There was no change in the number of terraced homes which came onto the market, staying at 32 for the second year running!

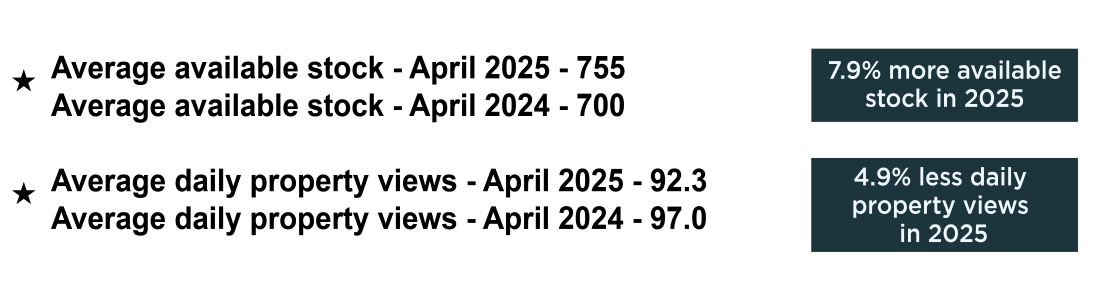

Stock levels up which will keep pressure on prices

The average stock available in April 2025 was a record 755 homes, against 700 for the same period in 2024. That is an increase of 7.9%

The average number of daily property views on Rightmove in April 2025, was 92.3, compared with 97.0 last year, so almost 5% down, which is quite a significant sign of where buyer sentiment is at the moment, despite there being more properties to choose from.

What’s happening with SK8 house prices?

The average price of a property in SK8 now stands at £359,887, which is 2.5% lower than the same period in 2024, but up slightly on January 2025.

When we look at the individual property types, detached homes are 2.6% cheaper than they were 12 months ago, standing at an average of £503,857, which is actually up £6,000 on January. Semi-detached homes are now an average price of £372,683, up 2.5% from a year ago. Terraced homes are the only style of property, where prices have come down a little, down 6% on last February and now stand at £289,273, which is up £500 on January, so virtually no change there. Flats continue to have seen the largest uplift in prices, up an impressive 11.7% on February 2024 and now average out at £194,493.

What’s happening to property prices in SK3?

The average price of a property in SK3 currently stands at £245,006 which is 4.1% up year on year, so prices generally in the area are doing pretty well and up £7,000 from January 2025.

The average price of a property in SK3 currently stands at £245,006 which is 4.1% up year on year, so prices generally in the area are doing pretty well and up £7,000 from January 2025.

Detached homes now stand at an average value of £388,367, which has shown some significant fluctuation in recent months but is still a very impressive 22% up year on year. Semi-detached homes now average £265,553, which is down £5,000 from the end of 2024, but still up 1.1% over the last 12 months. Terraced houses now average £219,989 which is up 5.2% year on year and £5,000 more than January this year. Flats now average £160,618, which have now levelled out with prices towards the end of 2024.

Sales figures levelled out in April 2025

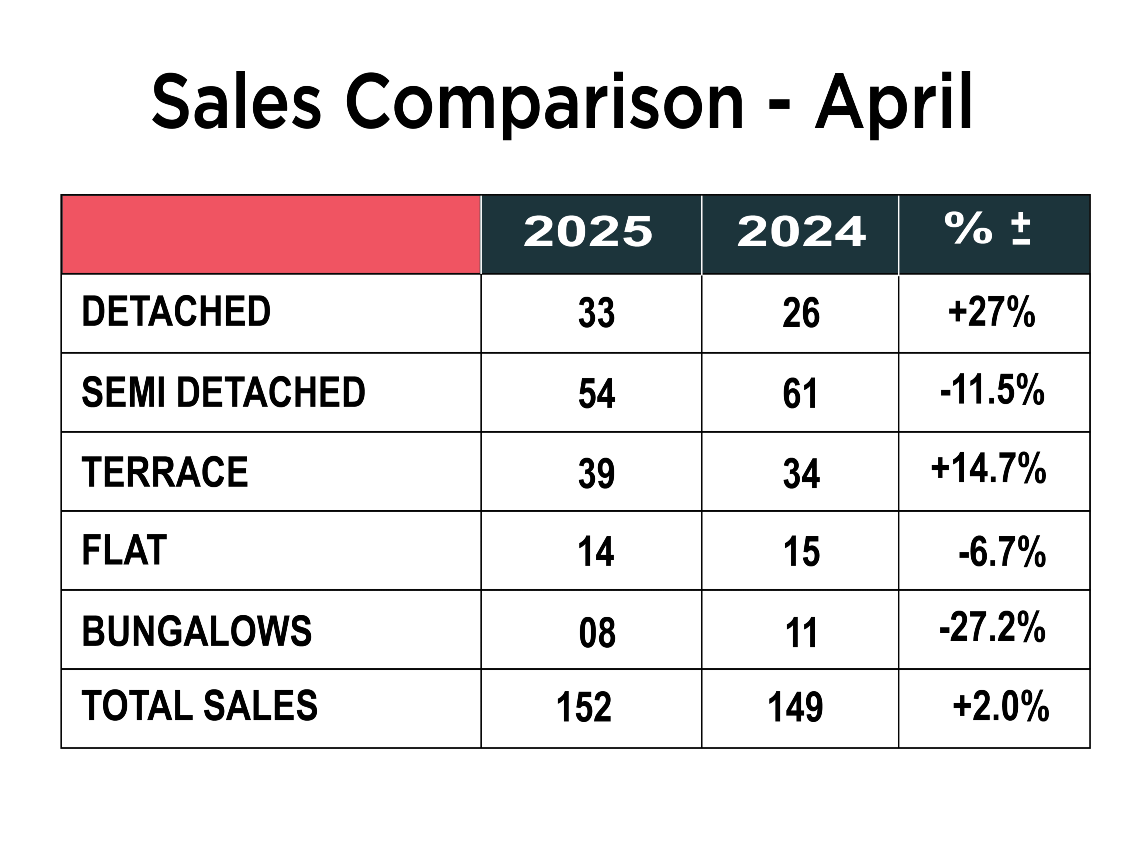

After a brisk start to sales in Q1 of 2025, there was a marked drop off in April with 152 sales compared with 149 in 2024 – a modest rise of 2%, which when you think there was an increase of 31% in available stock, we would expect the sales figures to be better.

After a brisk start to sales in Q1 of 2025, there was a marked drop off in April with 152 sales compared with 149 in 2024 – a modest rise of 2%, which when you think there was an increase of 31% in available stock, we would expect the sales figures to be better.

Sales were up a very healthy 26% in February from 131 last year to 165 in February 2025. As mentioned previously in the blog, some of this can probably be attributed to a flurry of late activity to try and beat the stamp duty increase deadline and some to the fact there are just a lot more houses to choose from.

When we break it down by individual property types, there was a huge uplift in the number of sales of detached homes – up from 18 in 2024 to 34 in 2025, which is a whopping increase of 89%. There was also a rise of 78% in the number of bungalows sold at 16, up from 9 last year. Semi-detached home sales were up a healthy 20% from 55 to 66, but the number of flats and terraced homes sold were down 8.3% and 8% respectively.

How are the SK8 and SK3 Rental Markets currently performing?

The new Renters Rights Reform Bill continues to go through parliament and the house of lords and various amendments continue to be made, so whilst some elements of the bill are likely to be implemented this month, the majority has been pushed back to later in the year.

The ongoing uncertainty and press speculation is causing many landlords to offload some or all of their rental portfolio as they worry about what effect the law changes will have, but this of course impacts on supply and keeps the upward pressure on rents, which is of course completely what the government say they are trying to avoid.

The average rental price for a house in SK8 is now £1686, which is 3% lower than a year ago and for a flat it is £1022. The yield is a very healthy 5.52%, which despite landlords fears about the new legislation, still make renting a property out financially attractive, particularly if the property doesn’t have a buy to let mortgage on it!

In SK3, the average rent for a house is now £1149, which is down 6.8% year on year. The yield is a healthy 6.09%. There is a strange anomaly this month, where the average price of a flat exceeds those of houses, standing at £1160 but that is likely to be a rogue month, rather than the norm, although the number of newly built flats in the Stockport area are likely to have an upward impact on rents in the future.

If you are a landlord with a property to rent out, we would love to hear from you, as we have a pre-qualified database of high calibre tenants waiting for the right home.

Call Patrick or Maurice on 0161 428 3663 to discuss our range of landlord services and fees or visit our website Landlord Services and Fees or if you have any questions or concerns about the Renters Rights Bill and how it might affect you.

What next for the SK8 and SK3 property market in 2025?

Q1 of 2025 showed a steady stream of sales in both SK8 and SK3, partly fueled by the added demand in the lead up to the closing of the Stamp Duty window. April 2025 has been an eventful month for both local markets reflecting a blend of resilience and dynamic responses to current economic factors. With ongoing shifts in interest rates and economic conditions, it is crucial for potential sellers to price their properties sensibly when going on the market. The fact that that was a 30% increase in the number of new properties coming onto the market, whilst sale figures didn’t alter, is a cause for concern. It is also mirroring the market in other areas of the country, who are seeing something similar.

First, let's examine the property pricing trends. Over the last six months, the average price per square foot in the local market has settled at an attractive £356. This figure serves as a helpful benchmark for those looking to buy or sell property in the area. While some regions may experience fluctuations, the stability we are seeing in the Cheadle and surrounding area is a positive sign for the overall market.

Buyers are still eager to invest, while sellers can take comfort in knowing that the demand is somewhat resilient even amidst all the economic uncertainty.

Speaking of interest rates, the average two-year fixed mortgage rate currently hovers around 4.65%. While some may find this rate to be slightly higher than in recent years, many buyers still perceive it as a viable option given the benefits of predictability in monthly payments. Consequently, this fixed-rate mortgage trend is likely to impact purchasing decisions across the board, shaping how buyers approach their financial planning.

Analyzing the turnover of sales, we note that the local market in SK8 has seen a transaction turnover rate of 20%. This indicates a healthy pace of sales, suggesting that property is being transferred at a regular rhythm. A 20% turnover means that properties are continuing to move in and out of the market at a steady rate. For sellers, this is an encouraging signal—they can feel confident that there are willing buyers ready to engage, but the market is more price sensitive than at any point in recent months.

As we move further into 2025, various external factors may continue to affect the local market. The ongoing discussions surrounding inflation and its implications could indeed sway property prices and buyer sentiment. It's always prudent for buyers and sellers to engage in thorough research and consider the long-term aspects of their investment.

Looking back at April 2025, we can say that the local market remains steady, with promising indicators for those involved in buying or selling properties in SK8 and SK3. Whether you're considering a move or simply contemplating your property's value, now is a beneficial time to seek advice and make informed decisions.

If you're looking for tailored insights based on your unique circumstances or wish to understand how the market could affect your future investments, Maurice Kilbride is here to help. As the only local member of the FIA, a network of high-quality UK independent estate agents, we take pride in delivering personalized, expert services that cater to the individual needs of our clients. If you are currently on the market and struggling to sell or undecided on whether now is the right time is to sell or you would like to know how the value of your home has changed in 2025, please contact Josh, Patrick or Maurice to arrange for a FREE marketing advice meeting on 0161 428 3663, e-mail sales@mkiea.co.uk or why not pop into our office on Cheadle High Street for an informal chat.

You can also book an appointment online by clicking on this link BOOK A FREE VALUATION

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.